October 04, 2024

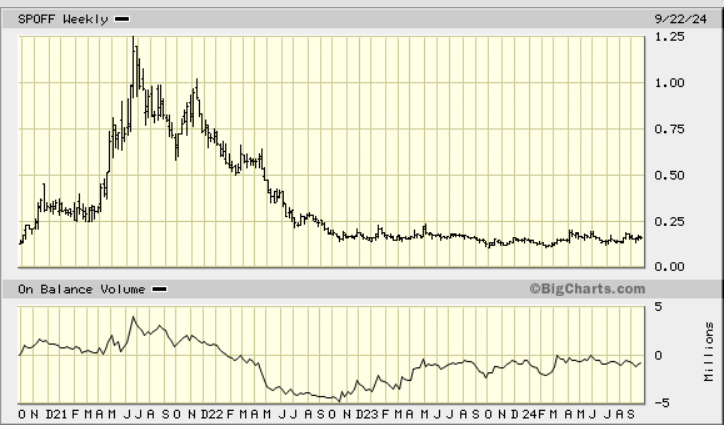

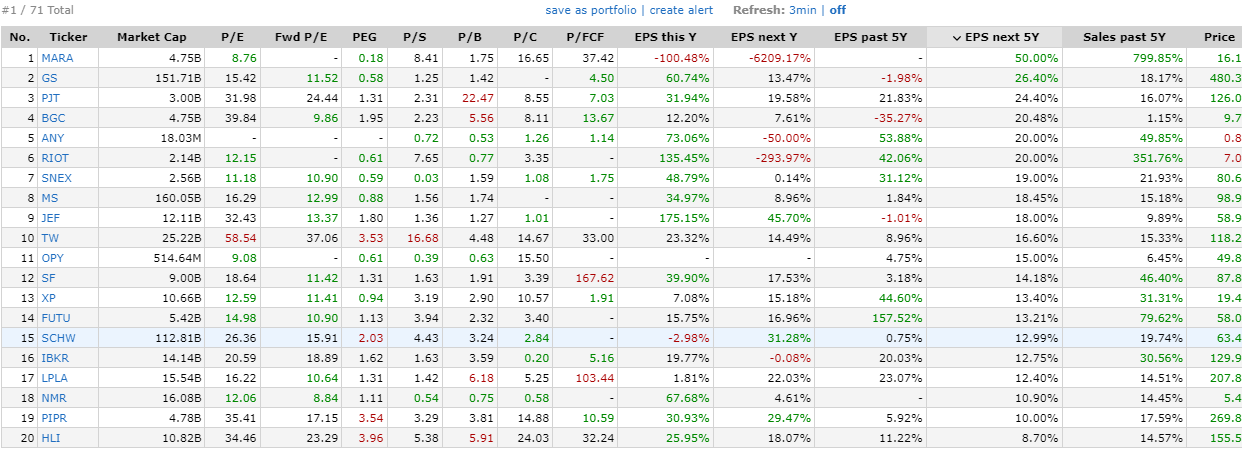

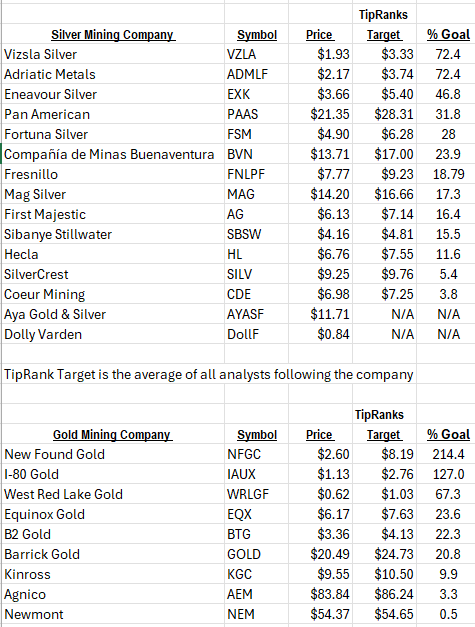

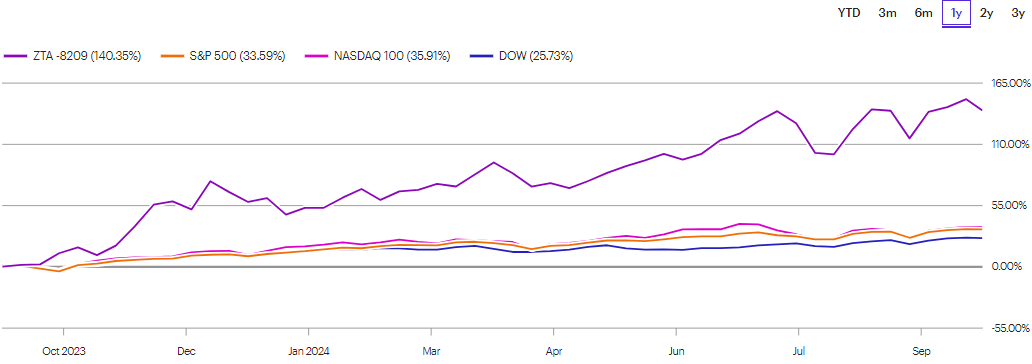

Over the past three years, our LOTM approach has migrated to a barbell approach as our investment theme. Precious metals on one end of the barbell with Crypto and Blockchain technology companies on the other end of the block chain. 2022 was a difficult year as gold and silver came down from their 2021 highs and Crypto/Blockchain related positions collapsed in a very hard bear market. Both sectors based in early 2023 and by the end of 2023, both sectors moved strongly higher. This shows up strongly in our ZTA partnership account performance history. Three time-line charts below of ZTA Performance –

One-year performance below: Continue reading

Continue reading

![]()