Other than the market collapse of 2020, gold miners are near the five-year lows when the VanEck Gold Miners ETF is divided by the price of physical Gold. Shown below are three investment divided by the price of Physical gold. Historically, the price of Gold miners trade at large discounts and large premiums to the price of physical gold. Currently the price of gold and silver miners are trading at a historic discount levels to physical gold. The investments shown are 1) VanEck Gold miners (GDX) , the largest Gold miner ETF, 2) Barrick Gold (GOLD) the second largest gold miner in the world and 3) Pan American Silver (PAAS) the largest holder of silver reserves in the world.

Why Gold and Silver miners now in three images priced over 15-years. Continue reading

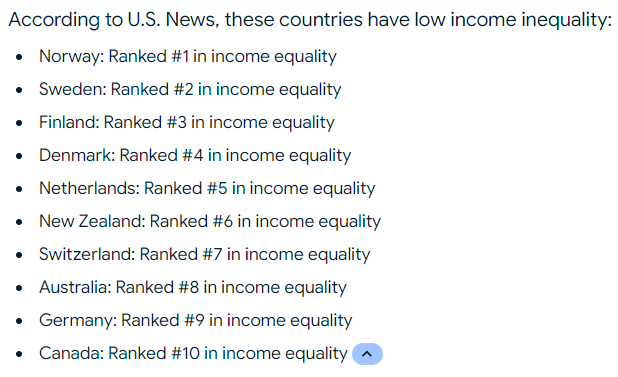

![]()