I am Sorry.

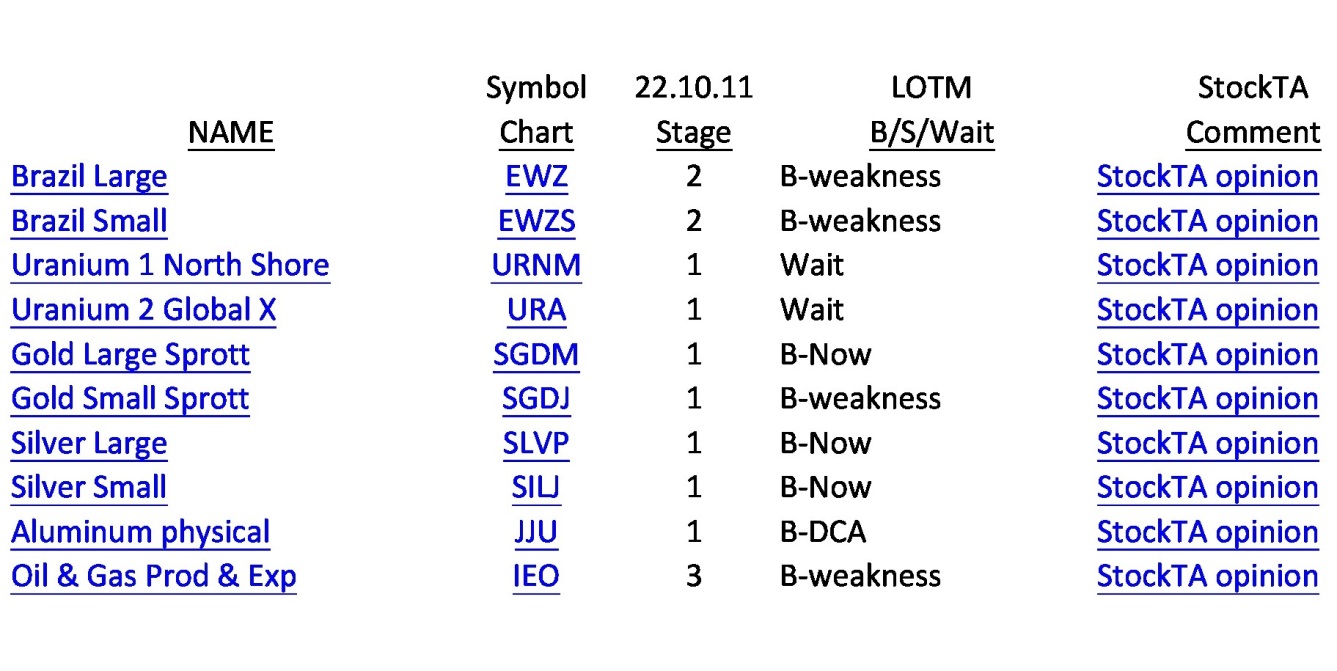

In the original version of “Trader’s Resource for Select ETF Trading,” sent October 13, the linkes in the spread sheet do not work.

- That screwed up the whole purpose of the blog post.

For those of you interested in receiving the active link version, please send an email to money@LivingOffTheMarket.com with traders resource in the subject line. I will get you the version with active links. Continue reading

![]()