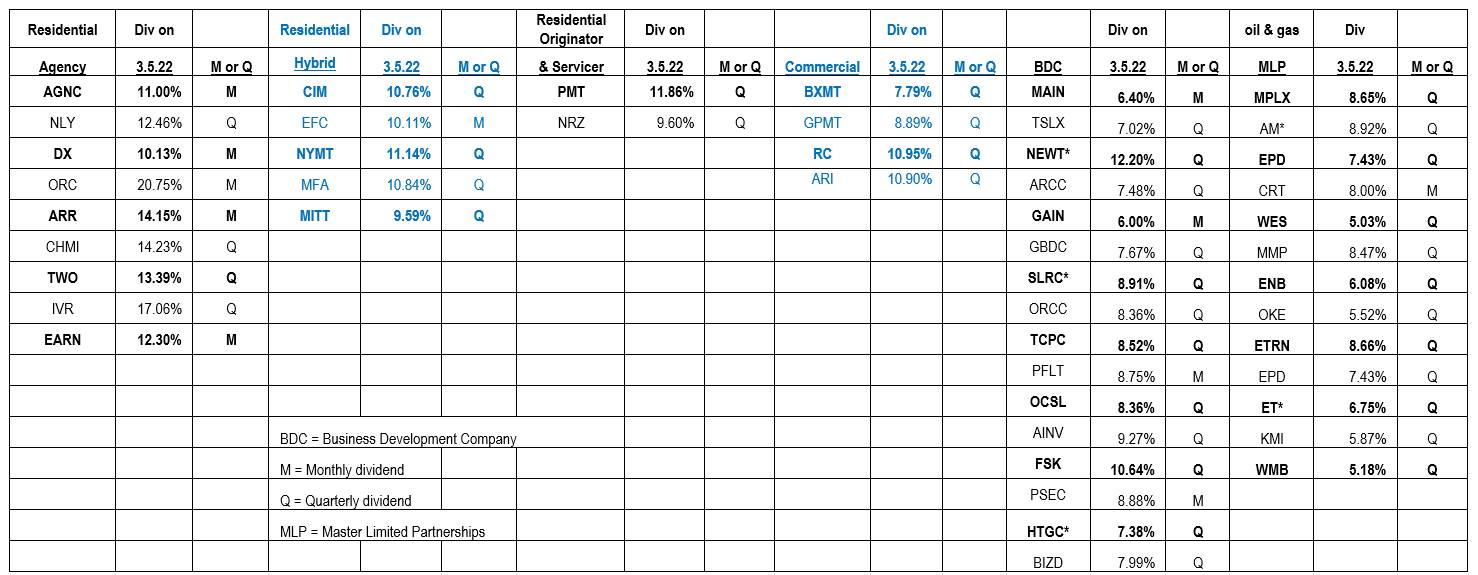

Goldman cuts U.S. GDP forecast to a full point below consensus, as it says recession odds are as high as 35%

Published: March 11, 2022 Continue reading

![]()

Goldman cuts U.S. GDP forecast to a full point below consensus, as it says recession odds are as high as 35%

Published: March 11, 2022 Continue reading

![]()

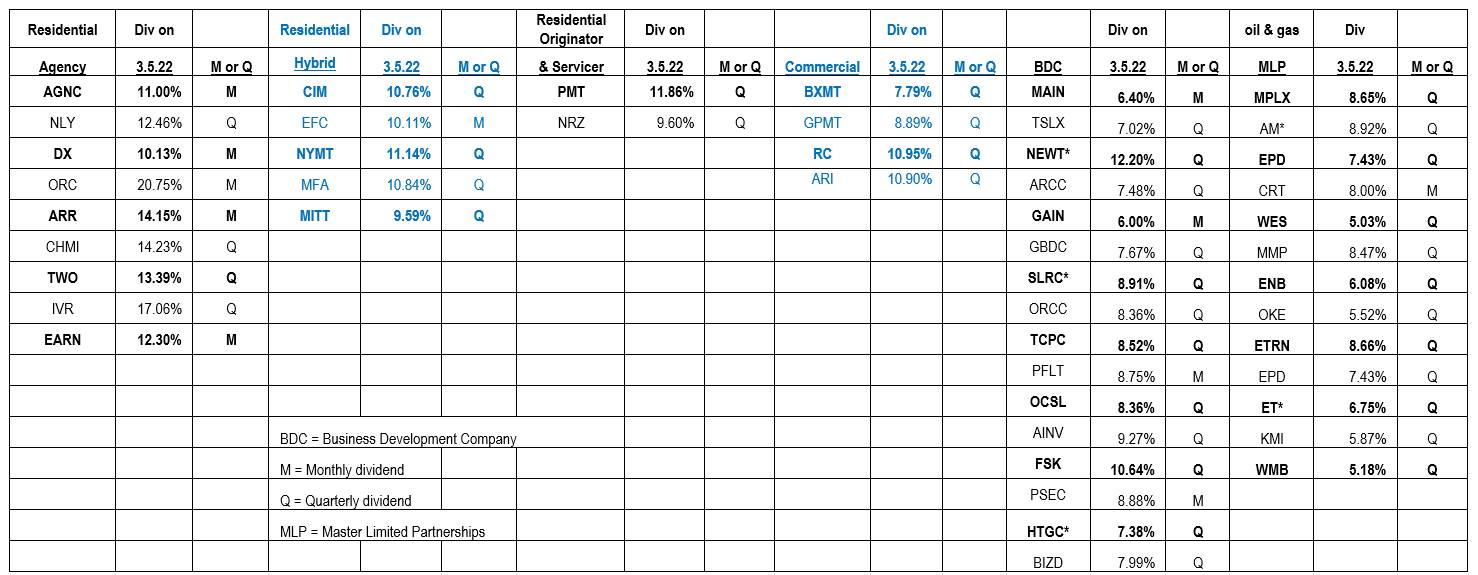

Soluna Holdings (SLNH)* $10.28

Price inflection point with ’21 year-end report in about two weeks. Continue reading

![]()

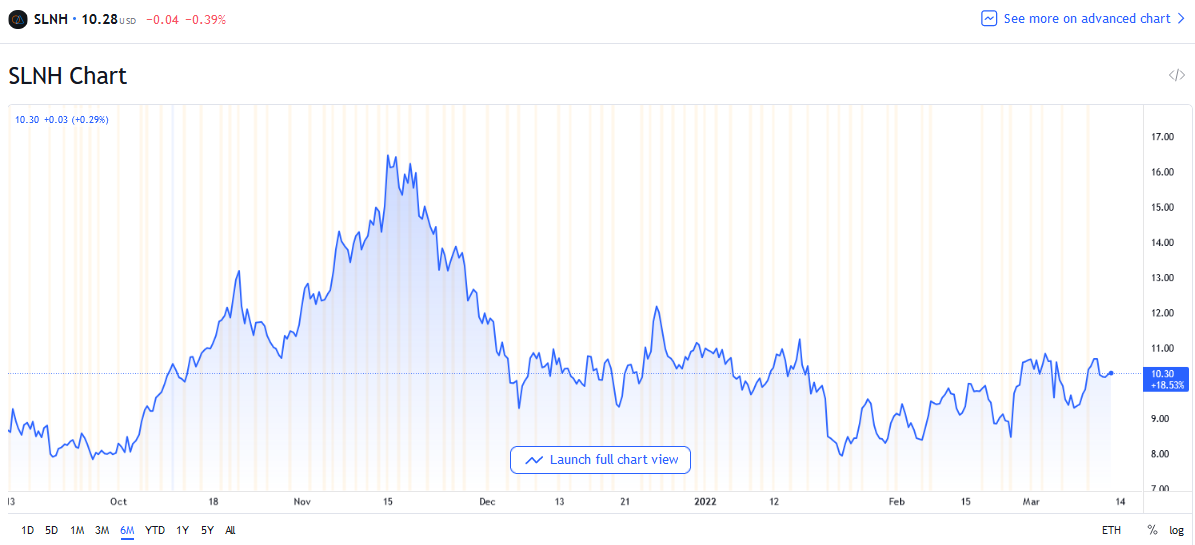

LOTM is in the early stages of beginning to accumulate longer-term positions in these names. Continue reading

LOTM is in the early stages of beginning to accumulate longer-term positions in these names. Continue reading

![]()

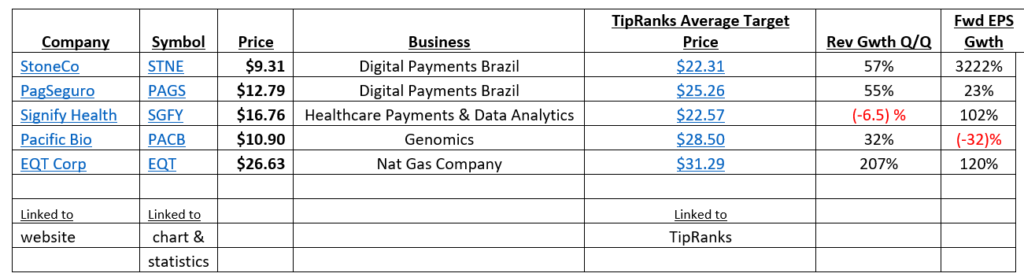

Summary:

Gasoline:

In 2019 / 2020 the USA was energy independent. Two things came together unexpectedly. The first was a joint effort by Russia and Saudi Arabia to flood the oil market with supply to break the back of the shale industry in the USA. Unexpectedly and at the same time covid broke out. This dried up demand for oil and gas. For the Russians and Saudis, mission accomplished with and exclamation point. March of 2020 saw the price of oil go to a minus $35 dollars a barrel! This weekend we saw oil touch $130 a barrel. Continue reading

![]()

GoldSpot Discoveries (SPOFF)* $0.60

I am not sure what is happening with GoldSpot Discoveries, but buying interest is really picking up. Volume in $ is still small but momentum is building. For me I want to own more longer term. It is now considered a core position by LOTM. I hope it runs into resistance at its 50-day moving average and backs off to allow more accumulation in related accounts. Continue reading

![]()

Vermilion (VET)* $19.70 was added to the LOTM: Ten under $10 for the Double on February 4, 2021, at a price of $5.49. A second unit was added to the Ten Under $10 on July 20, 2021, at the price of $6.51. Both units remain in the portfolio. Continue reading

![]()

Soluna Holdings (SLNH)* released a 26 minute Q&A on YouTube today Friday Feb 25th. The Q part of Q&A is from shareholders and interested parties about the forward outlook of Soluna. Management is very transparent. Shareholders appreciate this. Continue reading

![]()

That brings us to our final miner, Soluna Holdings (SLNH). In this case, I think we’ve saved the best for last, as Soluna has a unique way of going about crypto mining. Continue reading

![]()