- M&M Club (Let’s Make a Million$)

- ZTA LIMITED PARTNERSHIP

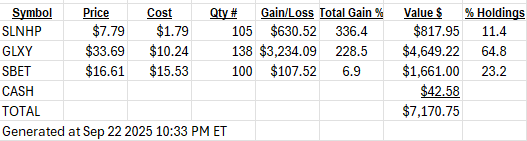

- Third Party IRA Acct:

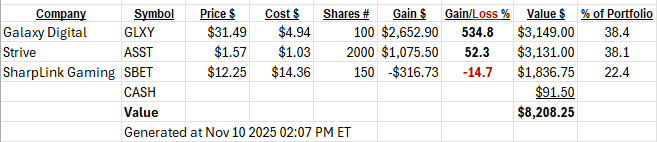

M&M Club:

Goal: Start with $1,000 (July 21, 2022.) Compound the value 100% each twelve-month period for ten-years to reach US$1,000,000 dollar valuation.

Restrictions: we cannot add any funds to this account. Soft rule: Can own no more than five positions and we can come down to one position if we have a high conviction for that position.

Disclosures: We are buying deep value when no one likes the company or industry. Highly concentrated in both company and industry. All accounts in this writing are considered speculative and concentrated by company and industry.

M&M Club Positions as of November 10, 2025 Continue reading

Continue reading

![]()