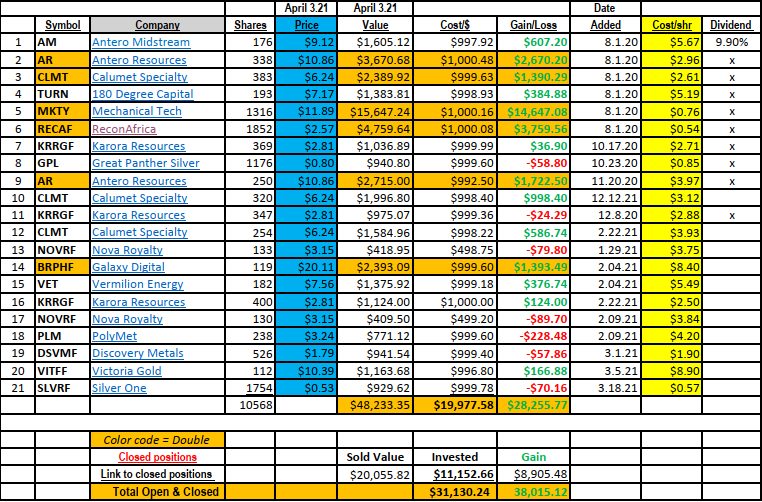

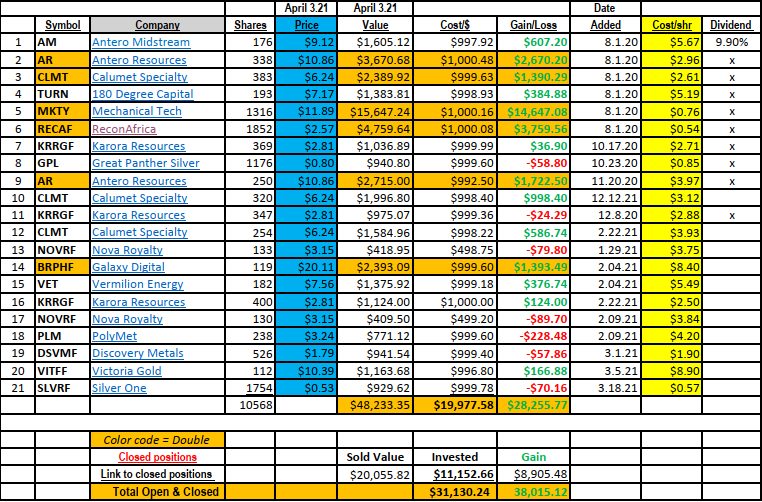

The market is in a bit of a mixed performance zone. Continue reading

![]()

The market is in a bit of a mixed performance zone. Continue reading

![]()

From a momentum and technical perspective, it is too early to buy AU. From a fundamental and value perspective we consider AU an aggressive buy recognizing the stock is very volatile.

Prices of physical gold and silver are elevated at multi-year highs. With inflation happening and projected (desired) by treasury and the Federal Reserve, we see no change in this theme for years. The mining industry is awash in low P/E ratios. AU is in the 8 to 10 area – likely lower for projected 2021 P/E ratio. FINVIZ has the projected P/E at 7.98 and the ttm P/E at 9.58. Continue reading

![]()

Consider Bill Hwang’s firm, Archegos, $20 billion dollar margin call a wake-up call.

![]()

Best Gold & Silver Ideas

It does not take much analyzing to determine that we like commodities. We have a lot of Oil & Gas, Precious and non-precious metals.

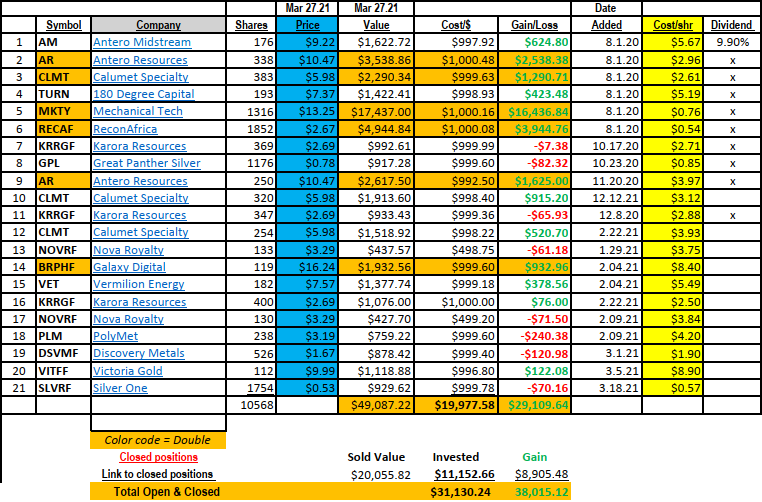

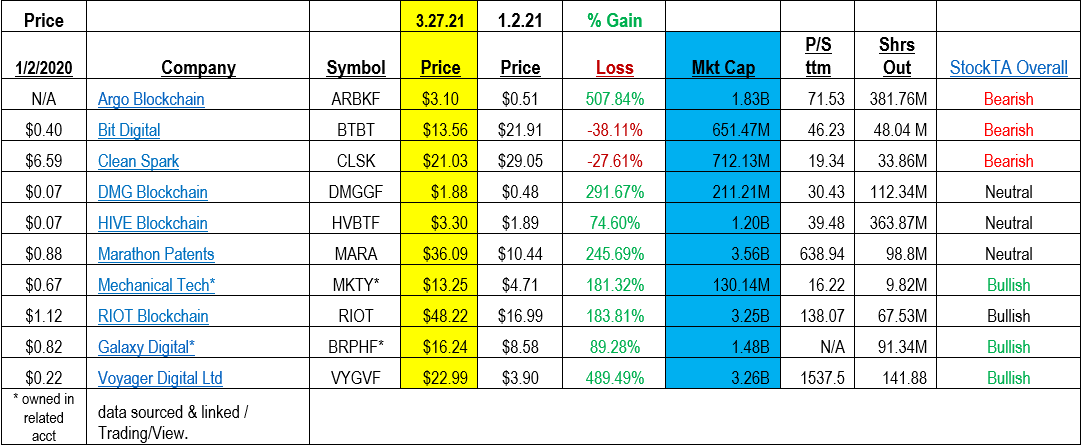

We also have exposure to Blockchain/Crypto in MKTY and Galaxy Digital as well.

Our biggest gold position is in Karora Resources (KRRGF)* Continue reading

![]()

We currently own two the companies above. Mechanical Technology (MKTY) and Galaxy Digital (BRPHF) Continue reading

![]()

When the company, Galaxy Digital (BRPHF), is mentioned, Co-Founder Mike Novogratz name comes to mind. It is certainly mentioned the most in context with Galaxy Digital. Novogratz was a partner at Goldman Sachs, before becoming a Partner and President of Fortress Investment Group LLC. Mike has served on the New York Federal Reserve’s Investment Advisory Committee on Financial Markets from 2012 – 2015. Continue reading

![]()

LOTM Sharing Ideas and Positions:

SILVER:

Silver has had declining production for about six years with the last four years where demand has exceeded new supply. Demand from Electric Vehicles, Electronic devices and solar – each solar panel has a thin coat of silver will increase demand for silver. Silver is the best conductor of electricity on earth. In addition, investor demand related to the rapid printing of fiat currency, is expected to create rising demand for physical silver. Continue reading

![]()