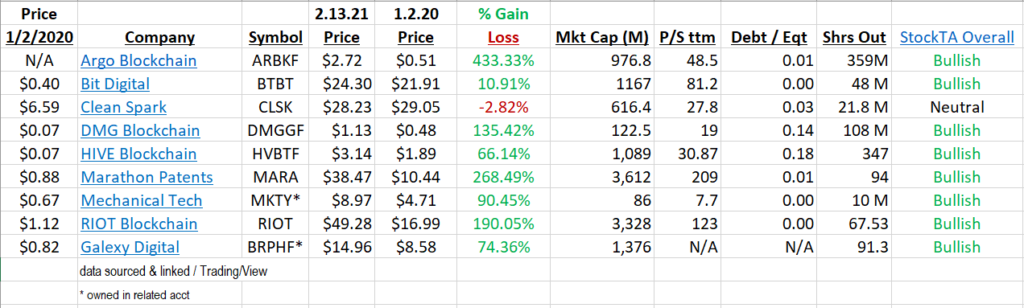

We are position builders in the infrastructure around Blockchain and Crypto. This is “the” emerging industry for the next decade among many. Cathie Wood and her ARK funds have much of that nailed so we will look for opportunities in her domain, however many are above $100 a share and we are on the other end of the spectrum in hunting stocks in the under $10 world. Continue reading

![]()