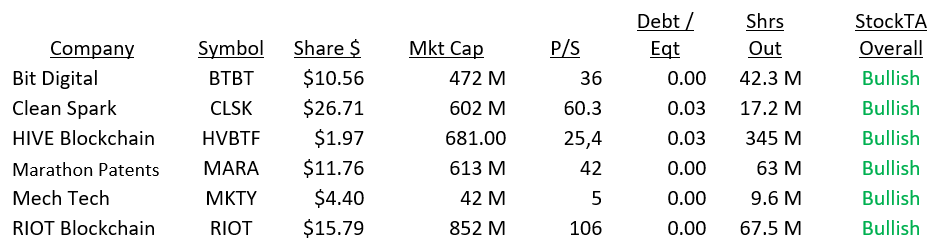

Crypto Miners are hot. So hot, they bring back recent memories of big moves cannabis stocks of not so long ago. They could move higher but is the risk reward worth it? That is a personal question for each of us. Where will these be trading in a month – three months or six months? At lower prices, there are companies here I like and would own, but most are too rich at this time. Continue reading

Crypto Miners are hot. So hot, they bring back recent memories of big moves cannabis stocks of not so long ago. They could move higher but is the risk reward worth it? That is a personal question for each of us. Where will these be trading in a month – three months or six months? At lower prices, there are companies here I like and would own, but most are too rich at this time. Continue reading

![]()