Summary: Continue reading

![]()

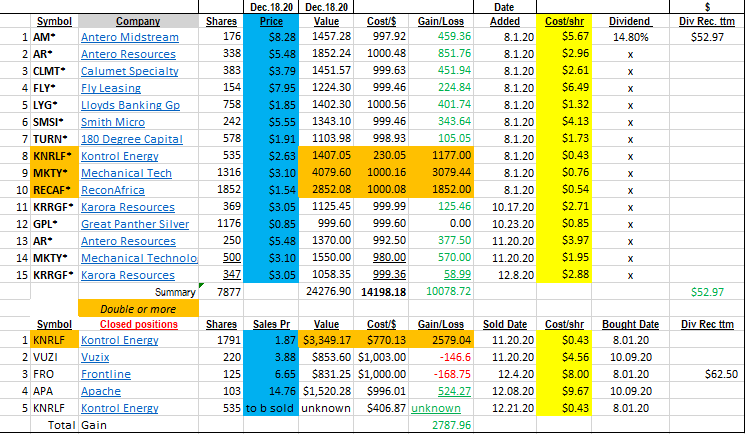

LOTM related accounts have positions in MKTY & GBTC, our focus today

It seems safe to say Mechanical Technology (MKTY)* is running with the “Crypto Currency Pack”.

LOTM Selected Ideas with TC2000.com date: 12.17.20 Continue reading

![]()

We like this stock as a trader and investment – though as an investment, it is so volatile, we think you should trade it or dollar cost average in the position. It is too volatile in our opinion to be sniping a purchase and a sale. Continue reading

![]()

Dec 10, 2020 – Audio Interview with Moshi Binyamin, President, MTI Instruments, Michael Toporek, CEO, MTI Instruments and Thomas Linzmeier, Investor & Blogger, LivingOffTheMarket.com

Link: https://www.mechtech.com/wp-content/uploads/2020/12/audio_only.m4a

Discussion Questions for Dec 10, 2020 Continue reading

![]()

I am not sure we could have done much better considering we put together this list of Ideas in Oil & Natural Gas. We started building the “Companies of Interest” for oil & gas list, August 1st, and added to the list since that date.

Continue reading

![]()

We are beginning to see initial selling coming into the Oil & Nat Gas Rally Continue reading

![]()

BEST Interview ever! From her mind to your Mind with no hesitation for 58 minutes. Great opportunity to hear and see an elite researcher, analyst and experienced trader who shares her 360-degree view into the next three to six months (her trading timeline). Intense with tons of knowledge, wisdom & information. Must Watch! Continue reading

![]()