Above is a link to an article written November 5th, 2020 – I have the opinion that yes, Junior silver miners are set up for. In a related account we do own SILJ the Junior Silver ETF, chart below:

Long Term SILJ chart: Continue reading

![]()

Above is a link to an article written November 5th, 2020 – I have the opinion that yes, Junior silver miners are set up for. In a related account we do own SILJ the Junior Silver ETF, chart below:

Long Term SILJ chart: Continue reading

![]()

A reminder that this is a dynamic list. We will hold positions greater or less than ten in the portfolio. During neutral and positive trending markets, we will expand this list. However, when the over-all trend begins to decline, we will shrinking this list and will add to the companies we consider “core” positions. This strategy is not for the weak of heart or stomach. It has produced big gains over multiple market cycles for our accounts. This strategy is part of our risk management policy. Continue reading

![]()

Provided to subscribers November 8, 2020

Summary:

VALUE:

The best 2020 values at the moment in the stock market are in energy, especially Natural Gas. We put together a list of some companies that look attractive for longer term. Some are debt free; most have modest debt and a couple have sizable debt that seems manageable.

DIVIDENDS:

A couple of the companies that are debt free and nearly debt free royalty companies that pay really attractive dividends that will grow when these companies expand drilling activity. They are MNRL and BSM (see below). Continue reading

![]()

I: Precious Metals are in a Bull Market

II: 2020 to 2030 will be the Decade of Commodities.

![]()

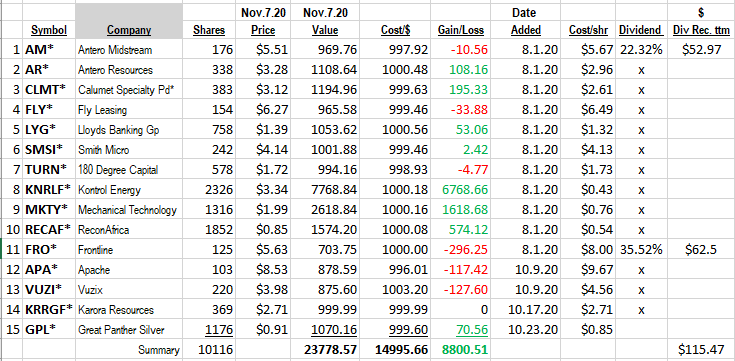

Ten Under $10 for the Double was started Aug 1, 2020.

Ten under $10 for the Double:

![]()

What to Do?

Prime Junior Silver Miners ETF

Long Time readers Know we have been bullish on Silver and gold since June of 2015. That is when the miners were valued at the lowest price Vs the physical metals ever. “Too Cheap”, is what we said at the time. Since then we have had some amazing rallies and some breathtaking corrections, but always working in an upward direction. It is not ending any time soon. The 2020 chart above is easy to read. A 50% decline in less than four weeks in March a really nice rally to August 1 and a correction until now. What to do? Continue reading

![]()

Market took a big correction this week. Our positions came down like everyone’s.

We have a position or two we will sell on a rally.

A possible candidate is FLY. Further research into the Airline industry suggest that lease rates were being negotiated lower even before Corona-19 Virus. Probably more so since the Communist China Corona Virus arrived. It is beginning to look like too much swimming against the current with no visible catalyst to resolve the issue. We do not suggest buying or adding to this position. Continue reading

![]()

There are some things we can place in the “high probability” camp as investors.

Fiat Money will continue to be printed in an effort to stave off depression – Inflation is easier to deal with and it allows the government to pay back “our” debt with cheaper dollars. What that means for you and me, is a loss of purchasing power. Continue reading

![]()