The stock market runs in cycles that historically have run between three to five years. There are additional market cycles that are both shorter and longer. Three to five years is the cycle we are focused on here.

We are heading into the conclusion of year four of the LOTM: Ten Under $10 for the Double. We have had some very big winners and some disasters. We still own some names that we believe can recover from their poor performance. Like any activity, assessing and refreshing the process is necessary for improvement. Our way of dealing with this is to wind down Game One as we head into the last few months of year four of the three to five year cycle. By winding down I mean not adding any new names to Game One and let the current positions run their course. We have some good winners that can continue winning. We have had some performance disasters that might, and hopefully, will recover. Thinking positively, we have some value as tax loss position to shelter gains from the multi-bag winners we have or might get. The mining sector is in what we believe is the first third of a bull market phase. We have a lot of mining stocks underwater we believe can recover in pricing.

A review of Ten Under $10 policies:

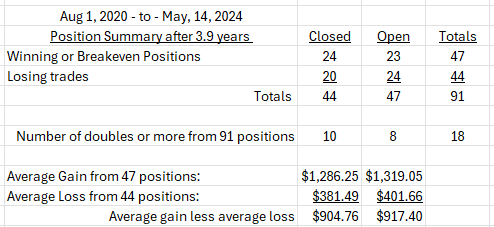

Our template is equal money into each position. We allow multiple positions in the same company but only with an equal second position sized as the first purchase. We have no formal stop loss policy. We do dollar-cost-average into both winning and losing positions. Some positions went to near total losses. Some positions we sold, and they continued higher. The goal was to let the winners run as much as we could stand. We like companies that are under stress, that we believe have value greater than the stock price when bought. We run this much like a venture capital fund. Four winners out of ten makes us profitable. Our winning trade percentage is a bit above 50% but we needed the 18 doubles or more to make up for the losing trades out of a total 91 positions. To get that return, we needed to let the winners run. 18 doubles out of 91 is a double or more success rate of 19.8%.

We are closing in on four years since this profiling for a price double started. How have we done?

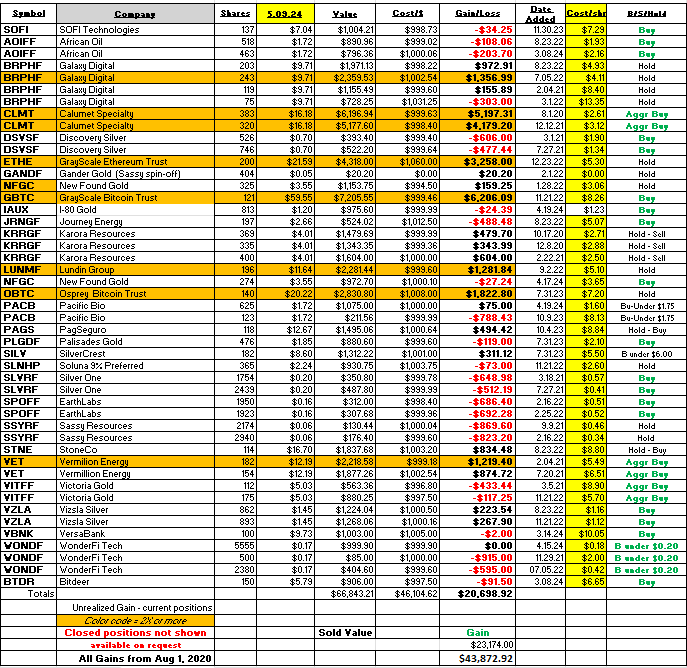

Unrealized gain entire period is: $20,699

Realized gain over entire period was: $23,174

Total realized and unrealized: $43,874

Average amount invested over the period was —- $44,000 —- Average size of each investment $1,000

We used $1,000 as the investment unit in this program. A better way that allows growth is to think in terms of 50 units allowable. This is the same as each new investment being 2% of the total account value. You could do 40 investment units which is 2.5% of account value. Work out what is best for you.

We will not add new positions to the Ten Under $10 – Game One. We targeted a five year plan with the idea that the market runs on three to five year cycles. In the period above, the market cycle rotations have come faster than we expected. We will keep track of Game One with no new additions for 14 more months remaining and see how the five-year cycle finishes. Of course, we will sell if selling opportunities present themselves.

Think of this approach as farming. There is a time to plant, a time to grow (or wither) and a time to harvest. We are in the Harvest season for Game One and the Planting season for the new Game 2.

How can we improve our performance based on what happened in Game One?

First of all, we are surprised, pleasantly, as to the uniform results over a nearly four year period. Losses on sales averaged about 40%. Average gains averaged about 130% for both open positions and closed positions. That is close to the 3 to 1 reward to risk goal on completed trades that we recommend targeting.

To answer the question above directly – Pay better attention to stock selection. Target larger sized companies for better liquidity and visibility for institutional investors. Pay more attention to the timing on dollar-cost-averaging into existing positions. This applies to DCA into winning positions and losing positions. Quicker sales when fundamental changes happen at individual companies. In dealing with small illiquid companies this is not always easy as their price drops quickly on bad news and may not trade is size. This negative is also the same positive we look for to catch explosive moves higher in the price. Consider this when reading LOTM material. You will need to self-select ideas from what I say I am doing and with what you can live with.

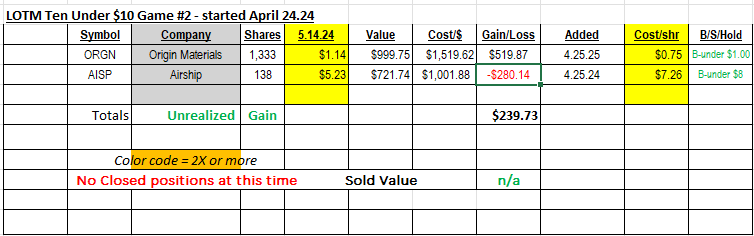

Ten Under $10 for the Double Game 2, has already begun. A mixed start with disappointment in Airship (AISP*) getting hit hard to the downside and Origin Materials (ORGN*) moving higher faster than our expectations. The period in which we initiate buying is usually a volatile stage. This period is loaded with uncertainty and lack of clarity. It might be a company’s turnaround point or a continuation of a downward trend. We try to get in at the positive turn but are not always able to do so.

We still like both companies below though Airship has share overhang to work through. ORGN seems to have passed that concern at this time. They will have to sell shares to finance what they want to do but that seems to be down the road a ways. Management inferred they want one big plant in Brazil that needs financing. After that and in their future, they will license the technology and process. By doing that they will not have to raise capital to finance the build out of plant and equipment. This action on their part is always subject to change.

LOTM: Ten Under $10 for the Double – Game One:

Keys to performance in Ten Under $10 includes:

- Letting your winners win. Harvest your original money and some profits from them but let your profits run – let your winners win as much as you can stand.

- Limit your losses even if its 100%. We limit loss by a portfolio approach of equal money in each position. Thereby, no one position can destroy the whole. That is why we can say 100% stop loss on each position. This is a difficult process because there are always reasons to dollar-cost-average into positions and reasons to cut and run. Deciding which is which is the hard part. The easiest way to express this in action is to decide ahead of time which companies you will trade (cut and run ideas) and which ideas you will weather the storm and buy more shares during tough times in the stock and the company.

- Your biggest winners and losers will come from the companies you dollar-cost-average into. True, because you put more money into them. It also allows more shares to be bought at a lower cost thereby lowering your cost of totals in that position significantly. Knowing when to hold’em and when to fold’em is a key decision process. This is where having a team approach can really help. Multiple views and comments that are not as emotionally attached to an idea as you might have, helps perspective. Multiple views and comments might also disclose something you have not considered or seen.

- Avoid leverage/borrowed money.

- Your winning positions must be allowed to pay for your losing positions.

In summary:

The structure is what makes this work more than individual stock picking or stock management.

It is an odds based, and probability based system, which is messy and filled with the uncertainty and the unknowable. Like any belief system it is often based on faith that the process will work.

It is not for everyone. It has to be called speculative for the many. It is a system that would benefit from conversations and discussion. Understanding the risk and rewards is important. More important than Understanding (intellectual aspect) is comfort and confidence (the emotional aspect) in the process.

The performance over four-years has been remarkably consistent. The open and closed positions – the winning positions and the losing positions – without any set stop loss metric other than 100% of each investment over four years is consistent within a messy process.

Understand what you want to do.

Are you trying to a) create assets, b) build cash flow from dividends, c) trade or d) preserve wealth already created. They each have different strategies and require different risk tolerances and target different returns.

Just saying you want to make money is not a good enough reason to be in the market.

That’s it. I’m done for today. We will have follow-up on some of the individual names on these lists next week.

An excellent weekend video report by Macro and Geo-political analyst, Pippa Malmgren. “Inside China, Russia’s Plan to Beat US Dollar and Bleed America Dry.”

Best always. Tom

Available for Coaching, Training or Mentorships

Inquire if interested

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()