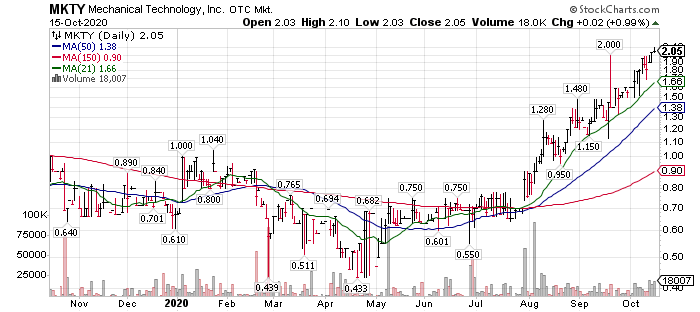

MKTY $2.05

Relentless in its advance. Impressive with no news. $50 million Mkt Cap would be a price of $4.34 and a $100 million market cap (where I think it is going, would be $8.77 – I do believe MKTY is heading towards doing a secondary offering of 5 million shares. A guess on my part – so add 5 million shares to the 11.4 million shares outstanding and divide it into 100 million Mkt Cap and you get a price target of $6.00.

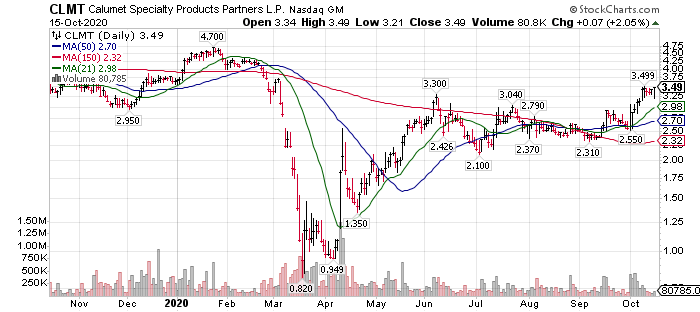

CLMT $3.35

Also impressive in its advance – now consolidating it move above $3.00. $4.50 is the next target. News of one or both divisions that are for sale would spike the price. Two major price catalysts pending with the sale & offers of two different asset groups. Total sale value is in the $800 to $900 million proceed range.

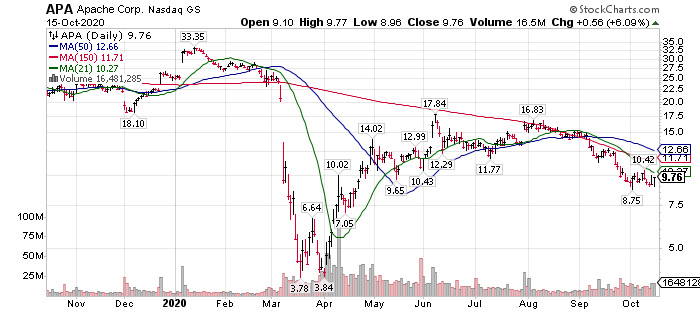

APA $9.45

Believe this is building a base. I like the way the share price sells down but snaps back pretty quickly. Think we have a little double bottom forming presently. Believe it is being accumulated as CLMT was between $2.35 and $2.60 before it broke out above resistance. Targeting a 50% move in twelve months or less. If oil goes above $50 a barrel, then a 100% move for Apache. Multiple buy recommendations on Apache in the past three months.

Here is what is going to happen in the next ten years.

The US Dollar is going to lose 30 to 50% of it purchasing power.

- How do I know this?

Fed Chairman, Powell said so if you know what you are listening for.

Cash and Bonds are Trash.

- Cash purchasing power will decline by 30 to 50% in ten years.

- Longer term bonds will lose purchasing power and value as interest rates rise with inflation.

Select Equities, commodities and perhaps cryptocurrencies are the best value values looking out five to ten years. - Do not be a victim.

Be aware what is happening and act accordingly. There are no excuses. Your financial future and your family’s financial future depends on it.Where Value meets Buy Signals!

Feel free to forward or recommend to others.* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()