Summary:

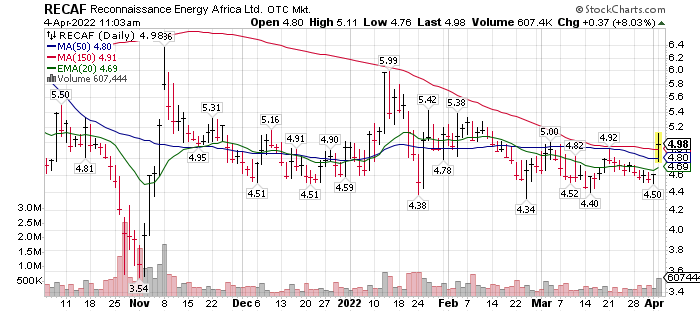

- Recon Africa (RECAF) $5.01

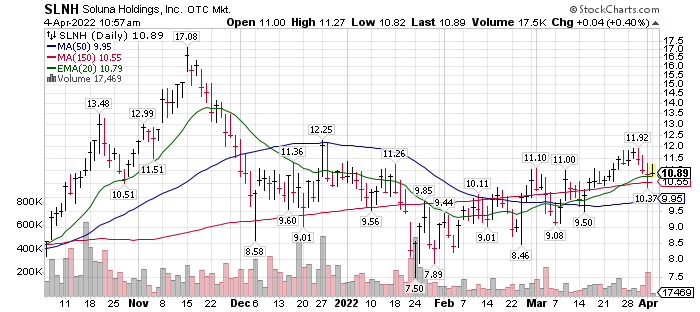

- Soluna (SLNH)* $10.83

- Have “Growth Stocks” Fallen to be so “cheap,” They are “Good Values?”

Recon Africa

Chart: Recon (chart above) is in what we consider a basing chart pattern. We expect the share price to stay in a choppy price basing pattern until further company developmental news is released. This could last well into the second half of 2022. Perhaps longer. LOTM call on RECAF is positive, but a hold and accumulate slowly on price weakness. This will take time to unfold.

As a LOTM: Ten Under $10 position, we invested $2,001.24 in RECAF – sold $4,874.92 worth of shares and have a remaining value in the position of $7,130.06 at today price.

Company: Recon Africa is a developmental stage company. LOTM was in early and recovered our original money plus a double. Recon has found oil and gas in each of its first three well drillings. Pretty impressive in its own right and the market cap (with dilution) reflects this success. The market cap is about $968 million as posted on TradingView. Drilling success is priced in the shares. We would wait for a market or company price sell off before getting aggressive in buying back in. We are in a very favorable position in having double our money and still owning 70% of the shares purchased.

Geo-political: The governments of Namibia and Botswana are strongly in favor of the development of their natural resources with Global Environmental Groups strongly opposed to the development of fossil fuels in Namibia and Botswana. This will continue but governments are expected to over-ride factors outside their territory. We desire a healthy environment. Technology exists to extract fossil fuels in an environmentally friendly way. We believe in ownership rights. The time to transition to green energy is greatly underestimated by environmentalists. It is up to the regulatory bodies to enforce the rules in place. We are realists. Without fossil fuels to bridge the thirty to fifty years to transition to green energy, we will not achieve green energy.

Soluna Computing:

Soluna is still undiscovered and undervalued in spite of its move from $0.75 in August 2020 to the $11 today. That is why they are a core position for LOTM. How do you beat inflation? You out-grow it! Soluna and Galaxy above, are two companies growing revenue and cash flows faster than our highest estimates for inflation.

Chart: the price is above its moving averages so by definition, Soluna is emerging from its correction after its November high price.

Institutional ownership is about 13% of the float. That is up from zero twenty-months ago. One money manage has accumulate more than 7% of the shares outstanding (1.2 million shares). Names like Blackrock, State Street, Invesco have accumulated shares. Six different Crypto focused ETF’s have started accumulating shares.

Total Revenue at the year-end 2020 was $9 million with $1.8 million in profit. The annualized run-rate 13 months later was $35 million. The projected annualized run-rate for year-end 2022 is in the area of $200 million. That is beating inflation! I am very positive on Soluna’s potential price for the visible future.

NOTE: Run-rate is the last month’s revenue projected forward 12 months. This is in contrast to total revenue which is the trailing twelve months revenue.

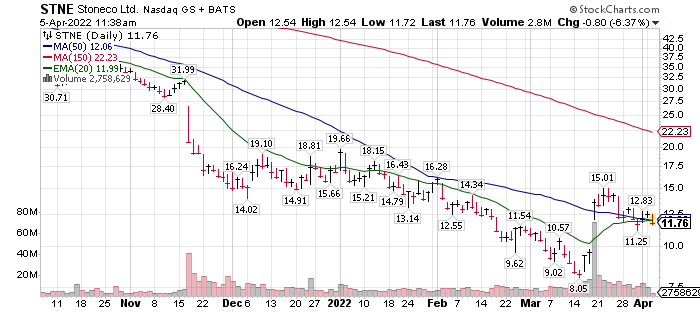

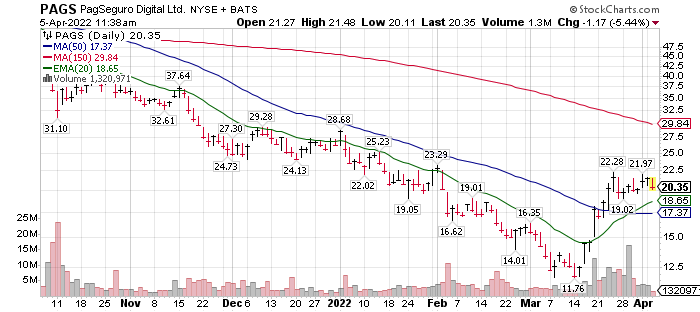

Have “Growth Stocks” Fallen to be so “cheap” They are “Good Values?”

Yes – in some situations we believe that to be true. Accounts related to LOTM are building positions in Payment/Blockchain Fintech companies. We are especially targeting Brazil where growth rates for a couple of payment fintech companies are growing in the high double digit percent area. We have talked about these companies so no surprise who they are. StoneCo (STNE)* $12.75 and PagSeguro (PAGS)* $21.16. (Charts below) We also like new technology companies that expand beyond fait currencies to include crypto and blockchain technology.

Headlines: it is not unusual for the Headlines to warn you after the fact. Cathie Wood ARKK funds are in the news today literally warning you of the dangers of her funds going out of business. This is after a year of decline. In looking at the funds chart action, the chart is looking interesting from an accumulation perspective. It could be a tempory accumulation and ARKK could resume declining. No one can say for sure. This is a probabilities game. Media are the worst source to read and take literally. If anything (related to making money) you should be skeptical and dig deeper to confirm the financial action, you take.

So yes, we are finding attractive buying opportunities in former darling growth companies.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()