LOTM: Comments on:

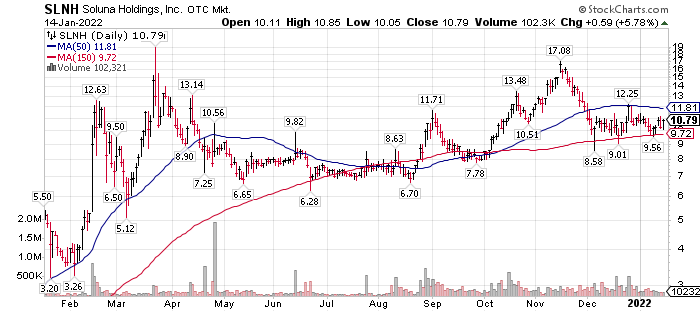

- Soluna Holdings (SLNH)*

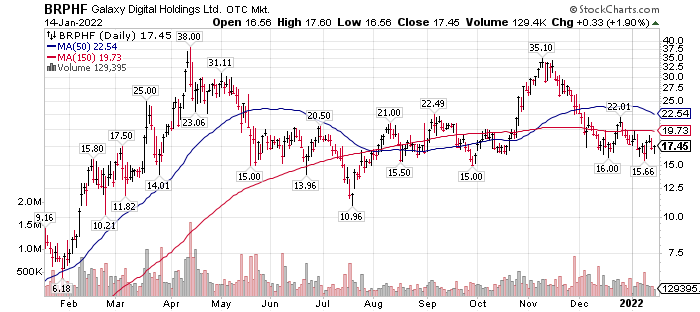

- Galaxy Digital (BRPHF)*

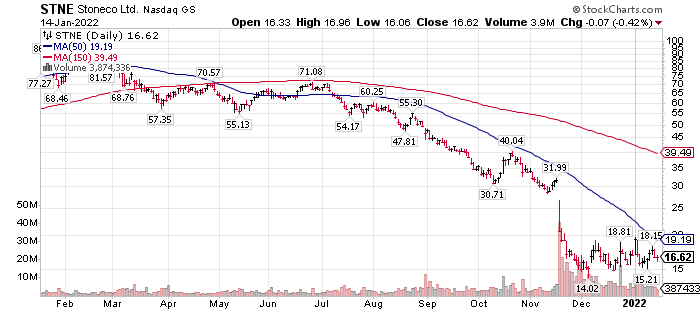

- StoneCo (STNE)*

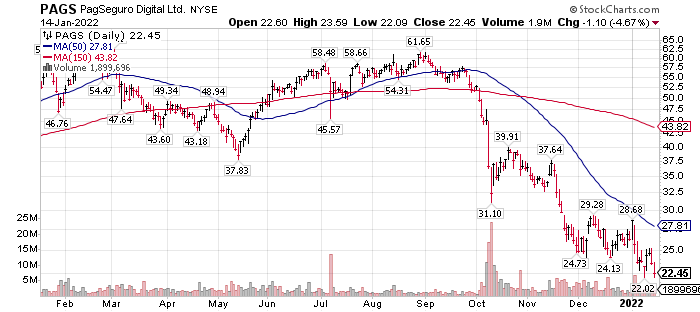

- PagSerguro (PAGS)*

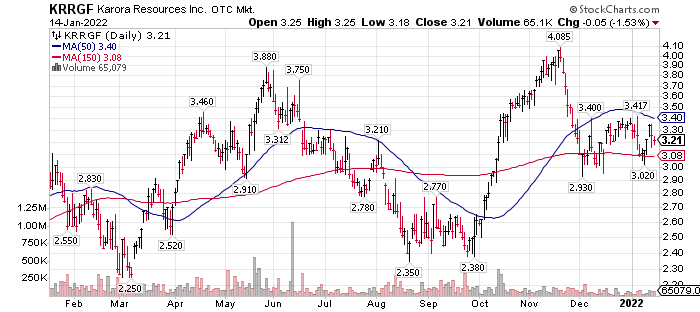

- Karora Resources (KRRGF)*

- PolyMet (PLM)

We are over-weight (position size) in three companies, Karora Resources (KRRGF)* – Soluna Holdings (SLNH)* and Galaxy Digital (BRPHF)*

All three are under-owned by institutions Vs what they could be following the next six month and longer development announcements.

- SLNH will have fundamental news as soon as January 17th when they do their monthly update of fundamental activities. They delayed their monthly announcement so the numbers they provide are the same as the numbers they will release for the Q4 ’21 and year-end announcement. This month and for the next year we expect to see rapid growth in revenue and cash flows that re-values the company and attracts new institutional investors. We feel a double to triple in market cap valuation by year-end is possible – maybe even a high probability. Risk factors include execution of “the plan”, market opinion towards crypto, rising interest rates and a falling equity market hindering the raising of capital for funding the quadrupling of revenue talked about for 2022.

Our view for SLNH is that News Flow is Marketing PR for institutional investors to have a reason to buy the stock. We’d love our ownership to catch the new accumulation of shares by an ETF or two. Presently Soluna has 5.35% institutional ownership as reported by NASDAQ. We think by year-end ’22, institutional ownership can rise to 30% to 40%. Ironically getting the market cap above $500 million will allow more institutions to own the shares. “Ironic” because it will be much larger than the current market cap at $180. It seems a $500 million MKT Cap valuation level is an entry valuation level for some institutions.

- Galaxy Digital (BRPHF) is in a similar situation as far as news flow happening this quarter that could be great marketing for the entrance of more institutional ownership and research. Galaxy is listed in Canada, soon to be listed in the USA. That will open doors for more ETF and Institutional ownership in my opinion. The closing of BitGo will expand the assets undermanagement, increase the geographic foot print of the company as well as add two new product offerings. Seeking Alpha released a blog post by Brett Rodway on Galaxy to day. Rodway compared Galaxy to Coinbase and Goldman Sachs as a valuation comparison. Both have higher price valuation metrics. The comparison was if Galaxy traded between Goldman and Coinbase for current valuation metrics, the suggest price for Galaxy would be slightly above $32. LOTM looks forward in our expectations so if is our hope that after the next two reporting periods the price expectations for Galaxy are higher than $32 price target.

A new area of focus for LOTM are payment software companies. We hold two at the moment – StoneCo (STNE)* and PAGS (PagSerguro). We believe money managers will look to Emerging markets for investment ideas. Both are operating in Brazil. Both of these companies have had big selloffs. Estimates are being reduced at the moment. We were & are tempted by the price drop, but we are probably early. Morgan Stanley (MS) covers both companies. If you have an account at eTrade the MS reports, are on the quote pages of each stock. eTrade is own by Morgan Stanley. We are early – too early with hindsight. We are within striking distance of breakeven with a 20% rally so feel we are ok. They are about 3% of related account held positions. We expect to accumulate additional shares over the next few quarters on weakness both of them. Our goal is a double or more in each on our cost when we sell them. Time will tell.

Our third working theme are precious metals. We think 2022 could be an excellent year for this group. We like the sector for the next three to five years. We don’t expect to get shaken out if the timing is off. As mentioned, multiple times Karora (KRRGF)* is our biggest position in gold/nickel mining. Similar to SLNH and Galaxy we feel there is plenty of opportunity for institutional holders to discover Karora and push/pull the shares higher. We hold about 12 other gold, silver and battery metal miners with a collage of different names and exposures.

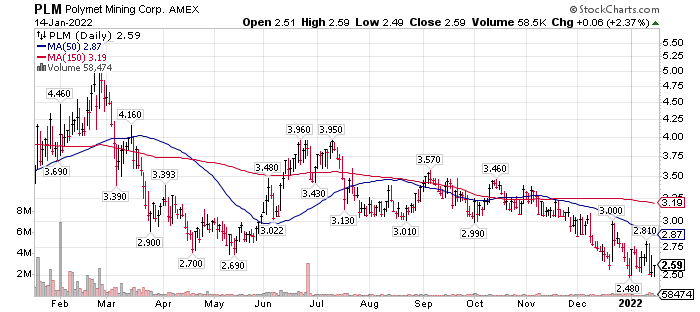

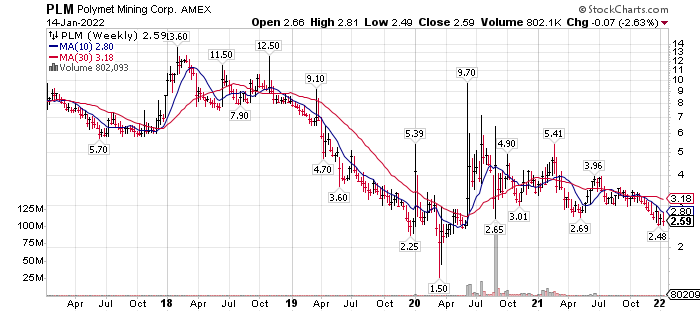

We recently mentioned PolyMet (PLM) in a LOTM email. We do not own it, but it is a massive deposit and strategic to the United States. We are fighting internally between not being “early to buy” and getting it at a “low price.” Timing wise, we are still too early but price wise, I don’t expect it to get much cheaper. The market cap is at $254 million as posted at Finviz. LOTM thinks this is an attractive valuation for a top 5 copper / nickel property. There is a lack of catalyst for price movement at this time. One would need a five year goal and expectation of three to five fold increase in share price. An increase in market cap from $254 million to a $2 billion market cap in five years is within our expectation. Lots of boring times in between now and 2027.

One year chart:

Five year weekly Chart:

As you probably know, we concentrate our positions. We are not diversified. This give us an intense focus with high volatility in our account values. We see Volatility as our Friend offering us Opportunity. You can assume we are bothered by being on the wrong side of volatility but use it as an opportunity.

Hope that helps you on our thoughts and positioning.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()