The past three years have been very rewarding for LOTM and our managed ZTA partnership. We have our periods of FUD, but we work to move through them. Periods of change are the highest risk and the greatest opportunity to capture new change or stay too long in the old ways.

Four Examples of New (rotating) Change:

- Money is moving into Financials – Banks and Insurance companies. Rising interest rates increase profit spreads at financial institutions.

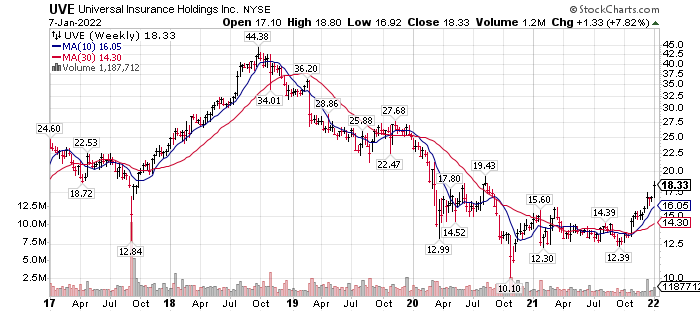

Stage analysis is obvious in the chart of UVE. From low price in late 2017, its price top in late 2018 to its decline from that 2018 top, to the current stage 1 bottoming process, we see the process of stage 2 rally, stage 3 top, the stage 4 decline, the stage 1 basing pattern, and now what appears to be on the verge of a stage 2 breakout. Look for pull-backs from the current price to buy. Better yet, dollar-cost-average especially n weakness.

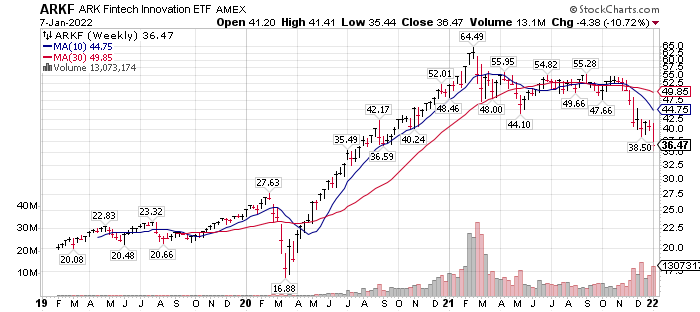

- Money Flows are moving out of “Growth at any Price” : Ark Fintech (ARKF)

It is hard to say this decline from Fintech sector is over. I suspect it is at a over-sold point but will need some months to even a year to base build a stage one chart formation. Certainly, we have seen money flows leaving this sector since February of 2021.

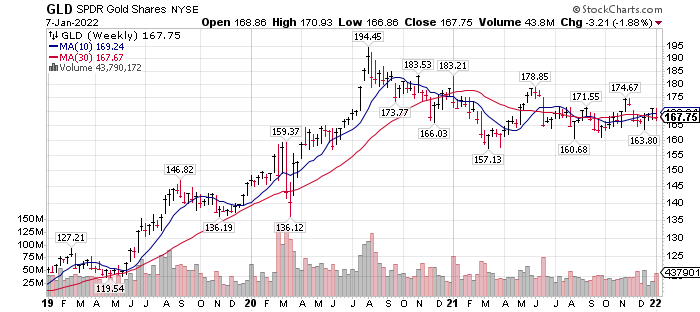

- Gold represented by GLD, the paper Gold ETF, appears to be completing a Stage one consolidation period from it two year bull run from late 2018 until it top in August 2020. This chart is one reason we are very bullish on Gold in 2022. In the chart below we can see the zone needed to clear is the $175 to $180 area for an all-in momentum buy signal.

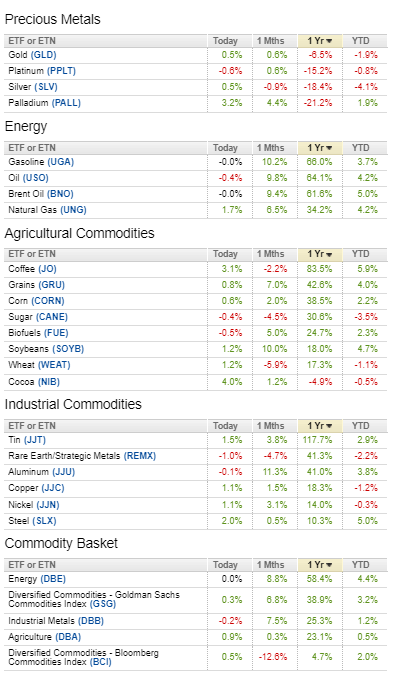

- Commodities in general with the exception of gold and silver have been hot for the last year. We expect commodity stocks to continue to outperform and Gold and silver to be the jonnie come lately catching up to the rest of the commodity herd. In the graphic below, sourced from Seeking Alpha web page, note the one year performance of the various commodity ETF’s. The date on the post below is January 8, 2022.

The LOTM goal in money management / stock selection, is to first find value in out-of-favor sectors. The greater challenge after finding value, is then the timing of entry and exit prices. This is ideally, in the later stage of Stage one, chart pattern. We are especially excited about precious metals as the asset class has been hot, that being Commodities and Real Estate with Gold and Silver having a classic late Stage one chart pattern and being the lagging group within the commodity asset sector.

We readily admit our interest in “Fintech” with positions in MoneyGram, StoneCo, PagSeguro and Bakkt might be “too early” as they could be at the end of Stage 4 decline or early into Stage one chart pattern. We especially like the Fintech sector however, as the industry is being revolutionized by blockchain technology. Blockchain’s impact from DeFi applications exploded in 2021. 2022 promises to be equally exciting for companies who apply Blockchain technology applications.

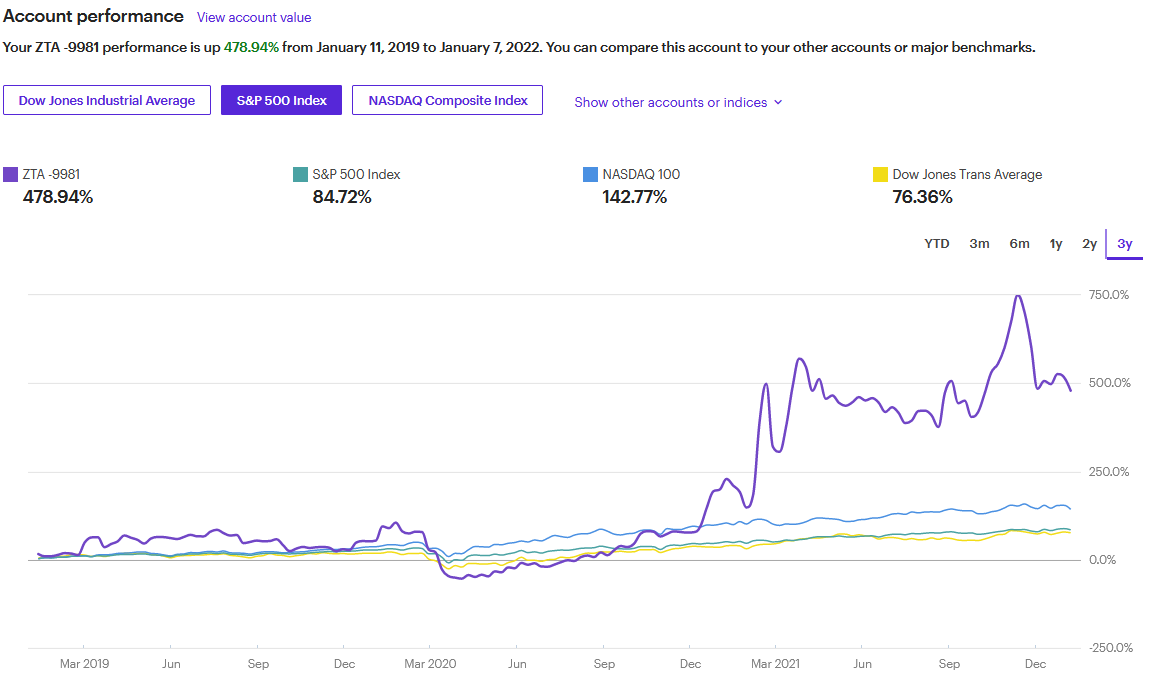

How has our performance been with this process of asset / industry / individual idea selection? There is always some luck in being in the right pace at the right time. The “science’ is the valuation metrics and technical analysis. The timing and individual stock selection is the “art” part of investing and wealth building.

ZTA is our managed partnership.

ZTA Partnership: Three year performance comps

The past three years have been very rewarding for LOTM and our managed ZTA partnership. We have our periods of FUD, but we work to move through them. Periods of change are the highest risk and the greatest opportunity to capture new change or stay too long in the old ways.

- If choosing from the following: Trader – Investor – Speculator – Gambler:

We are Speculators, although at times we Invest and Trade. We consciously work on not being impulsive gamblers. It is not easy to follow your intuition or follow your impulse. We work with probabilities across multiple disciplines. To smooth the impulses.

The LOTM/ZTA process is as follows:

- We look at money flows between asset classes and industry sectors to determine who is receiving and who is losing money.

- Company &/or Industry through a valuation lens. Valuation first for baseline potential and second for potential rapid change to either rapid revenue growth &/or profit margin expansion.

- We are seeking positions in which we believe the stock price has the potential to double in value in one year or average 100% annually, non-compounded. Example: Three times investment in three years.

- We seek Price Leverage from Capital Structure profile not our borrowed money.

- Most of our accounts are subject to annual taxation so positions are Tax Managed to minimize taxation.

- Technical Analysis (TA) is used to identify Stage One Chart Patterns. TA is also used to scale in &/or out with the goal of building the position size over time, should the long-term fundamental trend suggests it will be beneficial.

- We consciously look for points of transition between Fear & Greed, Asset Class Rotation &/or Industry Rotation.

- We also look for companies and industries that do not financial model well and are subject to wide valuation swings. Economically sensitive industries would be an example.

This report is presented as an up-date for ZTA partners on the current valuation, a real world performance example of our work at ZTA / LOTM, and educational purposes for life-time learners in the market.

We wrote this as a teaching / educational article to assist readers of LOTM in your wealth building plan.

Positions mentioned in this article and in the ZTA and related portfolios, can and will be sold at any time, without any notice what-so-ever. Neither Tom Linzmeier nor LivingOffTheMarket.com are Registered Investment Advisors. We are open for discussions on how to cooperate for our mutual benefit.

You can Read, you can watch Videos, but nothing beats Personal Interaction for accelerated learning.

This game has levels of understanding that could take a lifetime of Trial and Error to learn.

Available for Coaching, Training or Mentorships

Contact Tom through the LOTM website or by email

Rate: $150 per hour / Monthly Retainer, Lowers Rate

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()

Hi Tom,

I got introduced to your blog and like it. You do a good job. I also have a blog site and weekly newsletter. My website is http://www.twresearchgroup.com. Free to subscribe if you want. I’m signing up for yours now.

Cheers and good luck in the markets! I’m myopically focused on several disruptive tech and biotech firms…so it’s been a tough 11 months, lol. Expecting better times soon.

Dan