Chart #1

Chart #2

Chart #1 is EWZ – Brazil Large Cap ETF.

Chart #2 is QQQ – NASDAQ 100 ETF.

Maybe neither, but the fact that inflation is falling in Brazil and interest rates seem closer to falling in Brazil than in the USA, I am a big bull on Brazil stocks and the ETF.

Brief Technical comment on Brazil stocks by Gareth Soloway at about the 5 minute mark of the linked video.

- https://youtu.be/ZBzsWqUJK28 total video length, 10 minutes.

This video was released October 13, 2022, by Kitco. Soloway is well followed in the public media channels. His popularity is due to his accuracy over the past 18 months.

Soloway has positive comments on Pharma (blood pressure Meds in a recession haha) with sill negative comments on Apple (APPL) & Nasdaq 100 (QQQ). Bullish on Gold – needs time but actively buying gold now. His comment on Brazil was that the chart looks good for a break-out, short term. There is too much international money in the USA stock market that will flow to Emerging markets when the dollar weakens. No new high’s on tech equities for ten years. Three to six months, Soloway is negative on Crypto with a Ten Thousand downside price (potentially lower) but he is a very big Bull on Crypto (Bitcoin) long-term.

LOTM’s interest in Brazil started with interest in PagSeguro (PAGS)* and StoneCo (STNE).* From that interest, we looked at Brazil from a Macro fundamental perspective. LOTM is very positive on the stocks, PAGS and STNE.

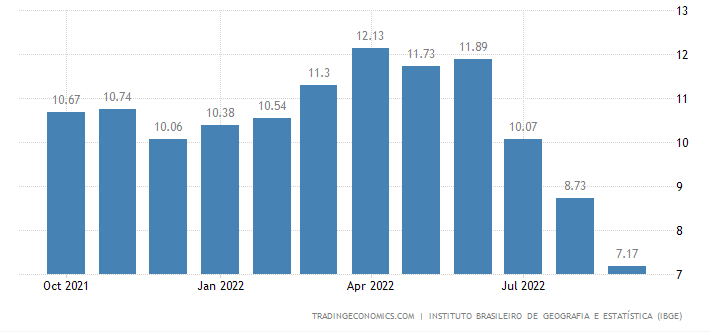

Fundamentally, Brazil is well ahead of the USA in addressing inflation. Interest rates rose from 2% in early 2021 to 13.75% this year’s summer. Interest rates are holding flat at 13.75% but the inflation has dropped from 12.13% in April to September’s rate of 7.175%. Chart below. This is positive for their economy and the stock and bond market.

Brazil Inflation Rate as of September reporting period. Source TradingEconomics.com

Speaking of Pharma stocks as Recessionary stocks, Alcohol sales rise in recession and depression cycles.

Have a great weekend. Think I will have some wine. Tom

Written October 14, 2022, by Tom Linzmeier, for Tom’s Blog at https://lotm.substack.com/.

Accounts related to LOTM and Tom Linzmeier can & will, buy or sell securities at any time.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Consult your investment advisor for investment advise appropriate for your situation.

To Unsubscribe, please select “return” and type Unsubscribe in the subject line.

Tom’s LOTM Blog page https://lotm.substack.com/

![]()