Sourced from Finviz.com

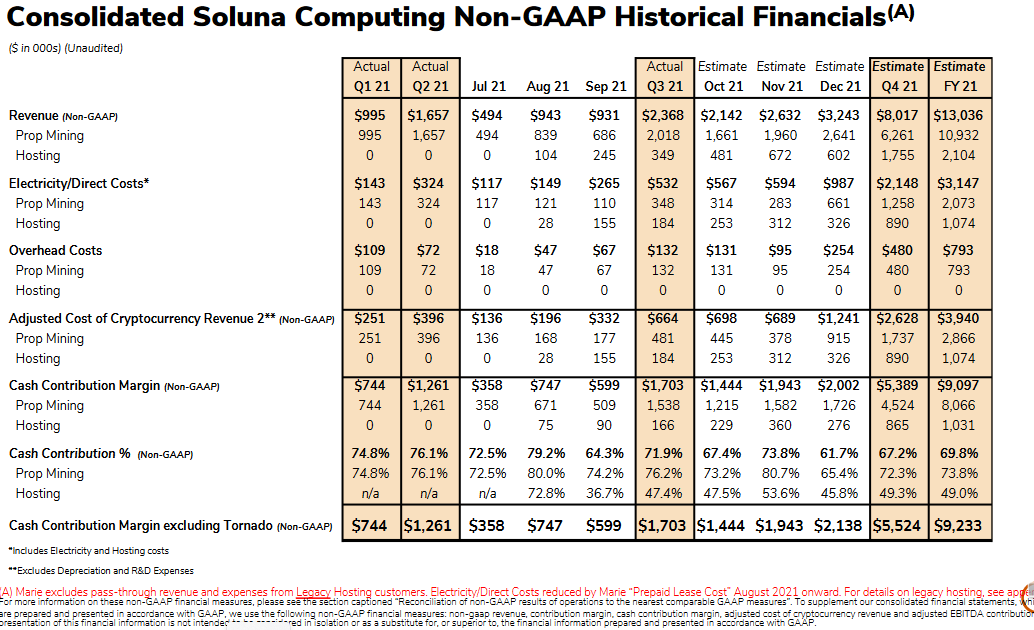

Soluna Holdings updated its December 2021 results for its Soluna Computing 100% owned subsidiary.

The most important figure for LOTM in the Jan 18th, 2022, up-date of Dec ’21 is Q4 revenue growth.

- Q3 Sept 2021 revenue was $2.37 million

- Q4 Dec 2021 revenue was estimated at $8.0 million

A high rate of rate of growth is projected to continue through 2022 and into 2023. The complete report is posted on-line at Soluna Computing, linked here. The numbers above do not include the results from its 100% owned (for sale with LOI in hand) MTI subsidiary.

Link to source

Soluna has a green-field for two years as they build out the rights to power from their related Wind and Solar farms in Morocco.

It is projected that 300 megawatts of power is available to Soluna from the Morocco Alt-energy project.

A negative for Soluna is that the barrier to entry from competition is low. It is important for them to run as hard and as fast as they can to gain relationships and critical mass. The related source of power from Morocco is a distinct advantage for a start-up company in this business vs competition.

The service & relationships seems to be critical factor since the barriers to entry are low. Management excels at service and transparency as seen in their communication with shareholders. In a digital world, personal relationships still matter. Perhaps that is their edge and advantage. For the next two years, control of their own destiny is in their hands due to the Morocco relationship. Revenue, when Morocco is fully built out and added to existing revenue, could be as high as $60 million monthly. This number is extrapolated from one megawatt of power producing monthly revenue of $170,000 as on the Q2 reported numbers. This is subject to change due to the price of crypto, the timing of financings and Joint Venture agreements. Cash flows from revenue at 250 megawatts (fiscal 2022 goal) will allow the company tremendous flexibility to adapt to changing times and new revenue sources.

An excellent blog post by Astrid Wilde linked below.

- $SLNH more than a Bitcoin miner – https://astridwilde.substack.com/p/soluna

LOTM considers Soluna Holdings (SLNH)* an aggressive buy and a core holding. While LOTM related accounts will some scale out on sharp rallies, we expect to scale back into larger positions on price weakness. Good fortune to all.

You can Read, you can watch Videos, but nothing beats Personal Interaction for accelerated learning.

This game has levels of understanding that could take a lifetime of Trial and Error to learn.

Available for Coaching, Training or Mentorships

Contact Tom through the LOTM website or by email

Rate: $150 per hour / Monthly Retainer, Lowers Rate

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()