- Gold (GLD)

- US Dollar (DXY)

- S&P 500 (SPY)

- Karora Resources (KRRGF)*

- Soluna Holdings (SLNH)*

- TZA – Small Cap Inverse ETF

Two to four month forward Technical indicator comments:

Gold:

If we take away the November rally in gold it appears like a double bottom in Aug and Oct.

Slight trend higher. All moving averages are under the price indicating both an uptrend and support under the price

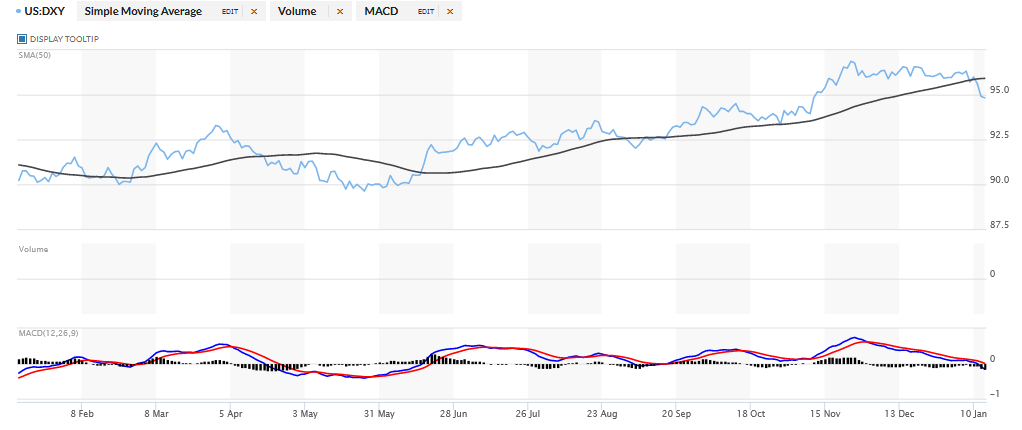

US Dollar:

US Dollar crossing below its 50-day moving average. Weaking trend. More often than not a weaking US Dollar is positive on a global basis for gold as stronger foreign currencies allow those countries to buy gold at a cheaper price. Not always a direct correlation but enough to be a factor.

S&P 500 (SPY)

The S&P 500 looks tired. Potential topping pattern should the price close below it 50-day moving average. Technical indicators are lagging the price action a signal of a tired market. Inverse ETFs link https://etfdb.com/etfs/inverse/equity/. If the S&P drops below its 50-day MA – the 150-day MA is the next target goal lower.

Some of Individual Stocks:

Soluna Holdings (SLNH)*

Similar comment as with Gold. Appears to be consolidating and at a baseline price to move higher. Positive news expected on Jan 17. Monthly update linked at this site – EcoChainMining.com Watch how the price action reacts to news. Not necessarily the day of the news but within a week the news – we want to see positive news begets positive price action. If not, then we know there are more owning sellers than new buyers. The price is between its 50-day (below) and above its 150-day MAs. Therefore, not trending at the moment. Flat-line price action suggests someone big is accumulating. It is important for the price to react positive to its news flow. Looking forward twelve months should management execute is plan this stock is greatly undervalued and unknown. This is our biggest position by far for that reason.

Karora Resources (KRRGF)* LOTM’s top gold stock pick of any market cap or level of development.

Fundamentally the story is great for an extended forward timeline. “The Company” is on track to double revenue over the next three years. Earning can be expected to better than a double. Should gold and Nickel prices move higher over the same timeline this stock could be a three to four bagger in three years.

Technically the stock is neutral – below its 50-day and above it 150-day MAs. Seems to be under accumulation. 150-day providing enough support to be a buy the dip near the 150-day.

TZA Inverse ETF for Small caps 3X leverage. Very volatile for traders.

A stage one chart pattern. Price is above all moving averages but just barely. Technical indicators are leading the price action in a positive (upward manner) except for CMF. So, counting moving average cross over (price above moving average we have four of five signals suggesting high price ahead for this inverse ETF.

TZA is three-X leverage so not for passive investors. It needs constant attention and more for those addicted to the market. TZA’s pattern suggests a position that is ready to shift to stage two price action.

- Unlevered Inverse ETFs to consider that are more hedge like would be listed at https://etfdb.com/etfs/inverse/equity/ as 1X leverage.

Choppy and rocky market but still plenty of long-side opportunities. Use stop -loss cuts for non-core positions and Dollar-Cost-Averaging for core positions assuming you have cash flow to do so. If you don’t have cash flows but follow the core and non-core position approach, then know and be ready to decrease the non-core positions with stop losses and use those proceeds to add to the core position until you are in harmony with the market trend. You could call this the batten down the hatches or circle the wagons approach to investing. It works but you have to be strong of mind and dripline.

Excellent comments on Bitcoin and why he loves Volatility for creating great long-term performance by Bill Miller III, money manager, formerly with Legg Mason, now his own funds. Video Linked here.

Email for a consult if you have questions. Great day to all!

You can Read, you can watch Videos, but nothing beats Personal Interaction for accelerated learning.

This game has levels of understanding that could take a lifetime of Trial and Error to learn.

Available for Coaching, Training or Mentorships

Contact Tom through the LOTM website or by email

Rate: $150 per hour / Monthly Retainer, Lowers Rate

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()