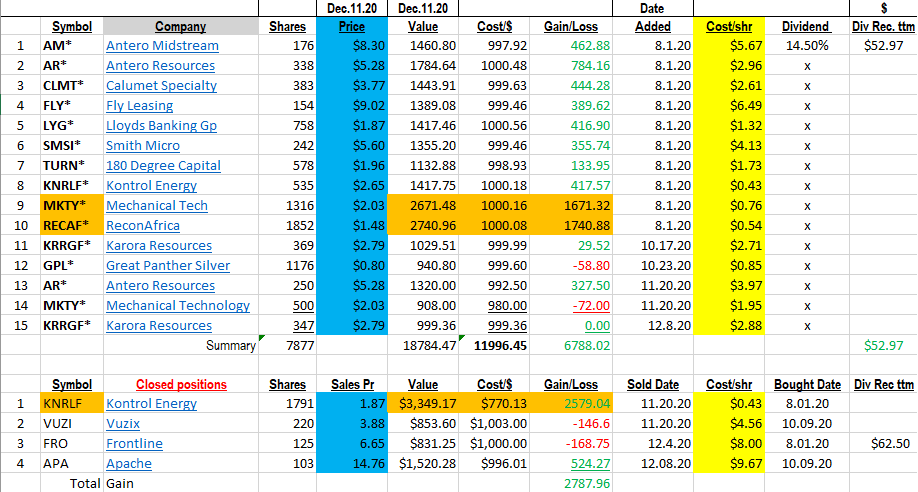

This week we do not have much to add other than some additional charts that we think are timely.

Smith Micro (SMSI) We do not have any comment other than the shares are strong and gapping higher. Look for pull backs to buy. Perhaps after, the new year we will see a pull back. I suspect the market will stay strong into year-end. The reason is a bit cynical. Smith has potential to create a large recurring revenue stream from it Telcom partners. Therefore, we like the company long-term. The contract awards are lumpy until the contracts are in place for a while. The ramp is gradual but builds. A push above $6.50 and we would probably sell 30% of the shares.

Calumet (CLMT) has one division for sale and a second division that they have been approached to ask if they would consider selling. One of the other sold would reduce debt significantly. The share price is drifting higher like someone knows something. Normally, we do not like this pattern and would be more concerned. With the potential sale in the next six months, it is a hard call. Our longer-term price objective is quite aggressive at $16.00. There are many variables at work when two large divisions are being looked at for sale. Time will tell but we are positive on CLMT know matter what they do related to partial company sales.

Fly Leasing Limited (FLY) is an airline leasing company. The rally off the lows came with news that a vaccine would soon be available. This is a tough business with competitive lease rates however in the chart you can see where the price was prior to Covid. Expectations are that commercial flights will return to more normal reading in the second half of 2021. We would consider buying into this little dip. I know we waffled on this one a few weeks ago but the nearness of the vaccine speeding up the flight schedules helped financial visibility for the airlines.

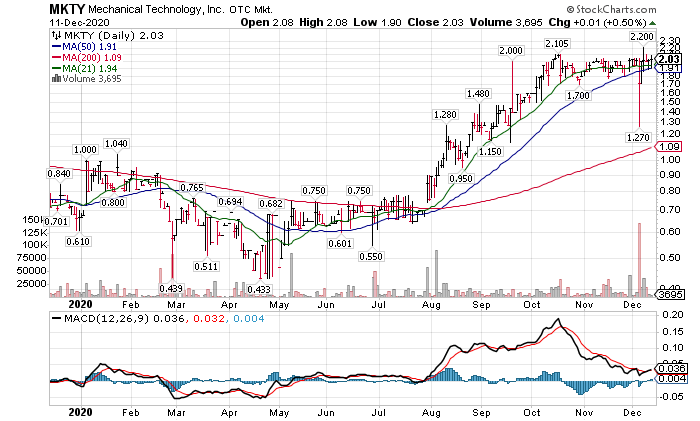

Mechanical Technology (MKTY) is very thinly traded as we can see but the big price swings. Limit orders only. We want to point out the MACD black line crossing above the slower red line. This is usually a good trading signal for any stock. It is a trading signal not a longer-term accumulation signal so. It works best in choppy markets. In trending markets, it can give some false sell signals where you would back been better off owning through. We expect news of progress in the company’s subsidiary EcoChain. (www.ecochainmining.co). MKTY is moving aggressively into crypto mining. Its market cap is tiny Vs its peer group. As news develops, we expect the market cap to expand. This of course will be influenced by the price of Bitcoin.

You might buy some and look for price weakness to add more shares. We were impressed at how quickly the share price recovered from the week ago selloff. We are targeting the $8.00 to $10.00 price area in 2021 as a goal.

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()