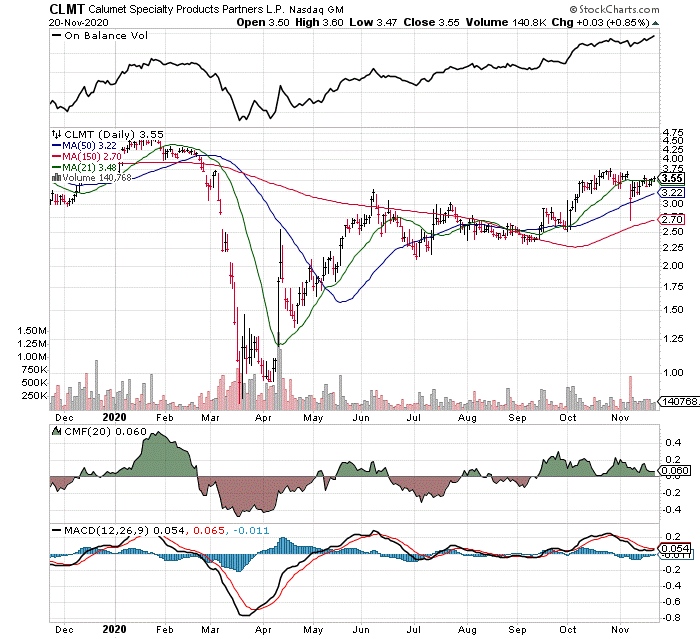

Let’s start from the bottom of the CLMT Chart:

- MACD: MACD is a good to great short-term trading signal. It is just a formula for the difference between two moving averages. The black quicker line is about to cross above the red slower line. A buy signals.

- CMF: CMF is a measure of the accumulation or distribution of share. It measures whether the larger trades are buys or sells. Green is showing larger trades executed are on the buy side of the trading activity. A Positive.

- Moving Averages (MA): MA is just that moving averages. We want to see MA’s rising in trend and the shorter ones crossing above the longer-term MA’s. Of course, we would like to see the Price above all moving averages. This is the current state of affairs. All positive for CLMT.

- Overall image of the chart trend: Yes, since the March lows, the chart trend of CLMT is up and remains in an upwards trend. Positive.

- On Balance Volume (OBV): OBV, like CMF, is a measure of trades showing accumulation or distribution. CLMT has had a positive accumulation of shares since the March lows.

- LOTM rates Calumet a buy on both short term and long-term perspective.

WARNING: Technical chart patterns can and do change in an instant. They are a picture in time as signals for the future can be. News, be it, Geo-Political, Economic, Macro, Company or Industry specific can happen at any time that changes the trend. Use charts as probability trades. Company fundamentals count as do the Human emotions, Fear, Greed & Apathy are additional factors to consider.

Accounts related to LOTM have an over-weight position in CLMT.

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()