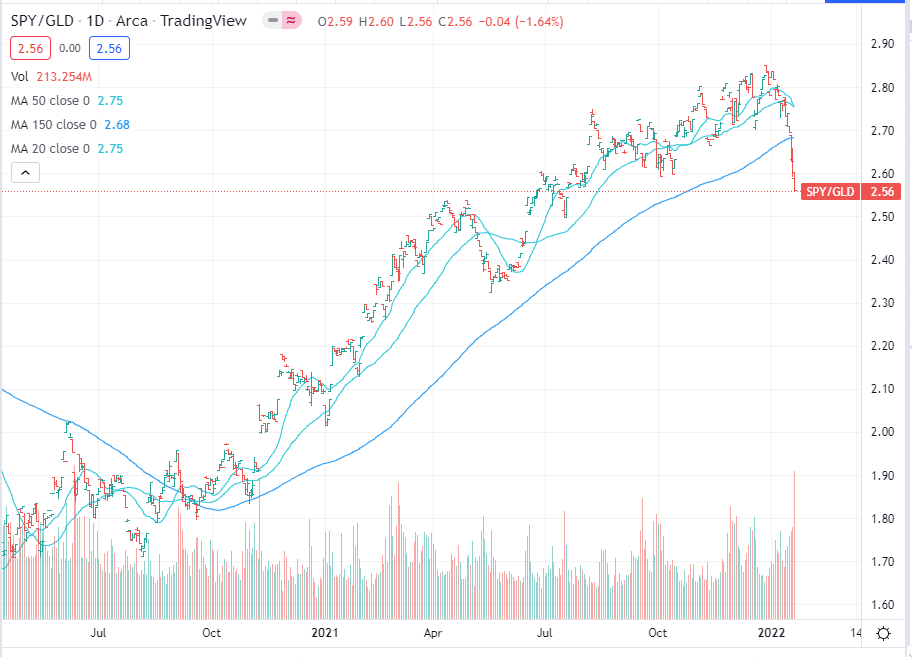

Last week, LOTM shared the relationship between the S&P 500 and Gold as shown in the SPY divided by GLD. The chart above provides a visual on whether more focus can be applied to one or the other. Currently we would use a rally in this chart to sell the S&P 500 and buy Gold.

The Current View:

- The trend in motion is in motion until it is not.

Basic Physics says a motion will continue in the direction it is moving until a greater force enters to change that direction.

This is where we do volume monitoring. Volume is where the greater force appears. Buyers Verse Seller meet and resolve their differences. So, Look at Friday’s (January 21) volume action. Notice the volume surge Friday. This suggests the Stock Market is over-sold and ready for a bounce. We will not know if this is a longer term change in direction (V bottom) or we need a second bounce (double bottom). We will assume An over-sold rally and selling again as the ratio approaches the bottom of the 150-day moving average.

This comment applies to the SPY Vs Gold activity. Our baseline theme or view is that for the year 2022. It applies to trading as well apart from the relationship between gold / silver and S&P.

- Risk on trade = S&P 500 rising.

- Risk off trade = Gold & Silver rising.

- Like a teeter totter.

Have a great day! I will predict one to three days of rally this week then we will see if we have a V bottom or a double bottom attempt. Let’s see.

You can Read, you can watch Videos, but nothing beats Personal Interaction for accelerated learning.

This game has levels of understanding that could take a lifetime of Trial and Error to learn.

Available for Coaching, Training or Mentorships

Contact Tom through the LOTM website or by email

Rate: $150 per hour / Monthly Retainer, Lowers Rate

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()