Technical View:

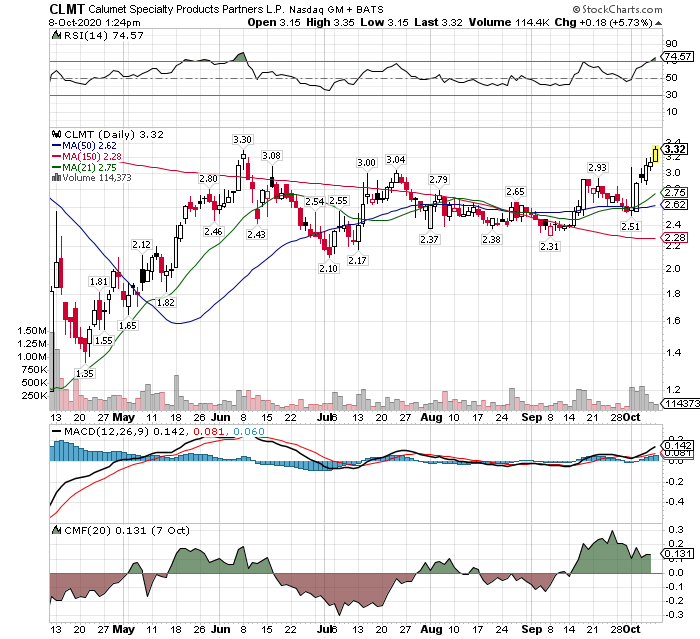

Calumet Specialty Products $3.33

Calumet price is breaking out above the recent consolidation pattern. Support is now $3.00 to $3.30 zone. Look for 5% to 7% dips in the share price to buy. Think $3.00 is pretty solid support. Next trading channel highs are $4.50 to $5.00. Longer term price goals are $8 to $10, on asset sales and debt reduction.

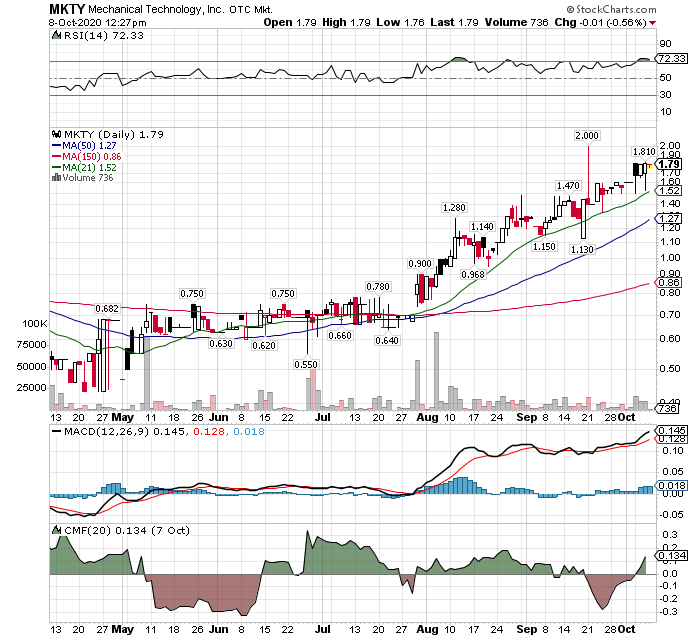

Mechanical Technology (MKTY) $1.75

Very Illiquid so look for sharp drops in price to buy. Suggestion is GTC limit buy orders at $1.55 or $1.45. Lots going as the company launches a new 100% owned rapid growth subsidiary in Blockchain and Crypto Mining. Core business is very strong as well delivering on its largest order ever in Q3 and Q4. Expect news related to its EcoChain Mining subsidiary by end of Q3 reporting. Our Target price is a $50 million to $100 market cap (11.4 million shares outstanding, apx 6M floating).

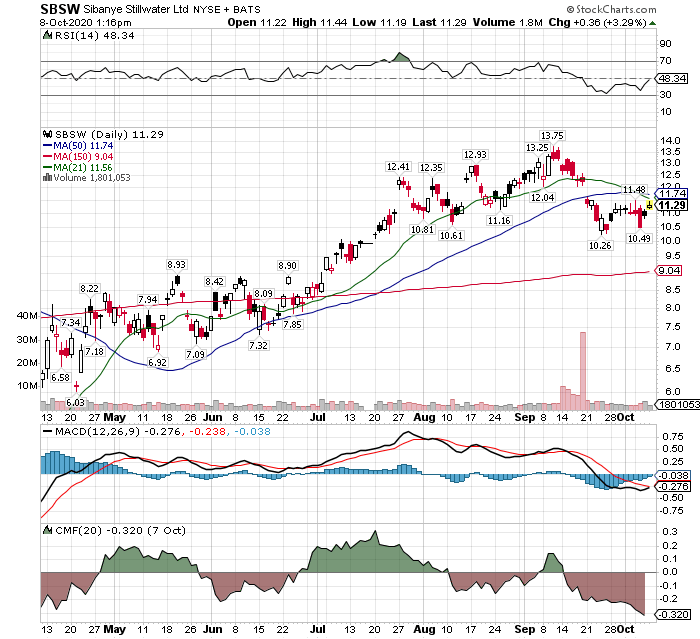

Sibanye Stillwater – Precious Metals sector (SBSW) $11.29

Technical Analysis

SBSW Price has consolidated the run up from its break-out move above its 150-day moving average.

RSI is rising agon as is MACD crossover happening. The chart has a bit of a double tap bottom at $10.26 and $10.49. Seems ready to move back above its 21 and 50-day M.A.’s

Earnings for the Precious metal miners can be expected to be strong as physical metal prices are nicely above Q2 Physical metal prices. Let’s admit it; strong management is desired in the miners, but the real measure of what going on with company and stock is, “what is the physical metal doing”?

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()