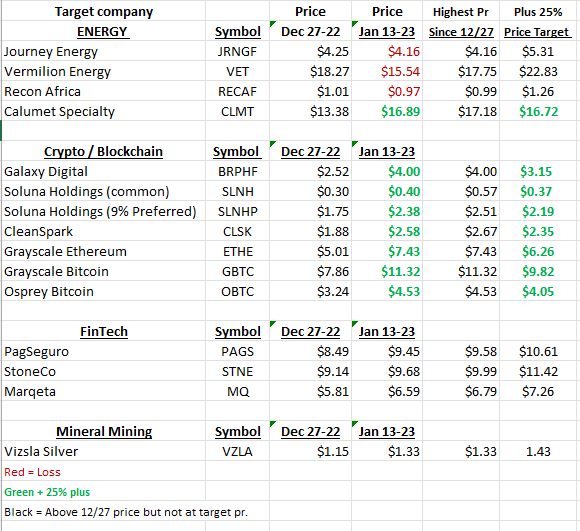

Purpose:

Demonstrate that buying when the majority are tax loss selling is an annual, profitable and repeatable event.

Goal:

Illustrate that 25% plus profit can be made in a 60-day selling target zone.

Trade a grouping of tax loss ideas rather choosing one or two stocks. It is the statical edge presented from tax-loss selling season that you are after, not a rife-shot on one or two names.

![]()