All the clean technologies that we need to combat climate change – whether that’s wind turbines, solar panels, or batteries, they’re all really, really mineral intensive– Lucy Crane, Senior Geologist, Lithium Cornish

The Hypocrisy of Clean “Green” Energy

The opportunity from investing in Mining, happening now and continuing into future years, is a result of Electrification of transportation and the environmental move away from fossil fuels for creating electricity. This will increase demand on mined products. These mined products, minerals, is all encompassing. Silver (solar panels and electronics) Nickle, Cobalt, Aluminum, Lead, Lithium & Magnesium (Lithium & Traditional lead acid batteries) Uranium (nuclear). Copper is needed for the core windings in electric motors.

Additional precious metal mining will come from the very clearly stated goal of the US Government to devalue the US$ through keeping interest rates low for an extended period of time and letting Inflation run “hotter”. Gold and other precious metals are a desired safe haven for protecting purchasing power from a declining US$.

At the same time, advocates of Clean “Green” Energy are advancing legislative moves towards more solar, wind and battery technology, they are also advocating the protection of the environment and thus passing legislation to restrict mining activity. This is economics 101. Expand demand, restrict supply and prices will move higher. Companies with mineral resources and existing production will reap the benefits of higher end product pricing. This is really basic stuff.

Lithium: The Not so Clean, “Green” Environmental Impact Solution Most Believe:

Lithium is sourced mainly from hard rock mines, or underground brine reservoirs below the surface of dried lake beds. Other extractions are from open pit mines. The resulting product is then baked , using fossil fuels, and requires a large amount of water. This process, releases 15 tonnes of CO2 for every tonne of lithium, according to raw materials experts at Minviro. Another method of extracting lithium, is from underground reservoirs. This relies on even more water to extract the lithium. Typically, source is in very water-scarce parts of the world. This palaces hardship on the surrounding environment and post mining sustainability.

Please do not assume I am against protecting the environment or alternative energy. I favor it. In the practical world of cause and effect, however, it is my job to see the strengths and weaknesses of group think and legislative direction to find financial profit. Today, group think is producing legislative activity that in turn, is creating an opportunity of owning the source of the materials needed to create energy from wind, solar, nuclear and the storage needed to utilize that energy created. This source is miners.

Ideas in Mining:

Silver: Silver is the most undervalued mineral of the high demand market of Clean, “Green” Energy minerals. Solar panels are coated with silver. Silver is also the best conductor of electricity. As such it is used in electronics (smart phones) and any electronics device that needs high speed and reliable transfer of electricity. Electronics for the auto industry is one use.

One could own silver bullion through a trust that holds silver such as Sprott Physical Silver trust (PSLV) $7.92 or Aberdeen Standard Silver ETF (SIVR) $21.88.

More volatile, and levered to the price of bullion, investment is to own the miners. If you are not comfortable selecting individual Silver Miners, then we suggest as the next best investment vehicle, is the Prime Junior Silver Miners ETF (SILJ)* $13.58.

Copper: Electric Motors without copper? Not yet. Silver would be the better substitute for copper but we not going to see silver windings used in electric motors because of cost.

Here are two Copper plays:

Rio Tinto (RIO) $66.05 trading at 10-time forward earnings is a world class miner of multiple minerals of which copper is a strong product line. At 10x forward earnings, it is the value deal of big copper producers. This next one might surprise you, because most people think of it as a Gold producer. We like it because it is a gold producer and because gold is in a corrective phase since August 1 of this year. Barrick has corrected with gold dropping. Barrick (GOLD) $22.69 trades at 14x forward earnings. Barrick is one of the world’s leading producers of Copper. You get gold production as a kicker. GOLD might not get the levered play of a pure copper producer, but we think gold and silver will be hotter than copper, so we don’t mind the tradeoff. Warren Buffet bought his Barrick in Q2. The price traded between a low of $14 and $28 in Q2. It is assumed Buffett’s team bought Barrick because of a gold but it very well could have been for the combination of minerals Barrick mines. Copper, Gold and Silver. It seems to be a great “company” buy, which is how Buffett operates.

Additional and well-known copper producers include BHP Billiton (BHP) $48.44 at 21x forward earnings and Freeport (FCX) $22, trading at 14x forward earnings. FCX has quadrupled from its March low near $6.00.

There’s Not Enough Copper for a Green Wave. Buy These Miners, Says Jefferies.

Barrons, Last Updated: Nov. 24, 2020

“Based on our analysis, the copper market is headed into a multiyear period of deficits, in part due to secular demand in renewable energy and EVs (electric vehicles),”say a team led by Christopher LaFemina.

Record Silver Shortage in 2020?

Posted on November 19, 2020 by Pat Heller – Numismatic News

Excerpts:

The forecasted combined net result of physical supply and demand is a 2020 surplus of 31.5 million ounces. However, that figure is not the bottom line. In 2020, it looks like net investment in exchange-traded products (especially exchange-traded funds like SLV) will reach 350 million ounces. When you factor in this demand, which is touted as physical demand, but may be largely on paper), the net silver shortage for 2020 could be 318.50 million ounces!

If accurate, this would, by far be the largest ever annual shortage of silver supply versus demand

NOTE: The projection for higher silver prices is independent of this week’s forecast by Citibank that a successful rollout of a COVID-19 vaccine could result in a fall in the value of the U.S. dollar by as much as 20 percent within the next year. A falling dollar would almost certainly support much higher gold and silver prices, without regard to supply, demand and inventory factors.

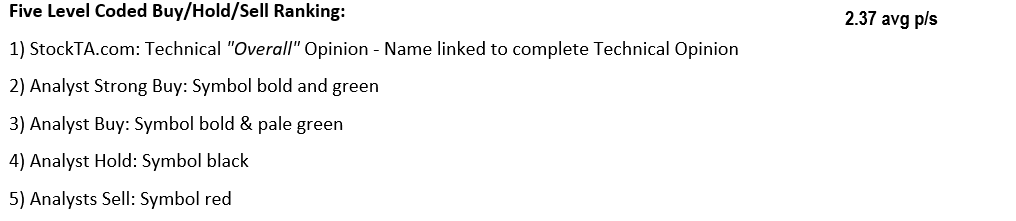

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()