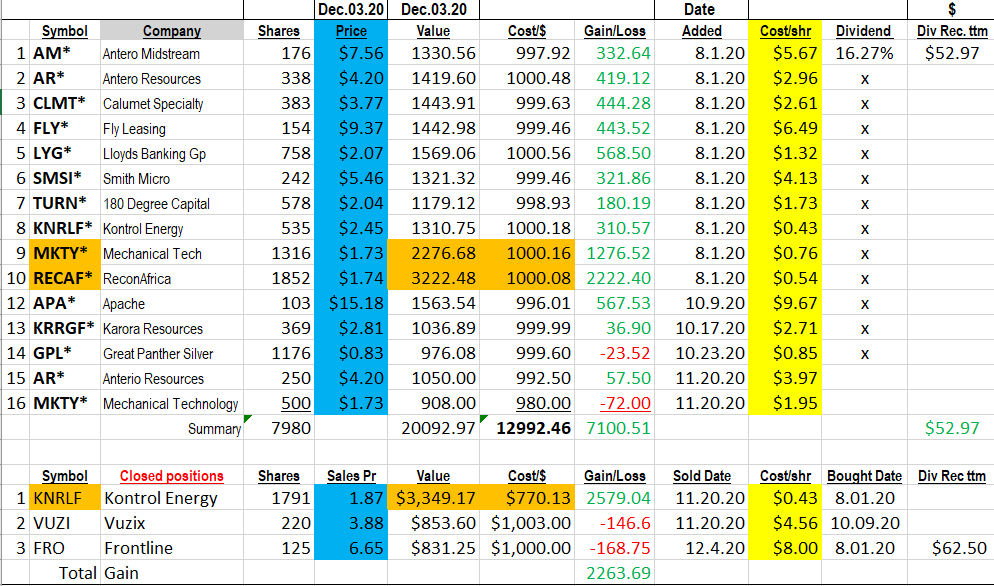

You can assume some things about the list above. First is that these are owned in accounts related to LOTM and second, we might sell them at any time without notice here.

We are playing a real game of turning $10,000 into One Million – Making a Million. Seven doubles of $10,000 without a miss to reach our goal assuming we own one double at a time. We doubt it will be that quick but that is the goal. Our timeline goal is to find stocks, that can double within one year. Therefore, it is a seven-year game. Work out the math for yourself. We might own one stock at a time, likely no more than three – maybe four. We will rarely own more than three stocks at a time in our game as the more diversified we are the harder it is to reach one million$.

A less intense player of the game of investing, can build a portfolio from the stocks above for upside appreciation. As you can see, the “market” likes small and micro-cap stocks at this time.

Yes, we will expand and contract from ten holdings at a time. Expand when things are doing well and contract during more difficult performance times.

Frontline SOLD:

This week we sold share of Frontline (FRO) $6.65. The company cut its dividend to zero this quarter event though the company met their target for paying a dividend. We expect to return in the future however the company sees something on the horizon that caused them to drop their dividend so we will follow their lead and drop the stock until such time as it seems “Too Cheap!”

NOTE – We now have a “Closed Position” on the spreadsheet for positions sold.

“BEST BUYS” AT THIS TIME:

Mechanical Technology (MKTY) fell sharply on Friday. We like the story and added to the position. We will have more to say next week. We believe prices below $2.00 are an attractive price to buy. We still believe there is room for the stock to double from $2.00 a share.

Karora Resources (KRRGF) $2.88 is making great progress with free cash flow averaging $5 million a month. We believe the company is not recognized in its peer group and will catch up as the bull market in gold and silver continues. Buy under $3.00 a share US$. Not sure where the hi price will be. This could be a multi-bagger over a number of years.

Great Panther Silver (GPL) $0.83; we like Great Panther under $0.90 per share so establish a position now and add shares on weakness. We believe the shares can trade between $2.00 and $3.00 in 2021.

Anteros Resources (AR) $4.24 traded above $60 in 2014 and is one of the biggest natural gas companies in the United States. They have more debt than the other companies on this list, but management has demonstrated its ability to consistently surprise against market expectations . The shares are up from Year-end 2019 price of $2.59 and a March / April low of $0.67… Believe the corner has been turned.

Market Comment:

Small-cap companies do well in inflationary environments. We believe we have multiple years ahead where inflation runs three to five percent above the ten-year treasury rate. This is a great environment for small caps. We especially like small caps that are in the commodity business with gold and silver companies our favorite industry.

Industry groups we like are Miners of all minerals, Bitcoin & Blockchain related companies, Oil & Gas – a bit extended now but one never know until you look backward.

Consider our receiving our LOTM, Daily Notes for closer tracking. I will answer questions to the group if asked. This service is free. If you would like Coaching, Training or Mentoring, ask for pricing and structure. We can custom plan for your situation. Four decades of market experience available to you for one to one coaching Training and mentoring.

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()