We are beginning to see initial selling coming into the Oil & Nat Gas Rally Notes:

Notes:

Six Level Coded Buy/Hold/Sell Ranking:

1) StockTA.com: Technical “Overall”

2) TA Opinion – Name linked to complete Technical Opinion

3) Analyst Strong Buy: Symbol bold and green

4) Analyst Buy: Symbol bold & pale green

5) Analyst Hold: Symbol black

6) Analysts Sell: Symbol red

ZACKS: the energy space topped the S&P standings in November with a gain of almost 30%. One of the major themes of the month was rising oil prices on the back of vaccine-related optimism, which had a direct bearing on energy stocks. It then came as no surprise that shares of oil-related companies were some of the biggest beneficiaries. As a matter of fact, the top five gainers of the S&P 500 in November were all energy firms — Occidental Petroleum, Devon Energy, Apache, Diamondback Energy, and TechnipFMC. Link to Story here.

We (Tom’s Blog) started buying the Oil & Natural Gas industry, August 1, 2020 with a focus on the Nat Gas industry. With the Democratic Party intent of putting the Fossil Fuel industry out of business, we projected that the Nat Gas would be the last fossil fuel standing and hardest to replace.

Why do we say this about the Democratic Party? In the Democrat, Platform is the convention statement stated they wish to defund the three-plus trillion$ in subsidies the Fossil Fuel industry receives in various benefits. History shows the last Democrat administration did great harm to the coal industry, so we assume they will take similar action against oil and gas. The Democratic Party has become more radicalized since the 2016 election. As an analyst, we have to accept that their word, is their intent.

Why do we say Nat Gas will be the last fossil fuel standing? Two reasons. The heating system in much of the USA is Natural Gas. That is going to be a pipeline infrastructure change that will be hard to replace any time soon. The second reason is that battery backup to Solar and Wind is not in place or the technology ready to replace Nat Gas as the intermittent energy supply for Wind and Solar. There are times the Wind does not blow nor the Sun shines, to supply electricity. So, there will have to be a transition period longer than 10 to 12 years to replace Oil & Nat Gas unless we want to return to an 1850’s lifestyle.

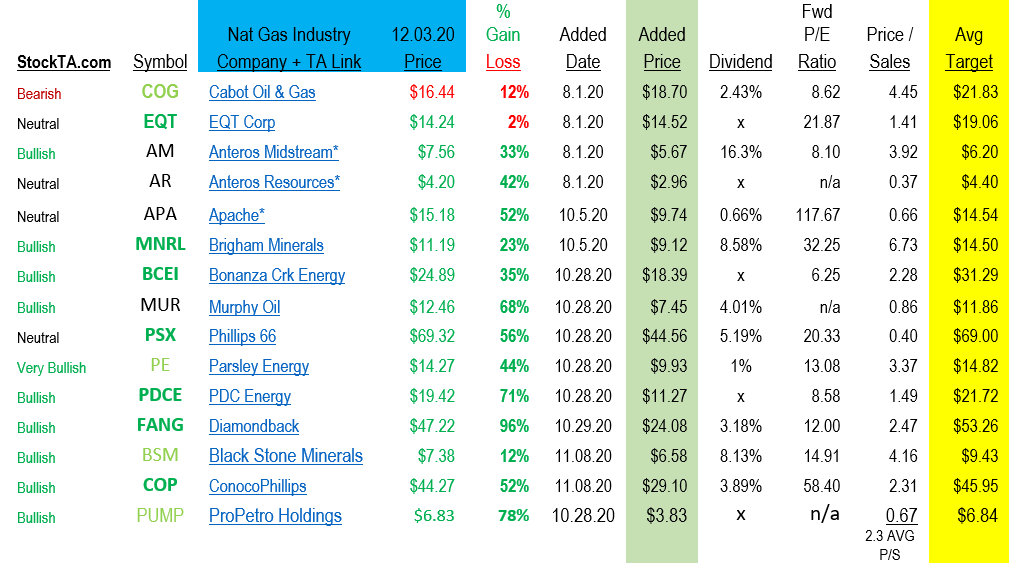

Current Situation for ownership of the Oil & Gas Industry: Since our starting date of Aug 1, 2020 to present the LOTM industry selections are up on average of 43%. We are starting to see some profit taking as well as a few company’s stock prices pushing to recovery highs.

In related accounts, we are responding to various companies’ price movements. Last week we added to AR and AM while selling some APA and selling calls against APA as well.

These are the three we own.

- For AM we like the dividend and eventually we think the price can double.

- For AR, we like management very much, the stock is down from $60 six years ago, and we believe as one of the top five biggest Nat Gas companies in the SA the price can recover to the high teens and low twenties. So, we are willing to dollar cost average should the price drop but do not want to give up the position should the industry continue moving higher.

- APA is a stock we also like a lot, but we will trade actively and sell options against. This stock is also down from a high of $66 five years ago. We have already taken some profits off of the stock as of this writing.

Timing concerns for a pull-back: We are concerned that that the democrats will be in office in 2021 and they will bring to back attention and focus the War of Fossil Fuels after the first of the year. We also gave the two senate seats in Georgia that could make the House Senate and Presidency, all Democrat. This would be hard on Oil and Gas companies and not a desirable place to be. Should the Senate stay Republican, January 5th, yes, we would expect stronger performance from the Oil & Gas Industry.

Comments on the stocks we do not currently own but have on our list:

LOTM, targeted P/E ratio for the industry in general is a 10 to 14 P/E ratio. We will adapt this range as the industry comes back into favor (or not). Our Price/Sales (P/S) Ratio benchmark, for the industry is now 2.3. We will use a weekly moving average of our companies to compare the individual P/S Vs the group, as an under or over-valued benchmark. Debt and profitability influence the individual company P/S as a variable factor.

Cabot Oil & Gas (COP) – A good long-term choice but we will wait to take a position until a sharp sell-off depresses that shares to Deep Value level

EQT Corp (EQT) – Industry leader in size. EQT has been buying within the industry so expanding its #1 position as the largest player in Nat Gas. We like them for this reason. The strong get stronger when the industry is weakened. Like COP above we will wait, and position as deep value gets deeper or technical opinion get stronger and the company comes out of this basing period.

Brigham Minerals (MNRL) – A streaming company to own for both dividend and appreciation. Debt free, we believe they will make acreage acquisitions in 2021. Likely use debt to expand but that does not bother us. This is a well-managed and conservatively run company. We will be looking for a weakness to buy shares.

Murphy Oil (MUR) – MUR is an excellent E&P company. We think the share price is a bit ahead of itself on the vaccine news. Look for call options to sell out of the money or in the money in January or February as a hedge or exit and look to rebuy.

Phillips 66 (PSX) – PSX is a high-quality company and a good long-term holding. Technically the chart is strong. The dividend is good at 5.2%. We are using the industry as a position trade so we would still look to sell some or all of the position by year end. We would repurchase in a heartbeat with weakness in Q1.

Parsley Energy (PE) – Seems to be approaching the top of projections. We would suggest exiting PE on this rally between now and year-end.

Black Stone Minerals (BSM) – BSM seems to have more debt and less cash than we like to see. We will track BSM into Q1, but we fully expect dropping BSM from this list.

Conoco Phillips (COP) – Excellent company, we suggest trading COP based on technical analysis. As with the oil & gas industry, we expect COP to follow the industry into a correction in Q1 2021.

Bonanza Creek Energy (BCEI) – Low forward P/E of 6.25 and average P/S of 2.28. Chart pattern is trying to finish the year on a strong note. We would hold and look to buy or add on weakness in the first quarter 2021. The P/E and P/S suggest more positive surprise potential in 2021.

PDC Energy (PDCE) – Low forward P/E of 8.6 and below average P/S of 1.49 (Average P/S is 2.3) so we like the shares. Very positive chart pattern. Looks like it can move higher into year-end. The P/E and P/S suggest more positive surprise potential in 2021.

Diamondback (FANG) – wish we owned this one. In five weeks, the stock is up 96%. FANG is an average in our targeted P/E at 12 and slightly above average at 2.47 P/S ratio. We consider this a modest buy. Looks good going into year end. We hope we get a chance to buy this one on industry weakness we anticipate in Q1 2021.

ProPetro Holdings (PUMP) – Debt free but an oil service company we expected a slower price reaction in PUMP than the stock gave. We hope this pulls back in price to give us a chance to buy at lower prices in 2021. From Zacks Post Q3 earnings: ProPetro’s outlook continues to remain ambiguous for the remaining year as the North American oil field is yet to revitalize its activities to produce a competitive return. However, the company is optimistic about sustaining strong customer relationships, a debt-free balance sheet and deep bench of committed talent.

Our overall action with the Oil & Gas Industry would be to lighten up or sell the industry going into year end. Personally, we expect to hold AM because we like the dividend and feel we might not have the opportunity to buy back into the stocks as cheaply as before. In 2020 we have traded AM three or even four times as it went into its Ex-dividend date. If we can buy into MNRL on weakness we might treat that as a dividend payor with appreciation potential. Also treat PSX the same.

In leu od selling the entire position in this industry you might sell 30 to 50% and buy back in on anticipated weakness in Q1. Of course, that weakness might not happen. One might also consider selling in the money or out of the money call options. Your risk tolerance would determine the strike price to sell. Look to stay within 60 days of expiration of the date you are selling. This period has the fastest decay in premium. If you have worked options before you know this.

Consider signing up for our free LOTM Weekly Summary or our LOTM Daily Notes. Do so on our website.

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()