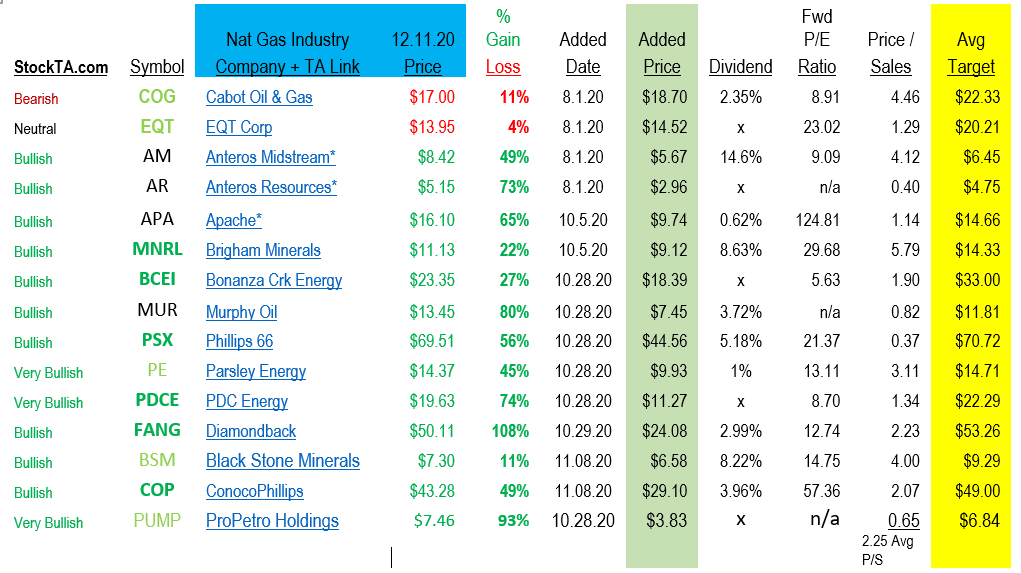

I am not sure we could have done much better considering we put together this list of Ideas in Oil & Natural Gas. We started building the “Companies of Interest” for oil & gas list, August 1st, and added to the list since that date.

Six Level Coded Buy/Hold/Sell Ranking:

1) StockTA.com: Technical “Overall”

2) TA Opinion – Name linked to complete Technical Opinion

3) Analyst Strong Buy: Symbol bold and green

4) Analyst Buy: Symbol bold & pale green

5) Analyst Hold: Symbol black

6) Analysts Sell: Symbol red

Our profiling technique is simple enough.

- Find the most sold-out industries for the year – A top-down approach.

- Look at companies in the industry for Value based on a simple profiling strategy – a bottom up approach.

- We look at balance sheet, capital structure and operating margins along with valuations Vs the peer group.

- Of course, we try to find a bit of paranoid perspective, like – Oil & Gas is a dying industry. That might be true, but it will take decades. The infrastructure is too big and the world too underdeveloped in new technology.

As hot as the Industry is, we think it is time to be very selective and take some money out of the industry. Oil above $50 is likely ahead of itself. We have the Georgia senate vote coming Jan 5th. We don’t know, is who will be the president? I assume Biden at this point in time. Saudi Araba and Russia are able to pump more oil at any point in time, so there is no shortage of oil – they are targeting prices, before increasing supply. Russia is happy with $50 plus but prefers $60 to $65. Saudi would like an $80 to $85 price. The Saudi cost is low, perhaps $3 a barrel, but they subsidize their economy greatly. They want higher prices to not have a budget deficit.

We will track the industry, see if there is a correction post Jan 2, 2021 and be ready to buy back into the industry.

In the meantime, look at the lowest P/E’s and lowest Price to Sales ratios for the best values. After that, look at reserves to drill and technical charts are the follow up buying triggers. If dividends are what is important look at the higher dividend payors. With oil around $50, the dividends become more secure.

Our recommended strategy is to keep a core position and trade around the core holdings. At this time, we’d be selling 30 to 40% of the oil & gas positions we hold to be ready to buy back in two to four months.

Sign up for our weekly summary email to be ready for ideas rebounding from over-sold positions!

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()