We are position builders in the infrastructure around Blockchain and Crypto. This is “the” emerging industry for the next decade among many. Cathie Wood and her ARK funds have much of that nailed so we will look for opportunities in her domain, however many are above $100 a share and we are on the other end of the spectrum in hunting stocks in the under $10 world.

We missed the “discovery” factor in VUZI. Cathie Wood added VUZIX to her ARK family of funds and as the word got out and the shares POPPED, they are now $18.14. Unfortunate LOTM related accounts had been in and out of VUZI over the past five or six years. Mostly long the shares. We made an estimate that it would take a while longer for them to grow critical mass enough to get “discovered’. Wrong call. Moving forward.

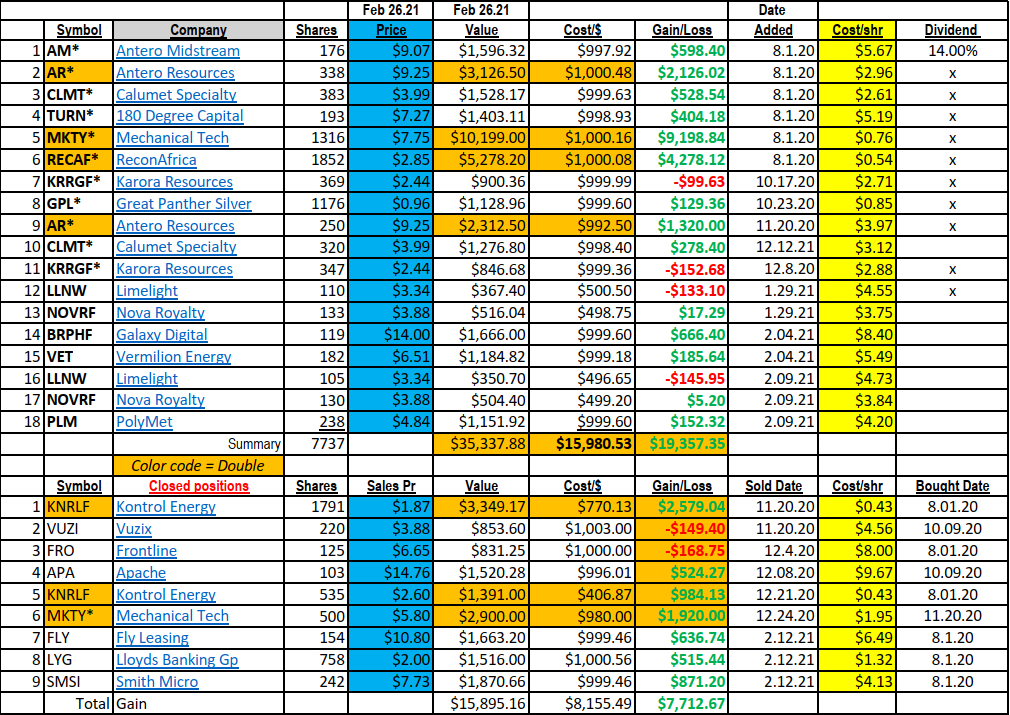

We are overweight with three units in each KRRGF and CLMT. We are over-weight in these two companies for two reasons. First of all, they each have the potential to double or triple in value. Second, the risk factor is limited. They both generate strong cash flows to the point that if their stock price does not move higher, someone will buy them for the cash flows. CLMT has free cash flow in the area of $220 million annually and is projecting growth in that Free Cash Flow to $300 million. KRRGF has Free Cash Flow in the area of $3.5 million per month and about 45% of revenue is Free Cash Flows. We want the luxury of looking at these in a hard market decline, and saying oh, we should be buying more. It lets us sleep at night.

Nat Gas and Energy is still undervalued, and we have multiple positions here as well with AM, AR, RECAF and VET. Easy to sleep positions at this time. We anticipate Nat Gas could get pressure from demand exceeding supply as the market underestimates the need for Nat Gas as an intermittent fuel for Wind and Solar. Nuclear will need to be built to supplement wind and solar, but that is years into the future.

Metals for electrification are critical and supply very limited Vs the growing demand. Silver Copper and Nickel. PLM, NOVA Royalty and Great Panther give is some exposure here. We will add a couple more. Again, we have little “market” or “company” fear in owning these companies. The trend to electrification is real, big, and undeniable.

ADDING Discovery Metals (DSVMF) $1.79 to The TEN UNDER $10 for the Double.

Discovery is not cheap on a valuation basis, but it is near bullet proof from the company risk perspective. We believe there is a shortage of Physical silver and demand is going to increase dramatically. Add in the excess printing of Fait Currencies around the world and the devaluation of said paper money and we like the precious metals complex.

Discovery’s story is like PolyMet (PLM). It is “minerals in the ground”, discovered, large in scale and high in quality. It will be about six years before Discovery begins selling silver and zinc from its property. When Discovery is producing silver, it is projected to be one of the top ten silver producing properties in the world. The property is in Mexico with Discovery Metals headquartered in Canada. Eric Sprott, perhaps the biggest single individual investor in gold and silver in the world, owns 27% of the company. Discovery metal is a portfolio company of Oxygen Capital. Oxygen Capital is a very successful group in the mining industry. Our goal is a double the price, but if the shortage of physical silver becomes acute, the upside is much higher. We do not expect to be an owner of this when they begin production. We fully believe in the current environment where demand exceeds supply in silver, and silver is increasing hard to find, a Major Mining company will buy Discovery metals.

The price is weak at the moment but at a support zone. We suggest taking an initial position and adding on a dollar cost averaging basis with a two-year minimum hold. You could – we expect – higher price action sooner than two years, but we want to stress not using stop losses.

Web site: https://www.dsvmetals.com/

Good weekend. The future is bright – like silver.

Tom

Training, Coaching & Mentoring available

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()