This week we will make some changes in the holdings of LOTM: Ten Under $10 for the Double

Position Comments:

Recon Africa (RECAF): We suggest reducing the position by 30 to 50 percent. The battle against Recon Africa by environmentalists and short sellers is growing in strength. Regardless, if it is yellow journalism or agenda driven journalism, it is a distraction to the investment. Recon Africa has risen nearly 20 fold ($0.53 to $11.00) since we presented the idea to you. Not so bad for eleven months work. It is time to harvest some of the crop and replant some money back into new ideas. Based on my understanding and examination, there appear to be controversial or inflammatory claims against Recon, by well known, global organizations and short sellers alike. Never-the-less, the market cap at its closing price on Friday is $1.37 billion. That is low if the property is as advertised, but high if there are delays or bumps in the road to getting to the company’s objective. Recon is years away from revenue. In the Ten Under $10, we will pick a time this week to exit 50% of the position. Yes, I believe they have found a massive strike in Oil and Gas. The next double from nine dollars will be harder than what we see in other names. We’ll rotate funds into some new situations we have uncovered.

Great Panther Silver (GPL): Great Panther has not performed as well as we expected but that isn’t the reason, we are going to sell the position on a rally. We have simply found other ideas that we think can mover a greater percentage in a shorter time than Great Panther. Our goal for is for a price between $2.00 and $3.00 for GPL. That still holds as our opinion. We simply found ideas in silver and gold sector that we like better. Timing of a sale in GPL will be in the future but we will rotate on strength into other positions in the sector.

Sandstorm (SAND) is another company in the Precious Metal sector we have no negative reasons to sell other than we have other royalty companies we believe are undiscovered and hold much larger percentage upside potential. We are in no hurry to sell but will use the current price or higher to exit the position.

Aggressive Buys:

Companies on the LOTM Ten Under $10 that we believe are aggressive buys at current prices include:

- Mech Tech (MKTY), we believe Q1 revenue 2022, from their 100% owned EcoChain subsidiary, could exceed total revenue of $9 million for all of 2020. This does not include revenue from their 100% MTI Instruments division. MTI does not get the exposure EcoChain gets but from what we see MTI, lead by Moshe Binyamin, has new business opportunities in the Wind Energy and Electric Vehicles markets.

- Galaxy Digital (BRPHF) is too cheap in our opinion. Both Galaxy and MKTY have been included in the Bitcoin / Crypto sell off. Both management teams are doing great jobs in building their respective companies. This is the growth sector of the next ten years or more. We feel compelled to own them as core positions long term.

Additions Comments:

- 180 Degree Capital (TURN) is boring us to sleep on its way to a double. It is ok, we need a few like this. A Strong hold with intent to buy on weakness brought on by general market forces.

- Oil & Gas has come so far since oil was negative $30 in March 2020! Nothing negative but we Hold rather than Buy. Exceptions where we would buy on sharp sell offs are Calumet (CLMT) and Vermilion (VET). Both could end up being very nice dividend when they re-instate their dividends – which we think they will do. We would not buy AR (Antero Resources) at this price, but debt reduction is happening quickly because cash flows are very strong and a convertible debt is expected to be, well converted, to common stock.

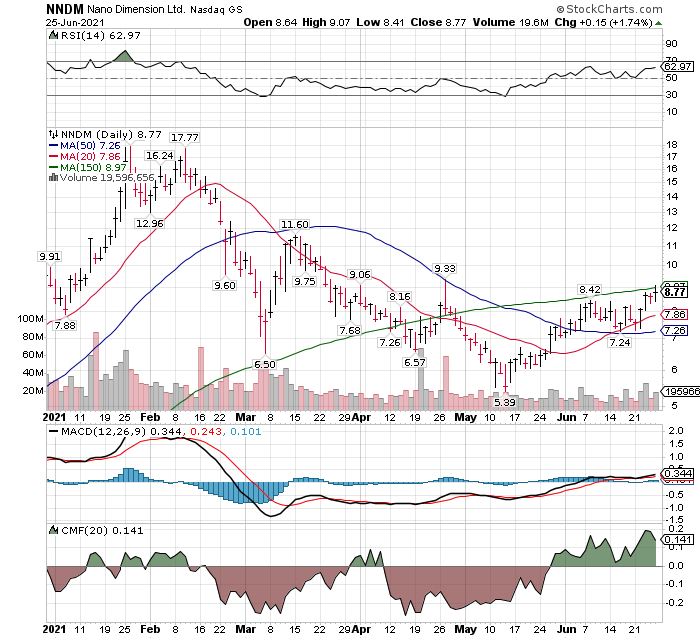

- Nano Dimension (NNDM) looks great on the chart. Close to breaking out above its 150-day moving average. We have it still in a buying range – correction is over.

- Relative strength is rising Vs the market.

- MACD has a buy zone crossover.

- Price is above the 50-day MA.

- 20-day MA is above the 50-day MA.

- Chaikin Money Flow (CMF) is positive.

- Price is about to crossover its 150-day MA.

Truthfully, it does not get much better technically speaking.

Consider getting the LOTM Daily Notes for our New ideas as we release them. Simply send an email to Money @LivingOffTheMarket.com (no spaces) with Send Daily Notes in the subject line.

We are striving to do better. The sell-off in MKTY and Galaxy, hurt our performance numbers. Our conviction on these two companies as companies we want to own long-term, overrode our need to trade out of the positions. We have been accumulating shares of both companies in the current price areas.

LOTM Research & Consulting Service

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()