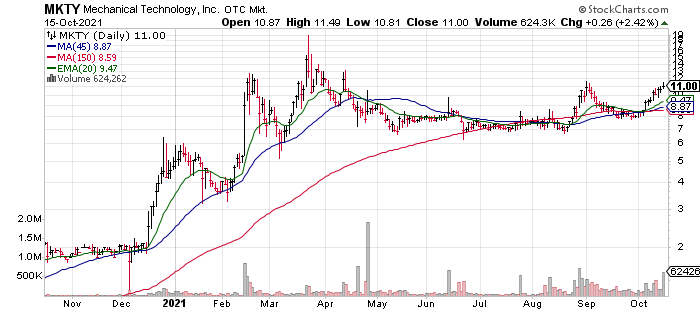

Mechanical Technology (MKTY)* $11.00

The stock is at a resistance price in the $11 to $11.50 area. Still, we are not going to sell any shares. We did some napkin numbers and have a pretty bold price target on the share price. It is my humble opinion that MKTY can trade into the $75 to $100 price area within twenty-four months. Based on megawatts available for mining we see 2022 revenue in the $300 to $350 million range. This potential will become more evident as the Q4 2021 and Q1 2022 are released. We believe this explosion to the $20 to $30 area can happen withing months after the quarters mentioned are announced.

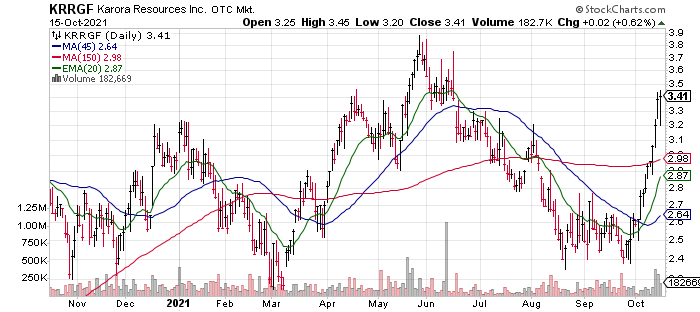

Karora (KRRGF)* $3.37 has rallied in three weeks from $2.37 – 42%. The price is due for a pull-back, but we are projecting that gold and silver in general has entered a strong seasonal period that will last until mid-January. Karora is our lead pick in the gold miners, but I would not be too quick to sell any of the physical metal miners for at least 60 to 90 days if trading. One of if not the cheapest industry in the markets. Check here for analyst price predictions on Karora.

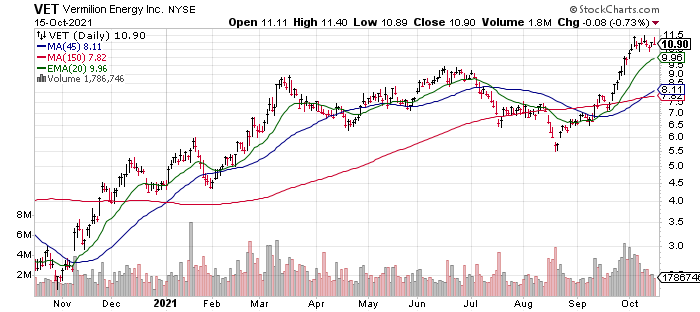

Vermilion (VET)* $10.90. Our biggest mistake was selling too many of the Oil & Gas stocks we bought a year ago. Many have doubled a second time from the prices we sold them at. In the case of Vermillion, there is a special reason we did not sell or sold and returned quickly. Prior to March 2020, Vermillion paid $0.12 per month in a dividend. This was a very big favorite stock in Canada. The company never got in troubled in Q1, 2020 but cut its dividend completely. The howls of pain, anguish and anger from retired Canadians were loud and long. The company is doing great. I do think the shares can retreat to support around $9.00. At that price funds permitting I will be buying more. The company repeatedly states that they will reinstate the dividend. Management still wants to lower their level of debt before doing so, however. At the current price they now have the cash flow to pay a monthly dividend that is above 10%. So, dips are for buying future dividends in a healthy company. Nimble traders who do not care about future dividends could exit or sell covered calls on the shares. VET is a quality, international Oil & Gas producer. The price follows the moving averages.

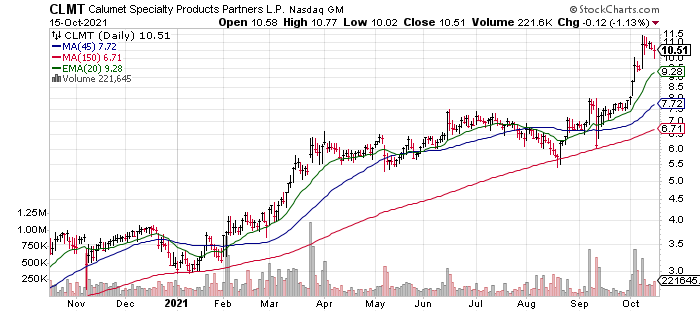

The last stock we will comment on today is Calumet Specialty Products (CLMT)* $10.51. We don’t talk much about CLMT because there is not much to say. It just keeps moving higher off its year ago price. We are over-weight in the LOTM: Ten Under $10 positions. That should tell you something. Like VET above, CLMT is focused on debt reduction but the move in the past twelve months is also based on their making a move to expand its cash flow. Cash Flow in three quarters, could jump from about $200 million annually to $350 million annually. I am understating what I have seen from others. Like VET, CLMT “could” reinstate their dividend. Prior to eliminating their dividend in 2016 the company paid $1.60 per share annually in dividend. the company will decide “if” they will funnel money into being a growth company or a Dividend paying company. Both are good paths, so we not too concerned at this time.

You can Read, you can watch Videos, but nothing beats Personal Interaction for accelerated learning.

This game has levels of understanding that could take a lifetime of Trial and Error to learn.

Available for Coaching, Training or Mentorships

Contact LOTM For One-on-One consultations.

Rate: $150 per hour / Monthly Retainer, Lowers Rate

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()

Hi Tom I have followed you for a while now and you’ve always answered my questions. You had a terrific interview With Michael Toporek a while ago. Just wondering if it would be wise for you to do a follow-up. Also a friend of mine told me last week that 2 of the buildings at the Anaconda facility were lit up all night inside in green. I checked the live camera this past weekend and there are now 3. Is it possible that they are already mining in some of their facilities?

Hi john – I believe they have moved on to a new format and would not do the same as in December 2020. At the time I was low hanging fruit and a long time follower of MKTY. Now they have the monthly update and are doing some Investor conferences. Much more effective than what I can offer them. Yes they have announced revenue from Mining operations in Q2 2020. It was a run rate of roughly $170,000 per megawatt per month. At the time they were working with 3 Megawatts. By year-end they will be at 53 megawatts and the goal in 2022 is to add another 150 to 200 megawatts. A fun exercise is to multiple the Megawatt from three in July 2021 Q2 to 53 at the end of 2021 53 megawatts to roughly 203 megawatts by Q4 2022. 203 megawatts at $170,000 per month comes out at $34.5 million in monthly revenue. Impressive indeed and means the shares are greatly undervalued should they hit those numbers.