Comments:

- MoneyGram is back in the news with a take-over offer. It is getting hard to count. We see what is in the press but have to assume there are non-public announced approaches as well. In 2018, MGI accepted an offer from Alibaba (BABA) at $18 per share all cash. The US government killed the deal. Since then, MGI has turned down offers from Western Union, Advent International & recently, private equity firm Madison Dearborn Partners. It seems a question of time before an attractive offer like BABA’s offer comes along. Still three years have pasted since the BABA offer. I will suggest that MoneyGram is a stronger company today than in 2018. One can make money on MGI from the current price however stalk this names for sharp selloffs like the drop in October as an opportunity to build your position. MGI is a Blockchain play that is in early stages of development. From a recent Seeking Alpha article by Second Wind Capital.

MoneyGram has built out the physical and digital infrastructure (the critical ‘rails’ so to speak) for its traditional remittance business. Moreover, now its early October 2021 partnership with Stellar Development Foundation, which will utilize Stellar’s blockchain technology, Circle’s USDC stablecoin, and MoneyGram’s rails, Holmes argues MoneyGram is well suited to bridge the gap between the crypto world and fiat worlds, as high transaction costs on major exchanges like Coinbase (COIN) and delays in getting back your money provide opportunity.

In other words, creating a rapid exchange between Crypto and Fait currencies. The best years of operation for MoneyGram are in the near future. Accumulate a position in MGI, especially on weakness and be pleasantly surprised by the potential buyout offer.

- StoneCo has a wide range of opinions on price potential – $17 to $65. A link here to TipRanks’ last 90 day opinions. StoneCo was in the news with rumors that they have contracted a law firm and JP Morgan to explore company options. StoneCo denied the rumors. LOTM believes there is room for a $30 plus price, maybe more depending on your time line for holding. Our time line is for a $30 price in one to two years. Accounts related to LOTM have traded this position short-term as well and holding longer-term in the past few weeks.

- We are not trading PagSerguro Digital but rather looking longer term in our holding period. Using price weakness to accumulate shares as available moneys allow.

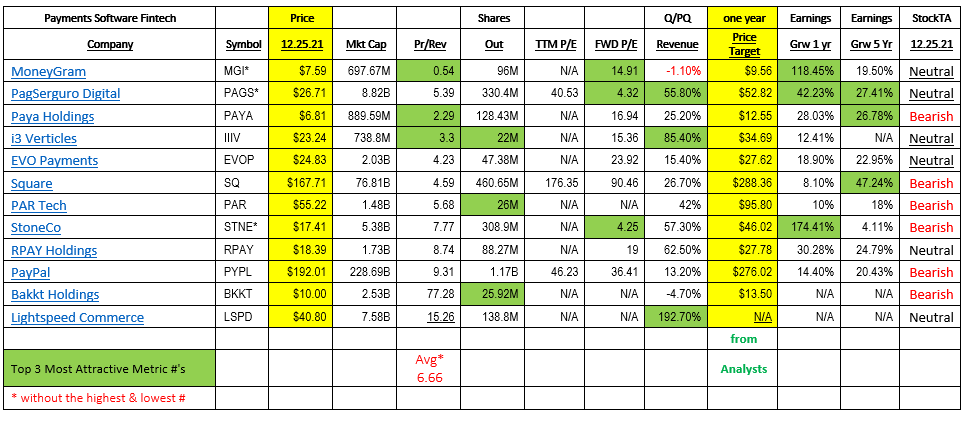

- In our sorting based on different metrics above, looking for the top three in each individual metric column, RPAY and Paya Holding just miss being in a number of the top three listings however on a cumulative ranking across all metrics, are impressive.

Payment Companies are out of favor, but historically are one of the most consistent growers with stable recurring revenue stream industries. It is because of this fact that this industry does not trade inexpensively that draws LOTM to the industry at this time. Visa and Mastercard are additional companies that populate this industry.

Blockchain’s Decentralized Finance (DeFi) is revolutionizing the payments industry. Visa and Mastercard are rushing to embrace the potential of DeFi technology to maintain their leadership roles. There will be a consolidation of the industry and rapid growth to the better run companies in this industry. Exciting times. A decade or more od change and growth due to Blockchain. Most of you readers remember the movie from the late 1960’s “The Graduate’. The hot new industry to make a fortune in the late 1960’s, was Plastics. Well, the hot new industry for the next decade is Blockchain. Consider getting exposure to it in multiple ways. If you doubt me, a bit of research into Visa (V) $216.62 and Mastercard’s (MA) $320.20 activity (linked in names) with Blockchain over the past four years will impress.

LOTM loves Visa and Mastercard as investments but are looking for the niche companies more so than Visa or Mastercard themselves. Visa and Mastercard are the industry leaders, but the smaller companies might be the faster growers, higher margin and the quickest to adapt. Hopefully, the smaller companies are the better stock price performers, granted with higher volatility. Explore them all and let me know what you think.

Related accounts can and will sell, trade &/or buy shares of these companies at any time.

You can Read, you can watch Videos, but nothing beats Personal Interaction for accelerated learning.

This game has levels of understanding that could take a lifetime of Trial and Error to learn.

Available for Coaching, Training or Mentorships

Contact Tom through the LOTM website or by email

Rate: $150 per hour / Monthly Retainer, Lowers Rate

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()