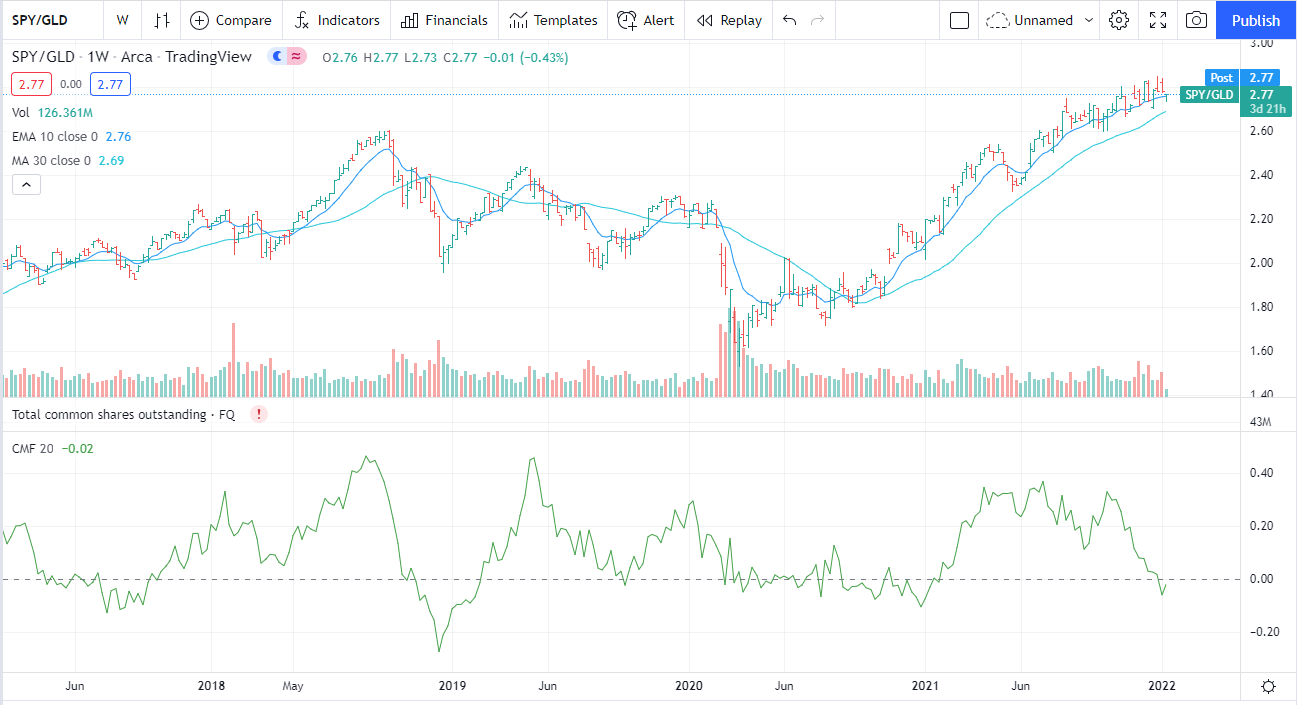

- You can see by the CMF (Chaikin Money Flow), money is leaving the S&P 500.

Above is a look at the S&P 500 as represented by the SPY ETF since 2017. In the chart we are looking at SPY dividend by GLD ratio. GLD is the ETF representing physical gold. This ratio is trading at a decade and longer high valuation. The last time the ratio was this high for the SPY/GLD was 2005. The date of the last high (2005) Vs today’s reading alone, might give you pause.

As a conservative hedge to equities and bonds the Sprott Physical Gold Trust (PHYS) and the Sprott Physical Silver trust (PSLV) would be a stable way to hedge Equity Exposure. This will not be a safeguard if there is a liquidity crunch but will work very well if the market rotates from Equities and Bonds to Commodities. In a Liquidity crunch typically, everything loses value except cash and short term treasuries. Gold and silver “normally” rally back the quickest after a liquidity crunch sell off.

As much as I like Blockchain / Crypto, I do not see Crypto (bitcoin) as a safe haven asset. It is too volatile. Bitcoin has longer-term safe haven characteristics in protecting from a loss of US$ purchasing power but it is too volatile to be as good a store of value as Gold at this time. Bitcoin is still in its early speculative days. I am a believer in Crypto as a new asset class. In no way do I minimize Bitcoin or crypto as a valuable property. I think of crypto as software for specific applications.

A more volatile hedge to the Equity and Bond market would be gold miners. Gold & Silver miners move up and down from 2 to 4 times the percentage moves of physical gold or silver.

Metal Miners might be less of a hedge but offer the potential to grant bigger gains – or losses. We like the Sprott Gold Miner ETF (SGDM). Sprott looks at the positions, company by company whereas most ETFs hold the largest market cap companies, regardless of quality. For silver we suggest the Junior Silver ETF (SILJ)*. We might not have “a market” sell off but a continuation of the market rotation from Growth at any price towards commodities.

Personally, LOTM likes individual mining companies’ vs mining ETFs but that is personal election for each of us.

Can gold and silver play catch-up to the majority of commodities?

Yes, I think they will and in this year. Money that has been flowing into the commodity sector with Oil & Gas stocks being the best performing sector in 2021. This is getting to be common knowledge. The rotation to value/commodities/cyclicals should not be anything new to you.

- Linked here is a January 11th or 12th interview with Gareth Soloway with chart comments on the mining stocks.

“Miners’ Charts Look Poised for Potential 2022 Breakout. YouTube: Mining Stock Education 25 minutes.

- Linked here is a interview with Chartist / Technician Katie Stockton, in an interview January 2nd or 13th 2022.

“Reading the Charts: Expect a Correction Soon” YouTube, Real Vision with Katie Stockton. 30 minutes. Different markets are topping at different times with recent softness in the NASDAQ 100 and S&P 500. No on a sell signal but close. Katie runs through some charts to show defensive stocks gaining relative strength,

House Keeping Note:

My deepest apologies for my grammar, spelling and typos. I have many things flowing through my mind simultaneously. Too many times, I write and send without reading, proofing or spell checking. When I read it as you do, I cringe. Writing this is positive for me because it forces me to focus and work the “ideas’ better. If I share my thoughts publicly it helps focus on the performance of those ideas – and that is the most important factor to me. Good luck and may the wind fill your sail. T.

You can Read, you can watch Videos, but nothing beats Personal Interaction for accelerated learning.

This game has levels of understanding that could take a lifetime of Trial and Error to learn.

Available for Coaching, Training or Mentorships

Contact Tom through the LOTM website or by email

Rate: $150 per hour / Monthly Retainer, Lowers Rate

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()