About seven weeks ago, gold miners starting a rising chart pattern (see GDX below) at the same time interest rates (see TBT –below in same chart) began weakening and the US Dollar started lower (not shown). No question all are interrelated.

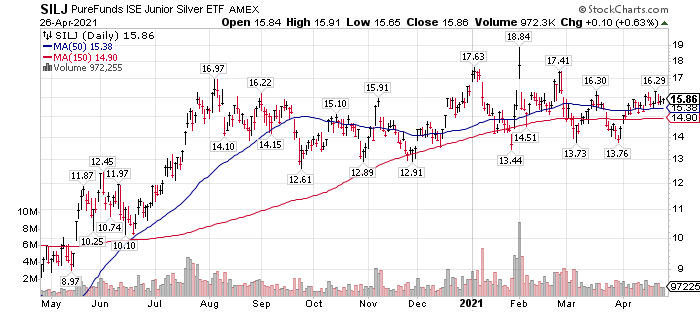

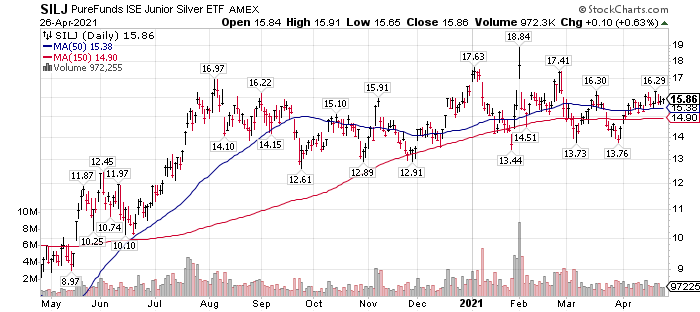

What had remained firm, technically, are silver miners (SILJ below). While GDX (above) representing large gold miners, has corrected over the last eight months, SILJ, the small silver miners, has moved laterally. Silver miners stayed stronger than gold miners over the past eight months.

The chart below is the Junior Silver Miner’s ETF, SILJ.

It looks like silver miners are about to rally from their side-ways consolidation pattern of the last eight months. Typically, silver follows gold but is more volatile than gold. Therefore, silver has bigger price swing patterns.

Here are different ways to invest in silver:

I: Physical silver

II: Physical silver in a trust purchased through the stock market

III: Silver Miners in an ETF

IV: Individual Silver mining companies.

The volatility factor rises with the lowest at # I above and the highest at # IV above.

Suggestions within each of the four categories above:

I: Physical Silver:

First Majestic (AG) offers a silver bullion buying opportunity from their web site. An example of an order is 20, one-ounce coins priced about $31 per coin. Link to the site store here.

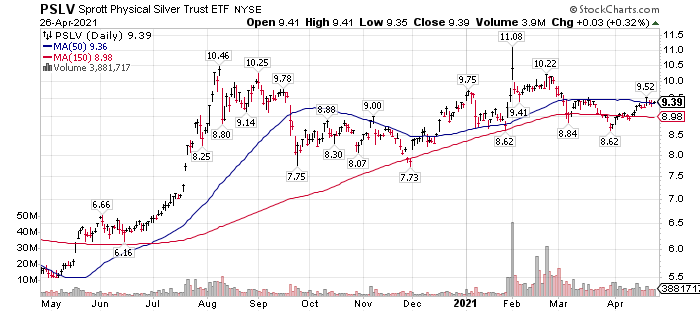

II: Physical Silver in a Trust

We suggest the Sprott Physical Silver Trust, symbol PSLV. The Sprott brand is very highly regarded. Eric Sprott has been critical of “paper” silver trusts like SLV, for not actually having physical silver in a vault backing up the purchases of SLV. Hence, avoid the risk as much as you can and go with Sprott.

III: Silver Miners in an ETF

LOTM opts for the small silver miners as they tend to outperform the larger silver miners in bull markets. SILJ is the best selection here. The ETF holdings can be seen at the SILJ web site linked here.

IV: Individual Silver mining companies

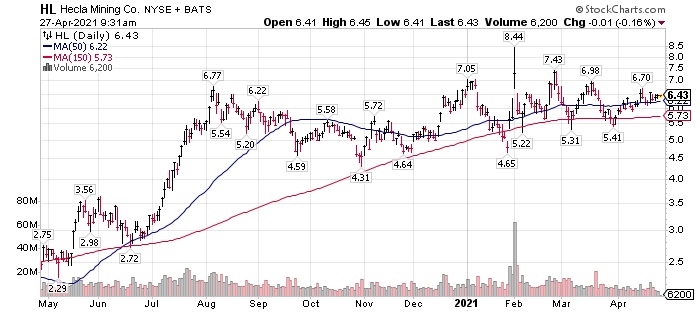

We will share the chart of one silver (and gold) miner, Hecla (HL) $6.43.

We like these facts about HL.

- The company’s stock is in an ETF. This helps drive the price higher as people / institutions buy the ETF.

- It is historically recognized within the silver community. Therefore, not too much thought needs to go into its selection as a silver exposure play.

- HL has a higher level of debt than most silver miners. In this case we are using HL debt to get leverage in the silver market rather than personally taking on margin or loan debt ourselves. This is a layer of protection, “Just in Case” the market has an excess leverage melt down like March 2020. It is easier to ride through a sell down and come out the other side without personal debt.

- The chart looks “Locked and Loaded” and ready to rally.

Other silver companies to consider include ones in the grid below:

Risk Management suggestions.

- We suggest not using leverage or borrow money to trade silver or silver miners. The silver market is a tiny market and will be suddenly influenced by strong outside forces exerting their will on the prices structure. You must have a survivability factor in your trading plan.

- Gold and Silver miners are best used when purchased at times of low valuation (like now) and traded – not bought as in a buy and forget strategy. There are big opportunities in the precious metals market and one can own them for long periods of time, but the price swing patterns are so big, you must consider a scale in and scale out risk management plan during the moves. Technical analysis is an important factor in working this industry.

LOTM Research & Consulting Service

Where Value meets Buy Signals!

Feel free to forward or recommend to others.* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()