![]()

-

Subscribe for our free daily newsletter

-

Recent Posts

- MARA Holdings* – A Stock of Interest

- Bitcoin Viewed from Technical, Sentiment and MoneyFlow Perspectives

- Comps and Projections for Galaxy Digital, DeFi Technologies and CoinShares

- LOTM Research Notes March 1, 2026:

- Summary of EQX and BTG recent earnings.

- A Slow Motion Portfolio Management Strategy

- Is ProShares Ultra Short QQQ (QID) at a Point of Change Alert?

- Real World/Real Time Examples of How Crypro & Blockchain are Impacting Traditional Payment Systems.

- Buy Signal Chart of the Day

- Bitcoin is Being Accumulated

- “Top Five” Fastest Growing Altcoin Networks

- Charts of Companies owned in different LOTM Portfolios Jan 23, ‘26

- Let’s Make a Million update (1.19.26) and comment on future changes:

- Major Brokers recommend a Bitcoin Allocation

- A Balance between Crypto/Blockchain and Hard Assets

- Summary:

- Bittensor (TAO) is HOT

- LOTM Predictions for 2026

- Key Update on the Price Action of Silver

- Focus on SOL Strategies (STKE) $2.00

- Contrarian View is to buy 20-year Treasuries.

- LOTM – Let’s Make a Million$ Update December 15th, 2025

- The Bitcoin to Gold Ratio suggests rotating “some” funds from Gold to BTC

- Solana: Leading Blockchain Activity and Revenue Growth

- Trade Alert! Forward Industries (FWDI)

- Western Union (WU) Value Buy or Value Trap?

- Three Must See Presentations On “Why Now, for Crypto!”

- Massive Insider Buying of Note

- Itaú Unibanco Holding S.A. ADR (ITUB)

- LOTM NOTES:

- If Your Timeline is Longer than six months – These names are TOO CHEAP!

- Opportunity in the Crypto Correction!

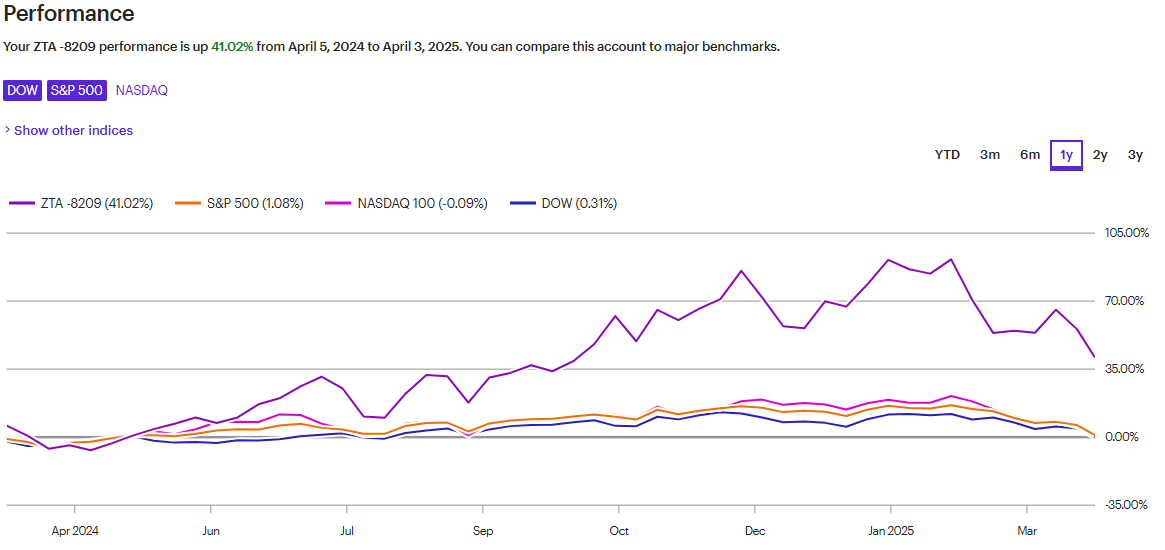

- Performance of three accounts related to LOTM

- Strong Buy Suggestion on AYA Gold & Silver

- Tough Days for Gold, Silver & Crypto/Blockchain

- Enormous Market for Crypto and Blockchain Applications

- Hard sell off on rising tensions between China and USA

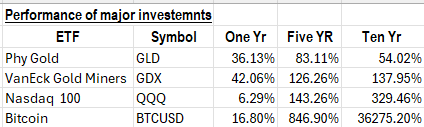

- Gold & Bitcoin as Best Performers

- Difficult Choices!

- Positions and Performance dated September 22, 2025

- Changes in the Let’s Make a Million$ Club

- Timely activity or news in these companies:

- Why Invest in a Solana Treasury Company?

- Silver Mining Sector Emerges as Clear Winner Amid Production Expansion Wave

- Five converging innovation platforms that define the current technological era

- VanEck – NODE ETF Very attractive as long term holding!

- Americas Gold and Silver Added to our Buy Watch List

- An Interesting Idea – Pacific Biosciences (PACB) $1.31

- There are Four Major but Interacting Approaches to the Markets.

- Different ways the US Government is considering adding Bitcoin to the US Reserves in a budget neutral way.

- The “Hot” new Crypto Treasury company fad is the Ethereum Treasury Company.

- Bitcoin by the Numbers!

- Key Interviews this Week for Guiding Your Personal Investment Strategy

- Bitcoin Treasury Companies LOTM Finds of Interest

- Equinox Gold – Buy, Buy, Buy

- LOTM – Let’s Make a Million$ Update July 17th, 2025

- HealWell AI (HWAIF*) $1.05

- Actionable News on New Found Gold Corp

- The Two Most Powerful Videos This Past Week!

- Catching the Digital Transformation Tidal Wave

- Interesting Dividend Idea

- Interesting Dividend Idea

- ZTA Strategy Update – June 16, 2025:

- Two Divdend Ideas (Master Limited Partnerships) with Large Insider Buying (and I mean BIG BUYING)

- Outcrop Silver (OCGSF*) $0.19

- LOTM NOTES: May 23, 2025

- LOTM NOTES: DeFi Technologies In The News

- BitBonds for refinancing Treasury Debt

- LOTM: Bitcoin Headlines to Pay Attention To

- April 20, 2025 Update on ZTA related LOTM account with Positions Held

- In Commodities, The Cure for High Prices is High Prices

- IN THE NEWS:

- LOTM Related account updated positions and performance – April 4, 2025

- LOTM NOTES March 30

- How Bitcoin Price links to Human Interest / Fear Then Apathy Then Greed

- LOTM NOTES – March 22, 2025

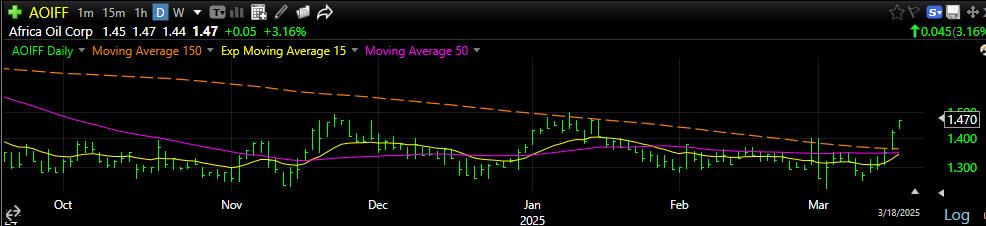

- LOTM NOTES: March 19, 2025

- LOTM NOTES: March 13 2025

- LOTM NOTES: March 10 ‘25

- LOTM NOTES: March 7th 2025

- LOTM NOTES #2 March 4th ‘25

- LOTM NOTES #2 2.11.25

- LOTM Notes Sunday February 2nd 2025

- LOTM Note: Jan 20, 2025

- LOTM – Let’s Make a Million$ Update January 20th, 2025

- LOTM Notes 12/28/24: Birth of a New Monetary System

- LOTM NOTES from around here and from there:

- LOTM Notes 11/21/24 – Important update for all who own Bitcoin and Bitcoin Miners.

- LOTM: Everyone has an opinion – Here are some of the best on Wall Street, post-Election.

- LOTM: Comparing Ten Crypto/Blockchain ETFs. Which is best for you?

- LOTM Notes: October 30, 2024 – Bitcoin’s Big Move & Actionable Idea

- LOTM – Let’s Make a Million$ Update October 12, 2024 Review

- LOTM NOTES: It’s Just Life

- LOTM: Headlines, Thoughts and Actionable Ideas

- LOTM NOTES:

- LOTM Notes: October 06, 2024

- ZTA Ltd Partnership Performance – Strategy – Supporting opinions

- Corporations are starting to hold Silver & Bitcoin as Reserve Assets instead of Cash

- LOTM Spot Light on EarthLabs (SPOFF*) $0.172

- LOTM: Marathon Digital Vs Peer Group.

- Gold and Silver Mining Companies’ Target Price from TipRanks

- LOTM: Bitcoin – Gold and New ideas for the Future

- Three Headlines from Crypto-world Draw Attention

- LOTM NOTES: August 16, 2024

- Gold & Silver Miner Stock’s relationship to Physical Gold Price – The Ratio over 15-years:

- Countries with lowest Income & Wealth Inequality

- When Company News is Very good But the Stock Price Falls – NFGC

- LOTM Notes – July 11, 2024

- Galaxy Digital Should Be a ‘Core Holding’ for Digital Asset Investors

- Everything of Value will be Tokenized!

- Top Investment Stories of the Week ending June 8th

- Three Ideas all related to Crypto & Blockchain

- LOTM: Featured Presentations & Views from the Past Week

- GAME-on, The Bull Market in Precious Metals is Off & Running

- Update for LOTM: Ten Under $10, Games #1 and #2.

- Tokenization is Happening Now – Will You Profit from this Change?

- Galaxy Digital (BRPHF*) $9.71

- Strong Trends emerging in Two Market Sectors

- Statement of Credibility for Bitcoin:

- (no title)

- LOTM: Must see interviews this week

- Galaxy Digital and Crypto Up-date from Mike Novogratz, Founder – CEO of Galaxy

- S&P Priced in Physical Gold – Game-on for Hard Assets

- Silver Stocks on the Move as are Gold Miners

- S&P 500 (SPY) divided by Gold (GLD)

- BEAR MARKET GO TO LIST

- Market Notes and Perspectives on What “might be” Coming Sunday March 10, ‘28

- Could the Silver Price Really Hit US$100 per Ounce?

- Seeking Alpha – Top Dividend Payers From the Top Rated

- Chainlink (LINK) is Rapidly being Integrated into Asset Tokenization

- Recent Headlines Involving Galaxy Digital – a LOTM Position.

- 3 Chart Trades Ideas: Over-heated – About to Break-out – Stage 1 to Stage 2

- Making your first Million – By Bill Powers

- News Worth Sharing – Feb 15, 2024

- CRYPTO & BLOCKCHAIN: Growth of a New Technology Eco System

- (no title)

- Galaxy Digital (BRPHF) $7.25 gets a bump higher price target at TipRanks there was a couple of weeks ago. Previous price target was to about $9.80 from one analyst. Now three analysts have price targets that average $12.32 – LOTM

- Which Spot Bitcoin ETF is the “One,” for You?”

- Themes, Perspectives and Views for 2024 Investing

- Ten Under $10 for the Double Update 12/22/23

- A Golden Cross for Physical Gold – Miners to Follow

- A True Growth Stock in the Making

- Fintech Ideas – running hot at the moment

- LOTM Technical and Quantitative Market Readings

- Consider a Stock Market (QQQ) Hedge that Pays you a 4% return

- Karora and Gold Rallies – Equities Topping, Michael Oliver, founder MSA

- LOTM: Highly Rated Dividend Stocks

- The Demand Vs Supply Bottle-neck Tightens in Crypto

- The Hottest Sector and the Best Fire Sale Sector Right Now

- $5 stock that outperformed Bitcoin in the Last Crypto Bull Run – A Repeat?