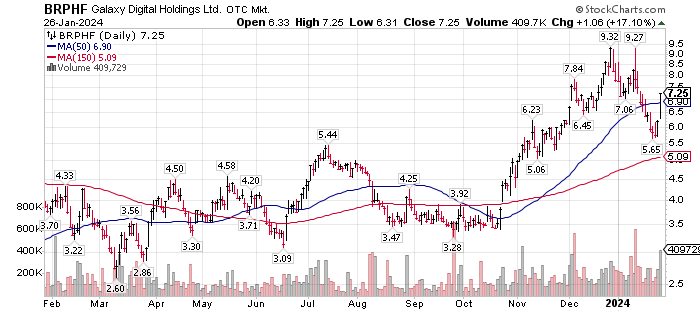

Galaxy Digital is a global leading company offering Investment Banking, Venture Capital and Asset management services to Institutional Clients in the area of Crypto Currency and Blockchain. They currently have more than 900 Institutional Clients. Galaxy partners with four different asset managers in four countries to develop and manage Crypto related products. This includes four Bitcoin Spot ETFs that are currently approved.

Should the price decline again, the six dollar area should be support. The added analyst comments would help hold the price. Galaxy is still reactive to the price of Bitcoin, so factor this into your personal approach to the market be you a trader or a dollar-cost-averaging investor. Continue reading

![]()