Below we will present one version of “harvesting” profits as a stock rallies. We consider this a conservative plan. A more aggressive plan might be the process popularized by Richard Dennis in his “Turtle Traders” program. In his process, once Dennis caught a trend upwards, he used price corrections back to a support level, to buy more shares thus increasing cost and the size of the share position.

Harvesting Profits with pre-set goals in Stage Analysis

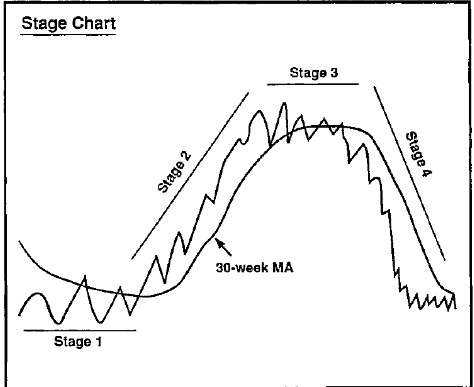

The LOTM approach below is similar to a farmer selectively harvesting a “crop” as the “crop” reaches different degrees of maturity. In our approach we plant the seeds during the over-sold or base building stage (Stage one chart analysis), watching the seed maturing and bearing fruit (stage two chart analysis) and harvesting that fruit in a planned and systematic way (late stage two stage three and early stage four chart analysis).

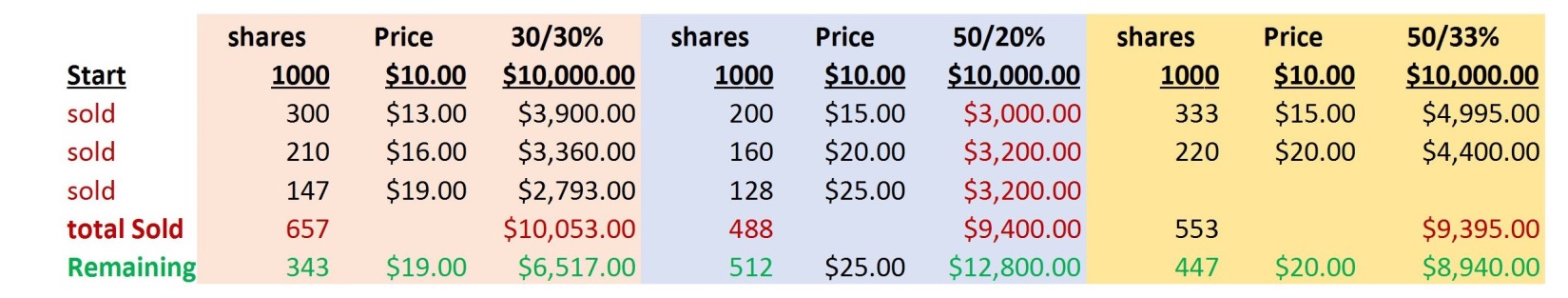

Below we show three different number based processes of “harvesting” our original money out of a stock position. This is the fun part of what LOTM calls, “Position Management.” Harvesting Profits is one aspect of Position Management. There are multiple levels in the process of making money from the market other than the Buy, Sell or Hold decision.

Explaining the grid above.

Explaining the grid above.

There are three different example models above. #1) 30/30%, # 2) 50/20% and #3) 50/33%

The first number refers to the percent appreciation we have above the original cost. In the first situation, 30/30% – each 30% level the price rises above cost, we sell 30% (second number) of the remaining shares held. The goal is to recover our original investment and Let the Profits Run. In selling 30% of the remaining shares, we never completely exit the position – until a decision to finally exit completely is made. This fulfills a market adage, “Let Your Profits Run!” We have all sold stocks only to see massive gains over a longer period of time. Winners tend to keep winning so let them work for you as much as possible.

Consider the numeric model that best fits your situation or create your own. My personal preference is the middle model 50/20%, because I tend towards an aggressive investment model. I want as many shares working for me as possible long-term. This does increase the volatility factor on your account so a characteristic to be aware of.

Depending on your goals, usually based on a tax decision, you might use a trailing stop loss to completely exit a position or chose to ride through a stage 4 decline and begin adding back shares in the following stage one base building period.

Size of a position factors into the decision and its tax implications. Example if you own one million shares of a stock with a cost under $1.00 and the stock goes to $12.00, a sale on a stop-loss trade; 1) might be difficult to execute a (liquidity constraint) and create a sizeable tax event when you really like management and what they are doing with the company. A problem I hope we all get to ponder.

• Thoughts, Questions Comments? Send an email to “Money at LivingOffTheMarket.com”

We’re here to help you

For more depth of knowledge on the LOTM, Position Management process, consider a Level I membership in the Let’s Make Millions Club. An annual membership entitles you to the LOTM daily newsletter, coaching, training &/or consulting of 18 hours annually used as you wish. We want to help you customize your strategy in the stock market. You will also get weekly summaries of three different “real” accounts and the activity that week in each account. Two of the accounts are actively working the plan of compounding a set amount ($1,000 & $10,000) into One Million Dollars. Of course, there can be no assurance that we can do this. This is speculative and a very volatile “game.” We will provide the Ten Under $10 for the Double listing of low priced companies that we sourced for doubles or more in appreciation. We will not tell you what to do but provide you with the good bad and ugly concerning the market and lead by example. We are not investment advisors. You decide what you want to do. We’ll be there for you as a Researcher, your Coach, Trainer &/or Consultant. Annual Cost is a one-time payment of $1,550. Tom’s CV online. Send a text to +1 651 245 6609 with Interested in Level I of LOTM. We will get back to you ASAP.

Written August 16, 2022, by Tom Linzmeier, editor, www.Livingoffthemarket.com

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()

Thank you very much — I really appreciate your articles about general themes like strategy/portfolio management etc. So this was spot on and very helpful :)

Thank You, Benjamin. We’re all in this world together and we’re trying to give something back from our experiences that can help others improve their situation. The feed-back is appreciated. T.

Pingback: LOTM: VIZSLA SILVER - Discovering a World Class Silver Property -