RecAfrica (RECAF) $0.45

Tom’s Blog – Aug 25, 2020

This is an update on a favorite speculative investment we own, ReconAfrica. Earlier comments about ReconAfrica can be found in our Previous Posts on the right.

ReconAfrica holds a 90% interest in a petroleum license in northeast Namibia and 100% interest in a petroleum interest in northwest Botswana which covers the entire deep Kavango sedimentary basin. The Namibian petroleum license covers an area of approximately 25,341.33 sq. km (6.3 million acres) and the Botswana petroleum license comprises approximately 9,921 sq. km (2.45 million acres). The deep Kavango Basin offers both large scale conventional and non-conventional play types.

Above is taken from the company website linked above.

FACTS:

- The amount of land rights is large – Very Large.

- The Geology is very suggestive of oil and gas reserves. Stronger words could be and have been used.

- The initial drilling to “de-risk” (find oil &/or gas) will be completed in the next nine months.

- A secondary offering was completed last week, and the company is debt free. Operating cash is not a problem.

Below interviews are with two of the original founders of RecAfrica – Scott Evens COO/ Geologist & Co-Founder Craig Steinke

YouTube Interview COO / Geologist Scott Evens:

https://www.youtube.com/watch?v=jyS59jgMgiU – 27 minutes – June 12, 2020

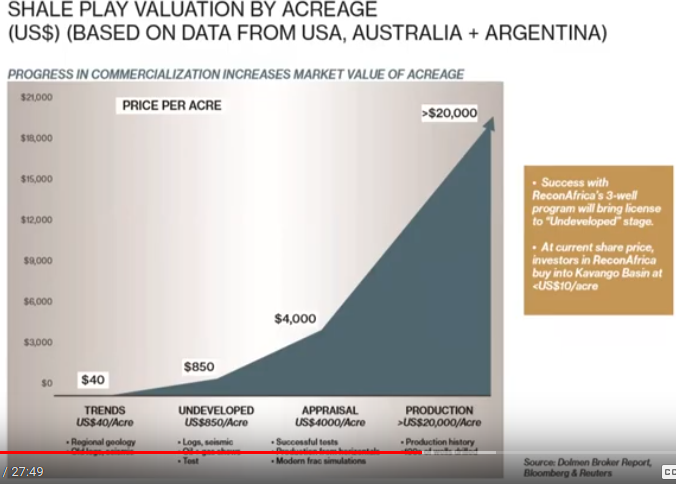

The slide below illustrates the potential value increase of the property as it is “De-Risked” or “Proven-up”. Currently RECAF is on the far left and under $40 per acre value acquisition cost. Assuming the successful results of the de-risking drilling that begins in Q3 & 4 of 2020, RECAF management believes the valuation per acre can shift to the “Undeveloped Acreage” category. This is expected to be established in Q2 2021.

The price estimates for successfully transitioning from “land rights purchase cost” to “Undeveloped Acreage”, is 20X.

- $0.45 at a 20 X valuation would be $9.45 assuming no further share dilution. To be conservative, if we assume a 10X price potential, it would be a valuation of $4.50 to $5.00

Sale of oil, should the property be proven-up, would be in 2022. So, the valuation labeled “Appraisal” in the chart below (80X value to $0.45) in the chart below would be in 2022 to 2024 time period.

We found the chart below very helpful in establishing exit points from an event and pricing target perspective

This slide is in the presentation shortly after the 15-minute mark of the YouTube Video linked above.

Second RecAfrica, YouTube Interview with Co-founder Craig Steinke

These are promotional interviews to the recently completed US$17.4 million offering completed the week of Aug 8/21, 2020. The offering was over-subscribed. Link to YouTube the second YouTube Interview: https://www.youtube.com/watch?v=cGbnB-aEsu0

Where Value meets Buy Signals!

LOTM is a free newsletter. Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security. These Investments are bought and sold constantly.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

![]()