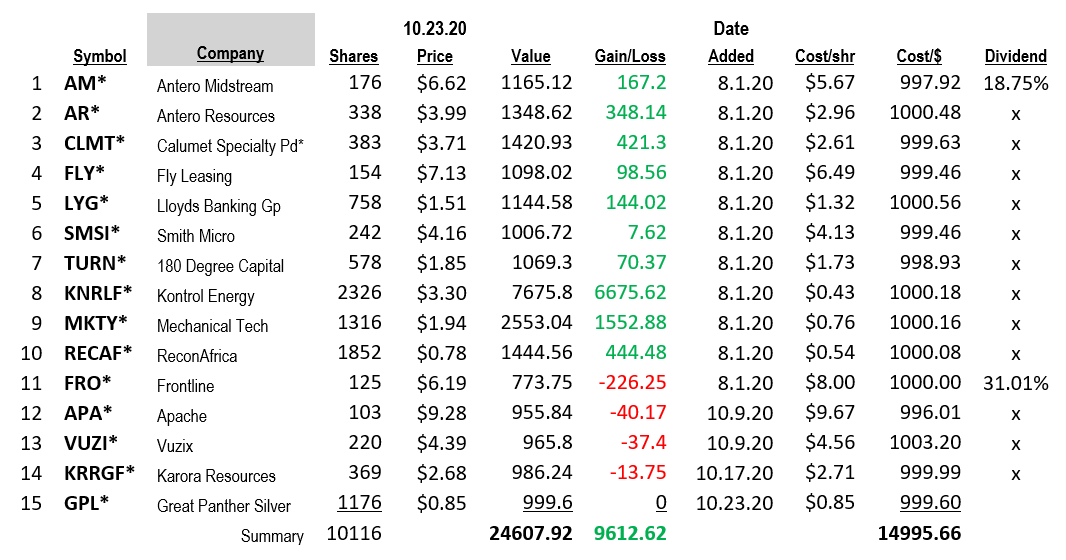

Our original issue date of Ten Under $10 was price dated Aug 1, 2020. We have updated our numbers because somewhere or how the numbers and dates got confused in previous postings. You can see our very first posting of Ten Under $10 for a Double on our web site to double check our beginning share prices.

Ten under $10 for the Double:

Reminder that this is a dynamic list so we will hold positions greater or less than ten in the portfolio.

During neutral and positive trending markets, we’ll expand this list. However, when the over-all trend begins to decline, we will shrinking this list and will add to the companies we consider “core” positions. This strategy is not for the weak of heart or stomach. It has produced big gains over multiple market cycles for our accounts. This strategy is part of our risk management policy. Weed out the weak and rally around (buy) the fundamentally strong when the price is weak.

NEW NAME ADDED: Great Panther (GPL) $0.85

We “love” the precious metals and non-precious metals. Miners are underrepresented on this list Vs what our investment belief is. The world cannot “Go Green”, without metals. Solar panels are coated with silver. Electric cars have 3X the amount of silver as combustions. Every cell phone contains silver and gold. Every electric motor contains copper. Batteries contain multiple metals – Lithium, Nickel, Aluminum, Manganese, Cobalt or Lead. When you hear the word, “Green Energy” – you think of the investment opportunity in miners.

Great Panther (GPL) and most Precious Metal companies are “minting” cash in the present pricing environment of Gold and Silver. The industry is among the strongest cash generators in the stock market yet very reasonably valued. Miners have high fix costs and low variable cost business structure. Therefore, when gold and silver prices rise above their cost structure, profit margins explode. Since the Federal Reserve is in a multi-year devaluation of the US$, Precious metals and miners are not only a path to make money, they are necessary to preserve purchasing power. 3% to 5% inflation a year, for ten years, is a 30% to 50% loss in purchasing power of the US$. In the next five to ten years, we expect money managers, corporations, pension funds and endowments to add gold and silver to their portfolios. The same will happen for Bitcoin in our opinion. Though volatile, precious metals have a long-term bright future for years.

WHO IS CHART BASING FOR A MOVE?

We have Apache (APA) on this description list. Its price seems to be chopping up and down between $9.05 and $9.70. Bigger volume seems to come in on the rallies and lighter volume on the pullbacks. CLMT, also on our list, did this same little dance ($2.35 to $2.65) before it broke out above $3.00. The shares are now $3.68. We suggest buying shares of APA on this chop and ideally on a drop in price. Use stops if that is part of your risk management practice.

TRADE IDEAS IN THREE TO FOUR WEEKS:

- We expect TURN to have a jump in Net Asset Value (NAV) from $2.70 around $3.00 in the coming earnings report. The stock price has dipped to $1.85. If our assumption is correct on the jump in NAV, to say $2.90 and TURN trades at a 20% discount to NAV that would present a target price of $2.32. Since TURN is similar to a closed-end fund, there really isn’t much news between quarterly announcements. When they do have a positive quarterly announcement, the price often Pop’s and then slowly drift lower throughout the quarter. Hence, we expect a 10% to 15% jump in the next three to four weeks on the Q3 earnings. This would be closer to its 20% discount value to NAV. Third quarter started off strong as stated in Q2 earnings report.

- MKTY is anticipated to have multiple announcements related to its Q3 release. We expect a new President/CEO to be announced. A strong Q3 in earnings and revenue is anticipated on previously announced deliveries and an update on its new growth initiative in Crypto mining is expected. Bitcoin and crypto currencies have been strong performers so attention drawn to MKTY and its new venture into crypto mining should be beneficial to the company’s stock. The drawback – the shares have rallied nearly 3X early August. We could have a “buy the rumor – sell the news” event. Even so, we’d not panic out of the shares if they drop on Q3 announcement. We like what the company is doing and hope, believe and expect a longer-term growth initiative.

We are bullish on MKTY because the Market cap is still tiny – $20 million. Peer competitors are, MARA Patents (MARA) $2.74, with a $70 million market cap and RIOT Blockchain (RIOT) $3.91 with a $165 million market cap. All three companies run $7 to $8 million in annual revenue. It is MKTY’s opportunity to trade at a market cap close or between the market caps of what we consider, its peers. That leaves room for a double or more from its current price. MKTY is a very thin trader, so LIMIT ORDERS ONLY! Buy weakness if you can.

Favored Market Sectors are:

- Precious Metals: KRRGF, GPL

- Blockchain / Crypto: MKTY, KNRLF

- Nat Gas / Energy: APA, AM, AR, RECAF, FRO

- Natural Resources

Where Value meets Buy Signals!

Feel free to forward or recommend to others.* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()