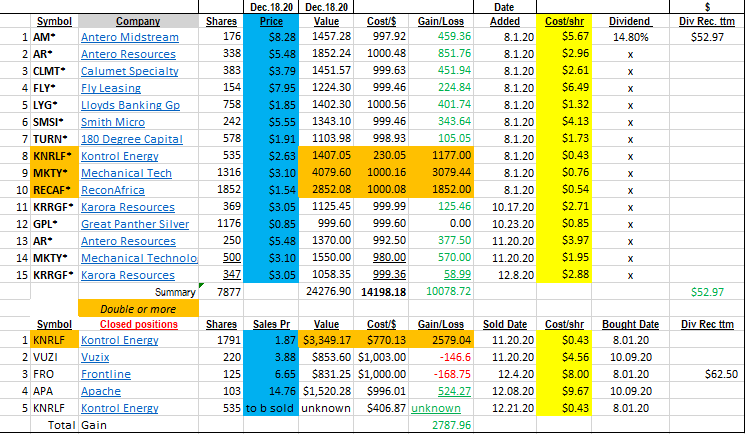

Summary:

- Asset Class Rotation Continues

- Closing out our position in Kontrol Energy – Technical reasons

- Mechanical Tech is under strong buying pressure – looks higher

- Antero Resources is refinancing – a positive for the stock

- Pressure is building in Calumet’s stock price

- We expect a strong Q1 2021 for precious metals; Like our positions in Great Panther & Karora

Asset Class Rotation Continues:

- The fastest way to make money in the market is to catch a rotational money shift from one asset class to another or a rotation of money from one industry to another industry by money managers. This rotation has been from large cap growth into value stocks, cyclical, commodities, and small caps. Add Emerging markets to the group receiving inflows list as well. This does appear like it will last some time. Goldman Sachs this week, raised their opinion and price target for oil to $65 in 2021. Goldman also said is a research report the commodity bull market is still in its early stage and expected a multi-year, out performance in this asset class.

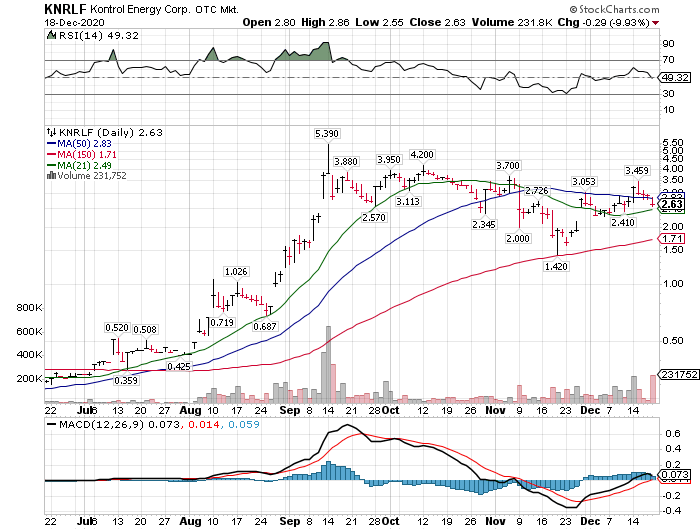

Closing out our position in Kontrol Energy – Technical reasons

- RSI (relative strength has dropped into a declining pattern

- MACD fast line appears to be dropping below its slower support line.

- The price relative to its moving averages just looks tired.

- It is possible the approved vaccines are taking the excitement out of its Virus and Bacteria detection product.

We will officially close the remaining position early Monday Dec. 21. We will monitor to consider re-entering the position in the future. We like the company.

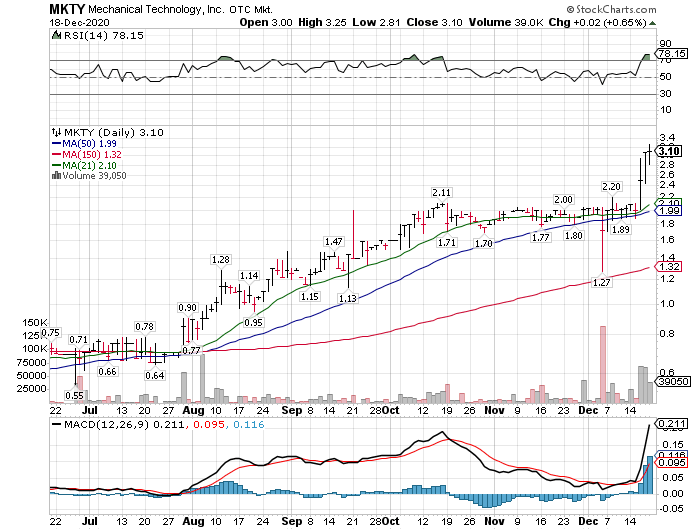

Mechanical Tech is under strong buying pressure – The price looks higher

Mechanical Technology appears to be in a “buyers but few sellers” stage rally stage. Bitcoin is hot and it is still early in the discovery stage of MKTY as a Crypto Miner.

- Our price target is based on Market Cap more than revenue or earnings per share (EPS). EPS is good with $0.19 in earnings for the first nine months of 2020. We do expect a falloff in eps with the completion of a large instrument contract that was a one-off situation. Never-the-less, we believe there are exciting developments under way at the company. We have previously compared Market Caps of RIOT Blockchain (RIOT) Mkt Cap of $529 million and Marathon Patents (MARA) with a market cap of $498 million to MKTY’s market cap of $29 million. They all do the same revenue, but MARA and RIOT are 100% crypto mining while MKTY is just beginning crypto mining. We believe the gap will close in the market cap between MKTY and their peers MARA & RIOT.

Antero Resources is refinancing – a positive for the stock

(chart and analysts are from Finviz.com)

- The chart trend is attractive as is the news flow on pricing expectations for 2021. Goldman Sachs just raised their price target for oil in 2021 to $65 dollars a barrel. We recognize that Russia and Saudi Arabia have plenty of oil available and are holding back sales in hopes of higher prices. So, the market could change quickly. The current price of $50 is a big positive surprise from the negative oil price we experienced in March of this year.

- Antero is current in the process of a $500 million dollar offering with a 2026 maturity. A successful offering would allow then to repay at par 350 million in 2022 notes and pay down their revolving credit line. We expect the offering to be a success but can give no assurances. The stock will react positive to the success or failure of the offering. Initial reaction by the share price indicates the market expects a successful deal.

- We have no target price on this stock. Five years ago, AR was a $60 plus number. They are a top five Nat Gas producer in the USA. Management was professional and ready for the March negative oil crisis (hedged sales) and completely surprised the market. The market was expecting a bankruptcy announcement. The shares were priced under $1.00 and have had a great rally from that valuation. We will react technically to the share price action and ride the trend as long as we can.

Pressure is building in Calumet’s (CLMT) stock price:

- Fundamentals are at play with Calumet that make us think the stock can double or more in value. One division, CLMT’s refining operation in Great Falls Montana is for sale with multiple buyers showing interest. It is just a matter of time before this division is sold in our view. In the sales process a potential buyer came forward expressed an interest in one of CLMT’s branded oil lines. 2021 looks to be an exciting year for CLMT from a transaction-based perspective.

- Free Cash Flow at CLMT is lumpy but consistently improving. Currently the free cash flow is in the $200 million annual run rate. The sale of a division (we expect $350 to $400 million from the sale of the Montana refinery) and resulting reduction of long-term debt, we expect positive price reaction. Presently CLMT has a price to sales ratio of 0.12. That is really low for a company doing $3.2 Billion in sales and generating $200 million in free cash.

- Technically the stock has a habit of a sharp sell off before a nice move higher. We think the current price is too cheap for the expected fundamental activity in 2021 but would bit be surprised to see a sell off before higher prices. We would be a buyer on weakness looking for a double plus in 2021. Out price goal is $7.50 to $10.00.

We expect a strong Q1 2021 for precious metals; We like our positions in Great Panther & Karora

- Low interest rates for the next couple of years with verbal comments from the Fed want to see inflation run hot with more liquidity injection coming in 2021. What’s not to like about gold, silver and a new asset class, crypto currencies. Paper currencies are being devalued to pay back debt with cheaper dollars. This is happening on a global basis – not just in the USA. For those willing to see, this is the clearest view of an investment path I have ever seen in 40 plus years in the markets. The Fed has no option. It will be a volatile trend as metals always are, but the rising trend should continue for three to seven years. We believe commodities because of the printing of Fait currencies will be the theme of the current decade. Great Panther and Karora are just two of the miners we like. Subscribe to our free “LOTM: Daily Notes” for more current comments on the miners and natural resource ideas we like.

Long term chart of a gold ETF (GLD):

Our opinion is gold is positioned to blow out the highs of 2011. We like silver better and we also own Bitcoin through the Grayscale Bitcoin Trust.

Note: Bitcoin (chart below) bumped its head against its all time high at mid-$19,000 level then blew out above that high. This is what we expect from gold. We like silver even better than gold.

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()