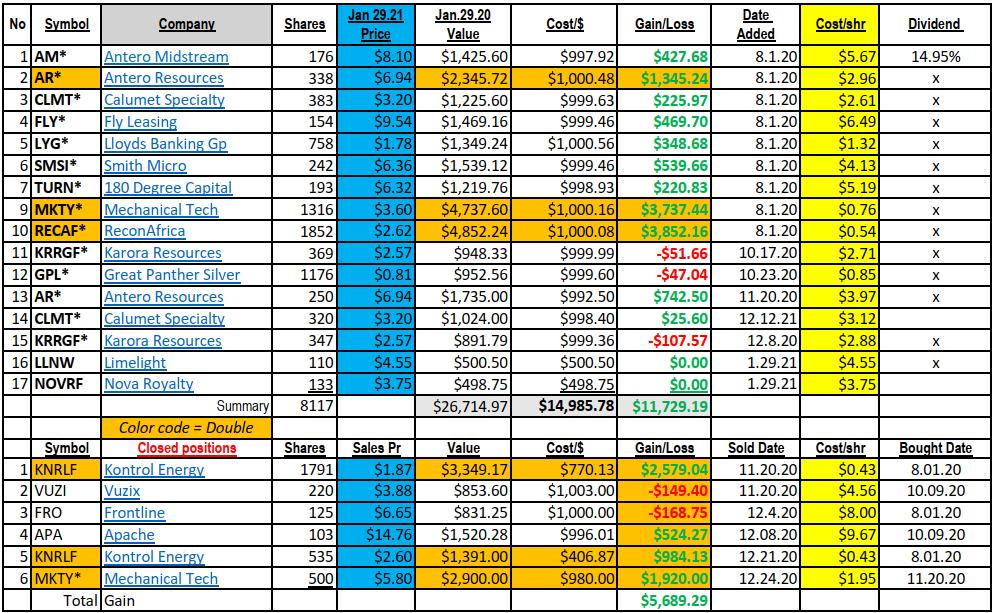

Today we will add half a unit ($500) to two new names to the Ten Under $10 for the double list.Notes:

- These are companies we are comfortable owning longer-term.

- We are buying half units because of market being over-bought and these have all rallied in 2020 or 2021 leaving room to correct.

- We plan to dollar-cost-average into these on weakness and have no stop losses planned.

- We do not see “company risk” but in general we respect the “market” risk. These are not in oversold and downward extended price situation.

The two companies are:

Nova Royalty (NOVRF) $3.78 – A Nickel and Copper royalty streaming company.

Limelight (LLNW) $4.70 – an internet content infrastructure company.

The company names are linked to the TradingView site for a Chart & Stats.

Nova Royalty Corp. is a Royalty (also called Streaming) company focused on providing investors with exposure to the key building blocks of clean energy-copper and nickel. The company came public in November of 2020. Website link.

- Investment Thesis: Establishing what we think can be a multi-year position in a company that provides financing to Copper and Nickel miners in exchange for a percent of revenue as royalty and warrants. For a minimum of five years Copper and Nickel will be in high demand and that demand expanding as the world moves to electrification of virtually everything, but let’s start with Electric Vehicles. This is an opportunity to grow with both increasing demand for their product as well as rising prices as demand pressure the ability to introduce additional supplies. Environmental rules and regulations will prevent the rapid introduction of new supply. We would consider NOVRF a core holding and consider the company lower risk but the industry volatile. We like the outlook for Copper and Nickel and would use weakness to accumulate and strong rallies to skim some profits but hold the core position for the two-to-four-fold price goal over the next five years. Hence our dollar-cost-averaging approach – no stop loss. Risk is we stop using Copper and Nickel. Just not going to happen.

Limelight Networks Inc Is a leading provider of digital content delivery, video, cloud security, and edge computing services, empowers customers to provide exceptional digital experiences. Limelight’s edge services platform includes a unique combination of global private infrastructure, intelligent software, and expert support services that enable current and future workflows. Website link.

- Investment Thesis: Underperforming (as a company) but industry leading Content Delivery Network (CDN) in video download performance, Limelight has new leadership (President & CEO) in Bob Lyons. Lyons was CEO at Alert Logic a software-as-a-service solutions for cloud-powered threat management and log management solutions company. Competitors to Limelight include Akamai, Fastly, CloudFront, CDN77, Amazon Web Services. We see the opportunity to take it industry leading Video Content Delivery services to a new level of growth and higher margins. The company could be a takeover target. LLNW’s market cap is only 550 million dollars with its public competitors Akami at $18 Billion and Fastly at $12 billon market caps. Amazon needs no comps. TipRanks has two Buy recommendations and two hold recommendations. There were no sell recommendations. Average price target is $6.25 with a high price target at $9.00. Short interest is at 13% of float. That is a sensitive subject considering the Bull Raids happening in stocks with high short interest. We don’t think that is a factor here. We do not think of LLNW as a core holding at this time. That could change.

Random Thoughts and comments:

Calumet (CLMT): LOTM has an aggressive attitude towards accumulating shares at the current price. We are talking about a $3.20 stock with a market cap of $253 million that has a Free Cash Flow annually of $250 million. Yes, trading at one time’s free cash flow. Catalyst is a refinery sale that is expected to be in the $400 million area. Proceeds will be used to reduce its long-term debt which is at $1.4 billion. The company has no issues with debt payments.

Antero Resources (AR) & Anteros Midstream (AM)

LOTM is very bullish on Natural Gas related companies. Production is not increasing at a fast rate from the Shale fields, demand swill be strong for oil and Natural Gas. The Renewable Energy Theme is over hyped on what it can actually deliver, and we expect much higher Nat Gas prices in the coming years. Accumulate additional shares on weakness. We believe the dividend at 15% from AM is solid. They say it is solid with rising free cash flows for AM in 2021. Look for our list of Nat Gas companies for more ideas in this area. There are some excellent companies on the list that we believe have higher stock prices in their future.

RECONAFRICA (RECAF)

Recon is drilling it first of three exploratory wells in Namibia and Botswana. They hold 100% and 95% drilling rights on 18,000 sq miles of property with the blessing of both government who want economic development successful drill results would bring. This is an enormous sized prospect. A true wildcat opportunity should they de-risk the property with successful results. We should know the results in six to nine months. A true lottery ticket. Of course, three dry holes could hold similar results as a losing lottery ticket. Geology has been done – Recon believes there is oil and gas in this basin. Do your own investigating. Their website is a good start, but of course they are talking their own PR story.

If we get a panic sell off in the market, we will use the opportunity to add to the positions if we can (money available allowing). These are uncertain times, so we are overstating the potential risks. We simply don’t know. The markets are unstable at the moment. We are acting appropriately but not in fear. We are taking a dollar-cost-averaging risk management approach with selective selling. We are not market timers or swing traders. We are limited position investors in companies we believe offer good to great value with appreciation catalysts in sight.

May positive energy, freedom of thought, speech and religion fill our creative spirits and provide leadership to the rest of the world!

Contact us if interested in Training, Coaching or Mentoring

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()