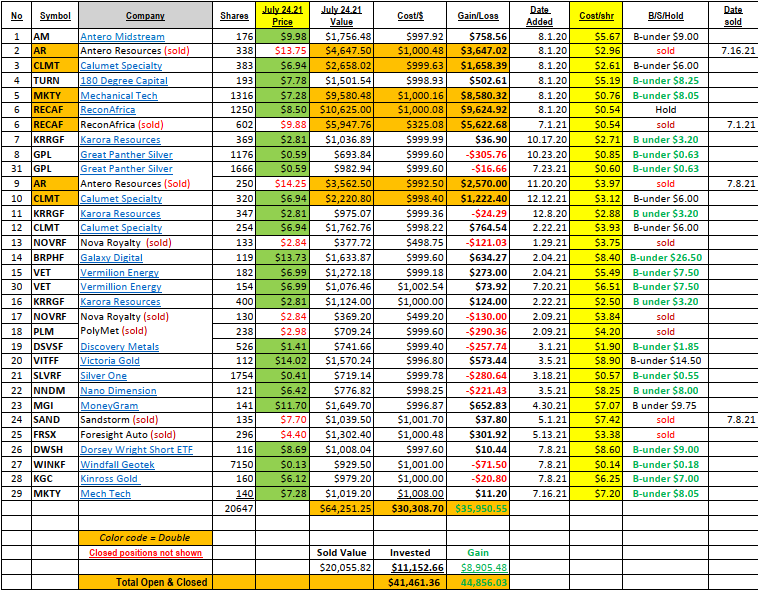

Additions to Ten Under $10:

Vermilion Energy (VET) $6.99 on Monday July 20 we added a second unit to VET. The shares fell on no company bad news with the industry oil sell off. The Industry news was that OPEC was going to increase production combined with fear of commercial slowdowns and travel restrictions related to COVID 19. This industry news does not bother us at this time. It was headline news not meaningful new at this time. I the future, perhaps three to five years out we will exit oil and gas if/when a cost effective storage system for Wind and Solar energy come to market. Even then the quantity of solar panels and windmills required to replace Oil & Gas as an energy source is prohibitive. Longer-term, we do see Nuclear being the replacement to Oil & Gas, but we are a decade or more away from that event. Between now and Nuclear, we believe VET will reinstate its monthly dividend and the share price can double or more from its current price.

GPL: We added addition one $1,000 unit to Great Panther Silver.

News out that GPL has resolver a maintenance issue and will return to 100% production immediately. The share price dropped on the news of the repairs, and we expect the share price to return to the $0.70 to $0.95 trading zone. Withy a breakout of silver above $30 and gold above $1,950 we would expect GPL to go to the $1.25 Our blended cost is about $0.73. a move to $1.25 would give us a chance to exit of review and see if we want to hold longer.

MKTY: We added a second unit to MKTY. Revenue for Q1 2022 is projected to be between $7 million and $9 million. Cash flow and earnings are also expected to increase in similar proportions. Revenue for all of 2020 was $8.9 million. Good outlook for MKTY indeed! We project MKTY could double or more from $7 area in 2022. Maybe more. We are very optimistic. Everything seems in place. If Bitcoin rallies in 2022 or sooner, we expect that contribute to an optimistic backdrop for MKTY’s price performance.

Silver Miners:

Silver One (SLVRF)* $0.41 and Discovery Silver (DSVSF)* $1.41

We will likely add to these positions in the coming week. These are exploration companies. Other than the price of physical silver changing, we do not see much negative happing with the companies. It has always been our intent to own and average down in the price of these and other Silver related companies. The Electric Everything is in its early days. There has been a shortage in silver production Vs Demand for silver for seven years. Increasing demand from Everything Electric in combined with environmental regulations on mining will continue to create a supply / demand imbalance that will cause the price of physical silver to increase dramatically. After all, one cannot flip a switch and supply more silver. It take years if not a decade and a half to bring new mines on-line. This is a simple, accumulate and wait, investment strategy that we expect to harvest multiples of our original investment. Along the way we might sell some of our higher cost shares for a profit short of our end goal. We might see something better to rotate into. For us this is a passive store of value that we 1) expect to make excellent money from the supply / demand outlook we have plus 2) a hard asset hedge against a falling US$. Think not of metal prices along with food, housing and energy prices rising, but rather it is the measure of the loss in purchasing power of the US$.

Contact LOTM For One-on-One consultations.

Rates are $125 per hour / less on a retainer basis

LOTM Research & Consulting Service

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()