Our process at LOTM is to look forward for what “could be” Vs what is today. If the “What could be” is not fully priced in the stock, we keep the stock as a core position while trading around the core position.

Things we consider:

- What are the odds/probabilities of the “What Could Be” happening?

- We consider balance sheet for survivability and financing the “what could be”.

- Current valuation Vs the “What could Be” for upside appreciation.

- Capital structure for appropriate shares outstanding and dilution.

- Does it make sense from a “is it scalable” perspective.

- Insider interests aligned with shareholder’s interests and history of that relationship.

Nothing is for sure or guaranteed in the market. There are many variables at play. This including Macro-economic, political and geo-political events – not to mention the dreaded Black Swan event. So, probabilities and survivability are key factors we have come to appreciate from painful experiences. We hope that now translates into wisdom. In this industry you are only as good as our most recent suggestion. Of this we are painfully aware. So, buyer beware 😊

MKTY Revenue Forecasts:

Here are some very interesting Revenue projections based on Probabilities, balance sheet, survivability, and capital structure for MKTY. We like what we see for appreciation potential.

If there is a market sell off or Geo-political event or black swan event, we are confident MKTY will survive. We will not sell MKTY because it drops 50 percent because of such event but rather will be greedy in finding cash to buy more. In our workshops of the past, we often used the analogy – Are you dating your stock or are you married to your stock. Either is ok, just so you know which is which. How you handle problems that arise are very different when dating Vs marriage (Trading Vs an Owner). It is harder to build true wealth if you don’t own a company and support the position by buying more in times of stress – like any good marriage. Times of stress can make the marriage stronger and more worthwhile as it can your position in stock.

How did the wealthiest people on the planet come to be where are? In times of stress did they run away or did they double down on their commitment. The same principle works in the market. Many of my long-term Biggest winners have come from my biggest losers. I go back a ways with MKTY. My lowest cost in MKTY is $0.08 from the 2009/2011 period. At today’s price or anywhere after that purchase, the return looks very good.

Here is what I see as potential for MKTY in the next eighteen months. I believe the probabilities are high that this can happen. Let’s see! Eighteen months is not that far away.

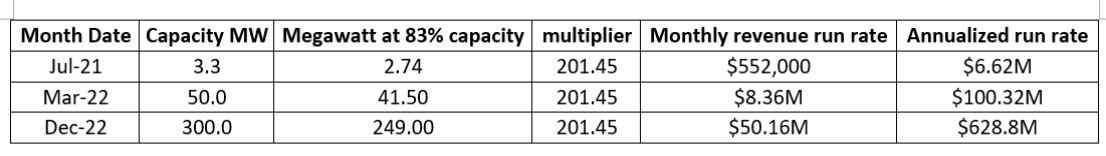

Our Conclusion is that MKTY has the potential to grow its Crypto business from today’s annualized run rate of $6.62 Million to $628.8 million run rate by the end of December 2022.

Numbers are based on

- MKTY year-to-date numbers presented in the July 2021 update linked here.

- MKTY goal of 50 MW capicity by year-end 2021. This is well on its way of being accomplished

- Comment that MKTY has 300 million MW in its pipeline, for the next 18 months, in the article linked here.

MKTY Technical View:

You should know our technical system by now. The stock appears close to entering a Stage 2 chart pattern. This is supported by what we consider preliminary technical, buy signals.

At this time, we will say we believe the stock can double or better in the next twelve months. If they hit the numbers in our projections above, that could expand to 3X to 5X potential. Too soon to project that. Rather, we will increase our price goals as management executes its strategy.

Have a Great Weekend!

Tom

Contact LOTM For One-on-One consultations.

Rates are $125 per hour / less for retainer

LOTM Research & Consulting Service

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()