The Background:

Russia and Saudi Aribia together, decided to flood the market with oil in the first quarter of 2020. This was their attempt to break the back of the fracking industry in the USA. At the same time, Covid showed up in February 2020. The combination one/two punch was devastating to the fracking industry in the USA. We now import oil from Russia and Saudi Aribia whereas the USA was a net exporter of oil and gas prior to March of 2020.

Nat Gas:

There is a global shortage of Natural Gas. We should expect an expensive heating season this winter. Prepare for the worst, but hope for the best, is the best way we can express it. Currently, Nat Gas is $4.15 per MMBTU. I just saw a price forecast with a working price target of $9.00 for Nat Gas from Momentum Structural Analysis, LLC. The report is dated, Aug 4, 2021.

Excerpts From Forbes:

U.S. Natural Gas Prices Flying Through Summer 2021 (link to full article)

The coal industry is getting a reprieve this year thanks to natural gas prices being 60% higher than in 2020. The U.S. Department of Energy sees a 21% rise in coal generation for 2021 – illustrating why anti-gas positions are ultimately just pro-coal, even in “climate leader” Europe.

Our climate change necessity of “deep electrification” will ensure that gas becomes an even more inelastic product since wind and solar are naturally intermittent and location specific.

The current market is short of natural gas and thus in backwardation, where near-term pricing on the NYMEX futures curve is higher than contracts farther out. For historical reference: while $4.00 gas is well above what we have been seeing, before “fracking” took off, from 2000-2008, U.S. gas prices averaged over $6.00.

There is also a huge shortage of gas globally, with prices in Europe and Asia in the $12 to $15 range (again, low-cost natural gas is probably our biggest competitive edge in the energy space).

Forbes Aug 2, 2021

Additional article: The Era of Cheap Natural Gas Ends

Bloomberg: Anna Shiryaevskaya, Stephen Stapczynski and Ann Koh – Fri, August 6, 2021

The era of cheap natural gas is over, giving way to an age of far more costly energy that will create ripple effects across the global economy. Headline link for full story.

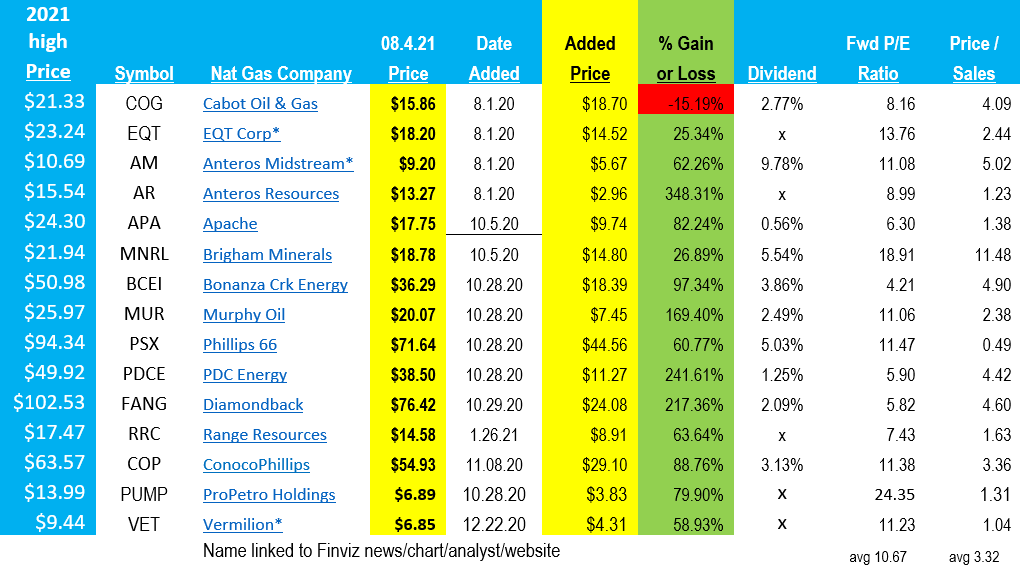

LOTM: Natural Gas companies, as shown in the graphic below, have corrected in price from their highs earlier this year. It seems valuations are reasonable, that oil & gas pricing will remain in the $60 to $80 range (oil). One could expect oil & gas stocks to make another run higher in late 2021 and 2022. Cash flows are strong as long as the price of oil stays above $60.

Below is an update of the names we have shared with you over the past ten months. It has been quite a ride. We don’t think it is over yet.

NOTE: The majority of producing companies above have raised their dividends to the point the payout as a percent of the current share price is higher today that when we first published this in October 2020. The exceptions are AM and MNRL. Both AM & MNRL are financially strong companies, so do not interpret our comment as a negative on these two companies.

We like Vermilion (VET) a lot. They are paying down debt and have voiced the intent to reinstate a monthly dividend in the future. Prior to March 2020 you can see the shares traded at a much higher price when paying a monthly dividend. It was a staple cash flow for many retired Canadians.

You might also consider the Nat Gas and Oil pipeline companies for dividend payers. Anteros Midstream (AM) above is one such pipeline company. Dividend is about 9.75% at the current price.

Demand for power is rising rapidly on a global basis. Oil & gas will be with us for the next 30 to 40 years unless we go back to stone age living.

Nuclear Power cannot ramp as fast as needed. Wind, Solar and Hydro cannot produce the base load need (demanded) by end users. Do not fear the ending of fossil fuel use as an investment. Restricted sources and regulations only sever to drive prices higher. It is basic economics many have not been taught or want to hear.

Good luck & good day.

Contact Tom For One-2-One Consultations

Rate: $150 per hour / Monthly Retainer, Lowers Rate

LOTM Research & Consulting Service

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()