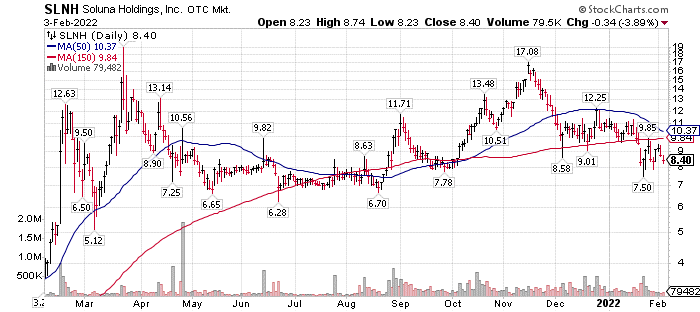

Re: Soluna Holdings (SLNH)* $8.40

John Belizaire is the CEO of Soluna Computing.

Soluna Computing is the world’s first utility-scale company combining Alternative Power Generation with high-performance computing facilities.

A little known fact is that traditional power plants and the grid system are interconnected in controlling the management of electricity between the Grid and the Power Provider.

With Alternative Energy Providers, this link or interconnectedness is missing. The disconnect creates a situation where the alt-energy provider has wind, sun and energy, but the grid system is full and cannot accept the electricity. Soluna solves this “wasted electricity” problem by building data computing centers on-site or close to the source of electricity. As much as 30% of alt-energy produced, is wasted because the inability of the grid system to accept this electricity.

In this hour-long interview, linked here, John shares the background and story-line on how Soluna came to be the first utility scale company to solve this global problem.

Why might you consider Soluna as an investment?

- At year-end, 2020 Soluna generated $9 million in Revenue with $1.8 million in profit.

- By year-end, 2022 Soluna is projecting $250 to $300 million in Revenue with profits.

This is an unusual situation. A situation LOTM believes creates an out-sized appreciation opportunity.

That is why we think you might consider ownership in Soluna as a company and not as a stock trade.

LOTM prefers the “buy the company model” of creating wealth.

Knowing the company, its management, and their goals on what the company is striving to achieve.

Certainly, there are times to “Trade the Stock” in times of over or under valuations.

Knowing your company approach can eliminate concern or outright fear of buying shares at the most opportune times. In moments of stock market panic selling, buying shares on the cheap can be your best friend. This is a time tested way to create wealth when dealing with strong and healthy companies. This is why we encourage you to know your company and make market volatility your friend in buying shares at a discounted price.

Important Metrics for Soluna Holdings.

- Market cap is about $114 million

- Shares outstanding are about $12.7 million

- Soluna has no long-term debt.

You can Read, you can watch Videos, but nothing beats Personal Interaction for accelerated learning.

This game has levels of understanding that could take a lifetime of Trial and Error to learn.

Available for Coaching, Training or Mentorships

Contact Tom through the LOTM website or by email

Rate: $150 per hour / Monthly Retainer, Lowers Rate

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()