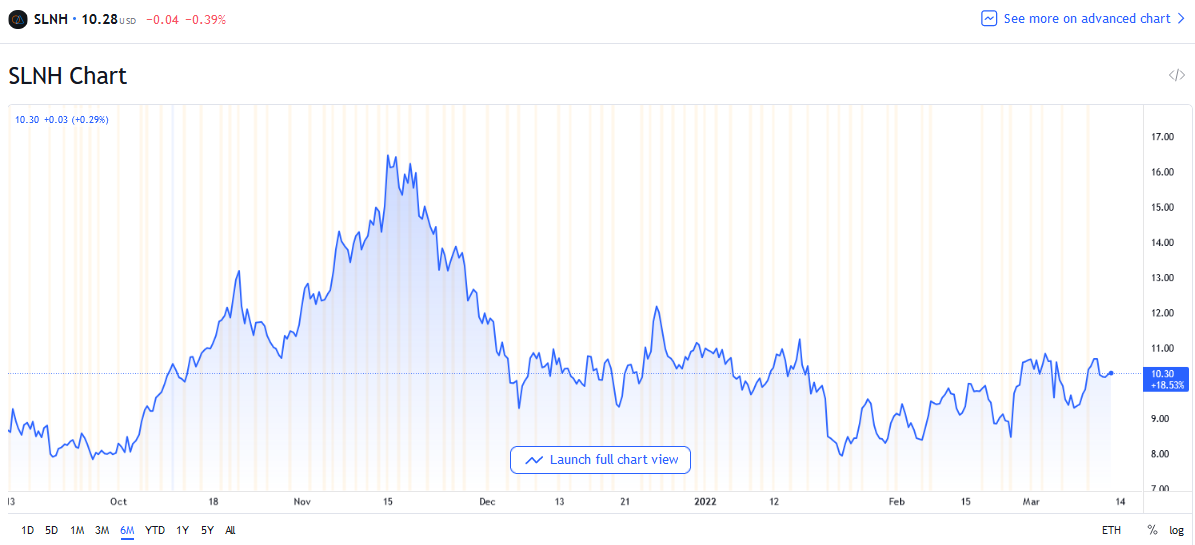

Soluna Holdings (SLNH)* $10.28

Price inflection point with ’21 year-end report in about two weeks.

I: Technical Comment:

Note the period from early December to mid-January in the chart above. This appeared to be a basing period – until the price broke lower going into the Jan 24 date of the Ukrainian invasion by Russia. The break lower in January left about seven weeks of resistance in the $9.25 to $11.25 price area.

Since the Jan 23 break below the 150-day and 20-day moving averages, (below chart) SLNH has been out-performing the market (seen in the Relative Strength index [RSI]) reading of 54.2% seen below.

Soluna has regained a price position above both its 150 and 200-day moving average (chart below). This is no small task in the chaotic and downwards market we have had since Jan 24. With the price above both longer-term moving averages, we can say SLNH is officially back on a long-term buy signal.

MACD – a short term trend indicator (below chart), has been positive since shortly after the Jan 23 break. A positive factor. Certainly, there are many other factors to consider – like the resistance in the $11.00 to $11.50 area.

There is about 7% short float position in the share so we have “dark” forces betting the stock is heading lower again. These two items (resistance area & shorts) are near term resistance factors to fight through. A pressure point in timing is building around the ’21 Year-end update coming in the next two weeks. We either break out in an upward direction (my opinion but admittedly biased) or we sell down one more time. I say one more time because execution of the business plan is happening.

Revenue is ramping fast. As on the Jan 2022 update, announced in Feb, the run rate for annual revenue was about $35 million. This compares to the total annual revenue of near $9 million at the end of 2021. In my napkin math projection of $35 million divided by 53 megawatts (current electricity scale) divided again for 12 months and that number project forward to 2022, December, 153 targeted megawatts, multiplied by 12 for year-end 2022, I get a revenue run rate of $101 million in revenue for calendar year 2022. I hope that is conservative because as SLNH scales size on each phase of expansion, they should become more efficient and productive.

By the Q2 2022 announced numbers (mid-August) we will have a data trail that analysts can use to do more sophisticated projections into 2023. What I am saying is, I expect analyst research reports to help gain exposure for the share price. It is future positive “marketing” for our share price in the second half of 2022.

II: Fundamentals are Ramping Fast:

Revenue is ramping fast. As on the Jan 2022 update, announced in Feb, the run rate for annual revenue was about $35 million. This compares to the total annual revenue of near $9 million at the end of 2021. In my napkin math projections, $35 million divided by 53 megawatts (current electricity scale) divided again for 12 months then taking that number and projecting 153 targeted megawatts, multiplied by 12 for year-end 2022, I get a revenue run rate of $101 million in revenue for calendar year 2022. That is conservative because as SLNH scales size on each phase of expansion, they should become more efficient and productive. All this is subject to execution of the plan of which management and team has been great at doing.

By the Q2 2022 announced numbers (mid-August), we will have a data trail that analysts can use to do more sophisticated projections into 2023. What I am saying is, I expect analyst research reports written that will help gain exposure for the share price. This is future positive “marketing” for our share price in the second half of 2022.

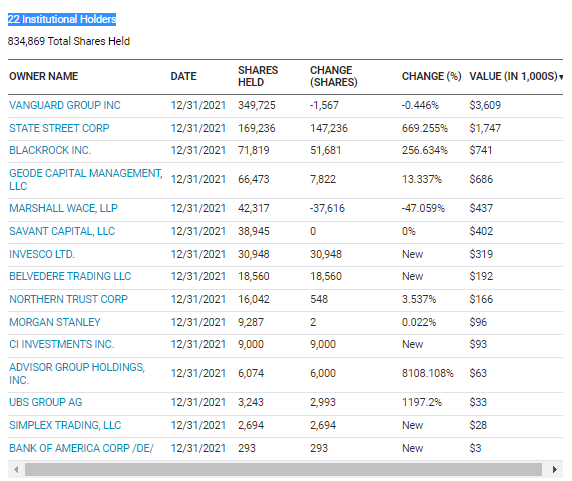

III: Institutional Holdings Comment:

Top three names of institutional buyers (below) are excellent names. We are starting to see other big names enter as accumulators of the shares. As (or maybe if) Soluna executes its business plan, I expect these firms to continue building their positions.

The numbers below are for the period ending 12/31/21. I believe accumulation by institutions increased in Q1 ’22, so we anticipate another positive check mark for Soluna shares, as these numbers get updated.

The NASDAQ site has Institutional ownership at 6.03%. Finviz is at 12.9%. Let’s see who catches up in the next reporting period to see which source is more current. I’ll project Finviz is reporting with the more frequent updates.

New Interview with John Belizaire CEO of Soluna Holdings.

Interview with John Belizaire CEO Soluna March 10, 2022.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()