Written Aug. 26, 2020, Tom’s Blog

by Tom Linzmeier, Editor LivingOffTheMarket.com

- Our assumption is that Precious metals are in a multi-year bull market that started in late 2015.

- AngloGold, the third largest gold/precious miner in the world, is anticipating a large profit increase in the next twelve months from increased end sale pricing.

- AngloGold is a very volatile stock that is a fun trading name if you get in rhythm with the price movement.

AngloGold Ashanti, (AU)* $28.38 in August hit a multi-year high just under $39.00 and immediately retreated 30% to its current area. Technically it appears to be consolidating the rapid fall. We are assuming the trend is up and this is an opportunity to buy into the company’s stock. We are well aware that perhaps the correction is not completed, and this is a pause before the next leg down. Assuming this unknowable factor, we have taken an initial position as a short-term trade and will slowly stage into a trading position.

TREND EVIDENCE – Fundamental and Technical:

- The Zacks Rank #1 company, has expected earnings growth of more than 100% for the current year.

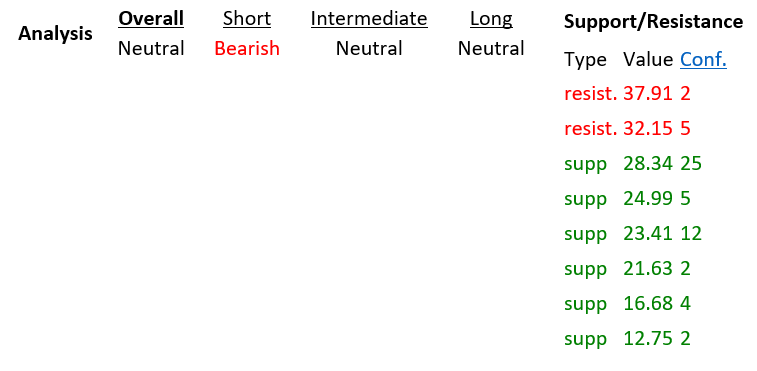

- com on Aug 26, rates the share price on a technical basis, Neutral overall, but negative short term.

- LOTM assumes Fundamentals out rate Technical on a long-term basis as long as Valuations are reasonable. Forward P/E ratio is projected at 8 which we consider very attractive, when combined with the 100% growth rate in earnings looking forward.

We will use the technical trend analysis at StockTA to increase or decrease the position size. Currently the opinion is:

As the technical signal improves, we will increase the size of our trading position. This stock easily moves 3% to 5% in one day – up or down.

As the technical signal improves, we will increase the size of our trading position. This stock easily moves 3% to 5% in one day – up or down.

Know Your Trade!

Stats / News & Charts from Finviz are linked here.

AU Website linked here.

Link to LivingOffTheMarket.com, Tom’s Blog:

Where Value meets Buy Signals!

LOTM is a free newsletter. Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security. These Investments are bought and sold constantly.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

![]()