September 15, 2020 Tom’s Blog

Aggressive Buy in a Healthy, Oversold, Dividend Payor!

- Oil & Gas Royalty Company

- 100% of free cash flow will be distributed as a quarterly dividend

- Debt Free – 6.54% annual dividend based on the last distribution

- Expected to become aggressive in buying royalty streams with prices low

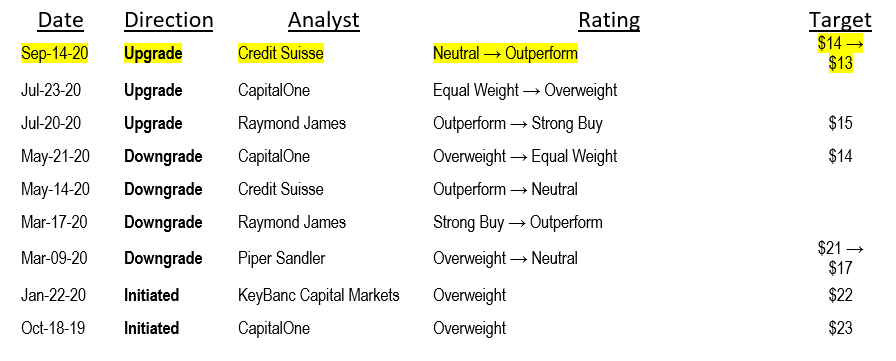

- Credit Suisse Upgraded to Outperform on Sept 14, 2020

MNRL* $8.56

Accounts related to LOTM have trade this stock since March of this year. We recently re-entered the shares at a price above $9.00 and became more aggressive when the stock price fell with the news of a 4.4 million share secondary offering by certain shareholders. The deal was priced at $8.20. In addition to the recently announced secondary by selling shareholders (no proceeds to the company), the stock price was weak because of a reduced dividend in Q2.

We would be remiss, if we did not mention that the current administration is favorable to the fossil fuel industry while the Democrats have an anti-fossil fuel agenda. In fact, in their platform they state that their intent is to eliminate all subsidies to the fossil fuel industry when elected. We don’t have any inside information on who will win in November but who the winning team is, will certainly have an impact on the share price. It will be a while before the planet can be taken off oil & gas so, we believe a healthy debt free company will be here for a while. Should the Democrats win in November, and new environmentally friendly regulations be put in place, the price of oil and gas will likely rise as production is restricted. For a royalty company that distributes that cash, it is not all that bad a situation.

MNRL is debt free and bought back about 10% of the secondary announced above as treasury stock. The secondary is expected to be completed Sept 15. Expect MNRL to do its own secondary in the next two to three quarters to raise money. The purpose is to buy additional mineral rights and royalty income to expand the company. They feel this period is an opportunity to grow the company, not hide and hunker down. There will be oil and gas operators who have trouble and have to sell their mineral rights. We agree. The strong always try to expand during difficult times.

DIVIDEND POLICY: Management has stated they will pay out 100% of free cash flow each quarter as the dividend. It is our projection, that the second quarter 2020 ending June 30 with a $0.14 dividend, will be the low water mark in 2020.

We are not buying MNRL for the dividend this time. Although we think it is a good opportunity to buy for that purpose. We bought, because we felt the share price is too cheap and there should be a pop back in the share price, post the secondary offering. We also believe royalty income will increase in the current quarter. Therefore, we expect better comparisons to Q2 when Q3 results are announced in about eight weeks. It is possible we’ll see an increase in the dividend from the Q2 dividend. That is a contributing catalyst to our “Price POP” expectation in the next two months.

New Buy Recommendation Today, Sept 14, 2020: Sourced at Finviz.com

There could be some posturing by Capital One, Credit Suisse and Raymond James to support the current secondary offering. That does not mean they are not right in their opinion. We are of the view that this debt free company, is oversold and is an excellent dividend payor to own for a trade or long term.

Accounts related to LOTM have been buying in the open market over the past five days with an average all in cost of $8.55. We bought thinking this is a trade. We are not sure how we will sell. Potentially all share as a trade or perhaps hold some and trade some.

Company Website linked at Brigham Minerals, Inc.

Recent Headlines:

11-Sep-20 : Shares of Brigham Minerals Drop on Stock Offering Motley Fool-13.10%

10-Sep-20 : Brigham Minerals, Inc. Announces Secondary Public Offering of Common Stock and Share Repurchase

LOTM views the secondary as an opportunity to buy weakness on a non-operational based news item.

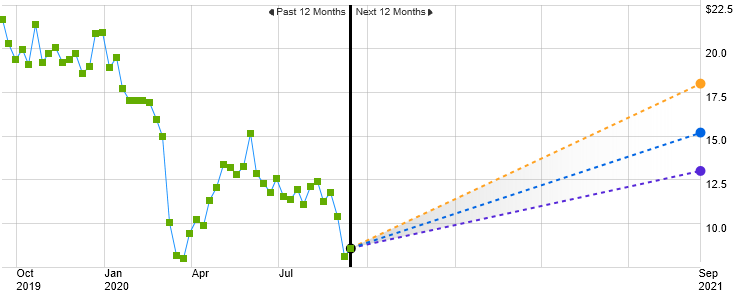

Analyst Price Targets Powered by TipRanks – Sourced from eTrade

Avg. Price Target – $15.20 –77.57% Upside

High Price Target – $18.00 – 110.28% Upside Low Price Target – $13.00 – 51.87% Upside

In the last 3 months, 5 ranked analysts set 12-month price targets for MNRL. The average price target among the analysts is $15.20. Analysts compare their price target to the current market price of the stock to determine how much potential upside or downside movement there could be in the stock price.

Ever wish you would have bought at the March 2020 lows? Here is an opportunity in a healthy company.

Where Value meets Buy Signals!

LOTM is a free newsletter. Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security. These Investments are bought and sold constantly.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()