- Forward P/E ratio on Finviz is posted at 16.66 – optimistic view for sales and profitability

- Short interest is at 31.56% of Float – a strong negative view by professional traders

- In looking at the chart below it could be the last weeks trading could be short covering. The market was very weak but someone is buying when a stock flat lines like INO is flat lining.

Sourced from Finviz – INO Sept 12,2020

We are reprinting most of the news release below because we believe it is critically important to the story behind Inovio (INO). For the compete story follow this link here. In our opinion the only reason we can see why the stock did not react to the news is that the market was in a steep selloff that had “hot” money on the defensive. Our Interpretation of the news is that it is an outstanding development to compliment phase one of the clinical trial.

Released Sept 10, 2020

This week, one of the key players in the COVID-19 vaccine race took a leap forward.

On Tuesday, Inovio Pharmaceuticals (INO) announced that Thermo Fisher Scientific had signed a letter of intent to manufacture its DNA COVID-19 vaccine candidate, INO-4800. Thermo Fisher will be added to a list of partners that includes Richter-Helm Biologics and Ology Bioscience. This global manufacturing consortium will support the commercial production of 100 million doses of INO-4800 in 2021, should the candidate ultimately receive FDA approval.

H.C. Wainwright’s Raghuram Selvaraju points out that Thermo Fisher plans to manufacture INO-4800 as well as perform the fill and finish at its commercial facilities in the U.S., which have a peak production capacity of at least 100 million doses of INO-4800 annually, so says management. On top of this, Inovio is in active discussions with additional manufacturers to join the consortium.

Weighing in on this development, Selvaraju stated, “In our view, the inclusion of Thermo Fisher in the global consortium significantly strengthens Inovio’s manufacturing capacity and represents one solid step towards potential commercialization of INO-4800 in 2021.”

As INO-4800 gears up to enter a Phase 2/3 trial later this month, another COVID-19 vaccine candidate has been attracting significant Street attention. Also, on Tuesday, rumors swirled that AstraZeneca had halted the clinical trials evaluating its COVID-19 vaccine candidate, AZD1222, for an independent committee to review safety data while it investigates a “single event” case of a serious adverse reaction. The adverse reaction was transverse myelitis, an inflammatory syndrome that affects the spinal cord and is often brought on by viral infections. It isn’t clear if the reaction is directly linked to AZD1222, a non-replicating ChAdOx1 vector-based candidate.

“If the serious adverse event is proven to be vaccine-related, it may prevent this candidate from being approved and commercialized, in our view, thus leaving the COVID-19 vaccine market to those that could pass all developmental and regulatory hurdles. Notably, nine pharmaceutical firms issued a joint pledge yesterday stating that they would not launch any vaccine until it had been thoroughly vetted for safety and efficacy,” Selvaraju commented.

Looking at the data for INO-4800, in the U.S. Phase 1 trial, interim data showed that 100% of participants demonstrated overall immunological response rates and roughly 95% of vaccinated participants had overall seroconversion, or responded with neutralization and/or binding antibodies, after two doses. Adding to the good news, almost 90% of vaccinated subjects generated strong T cell responses, including CD8+ killer T cell responses.

“In our view, the presence of T cell responses in the majority of participants could be associated with long-lasting immunity or duration of protection,” Selvaraju noted.

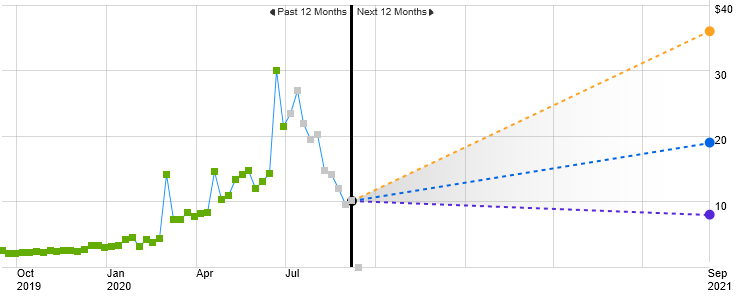

Analyst Price Targets – Powered by TipRanks – sourced from eTrade

Avg. Price Target – $19.00 an 88.49% Upside

High $36.00 a 257.14% Upside

Low $8.00 a 20.63% Downside

In the last 3 months, 8 ranked analysts set 12-month price targets for INO. The average price target among the analysts is $19.00. Analysts compare their price target to the current market price of the stock to determine how much potential upside or downside movement there could be in the stock price.

Where Value meets Buy Signals!

LOTM is a free newsletter. Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security. These Investments are bought and sold constantly.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()