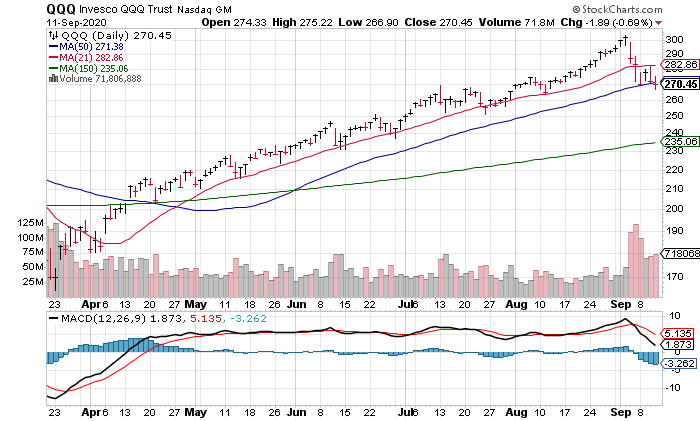

NASDAQ 100 – QQQ

Many people use the 200-day moving average as the-long term indicator of a rising trend (price above 200-day MA is a rising trend) but most traders use the 150-day which is shown above. This market is too close to call for the correction to be completed. Because the price is coming down from a high point, we’d give the edge to wait and see. The 150-day MA, which is the next major support, is far below (15%) where we are at now.

We are not a big fan of the MCAD in the lower portion of the chart. It can give you whip-saw signals in a trending market but can be an uncannily accurate indicator in a choppy market. In this case we would wait for the faster line (black) that is now below the slower line (red) to cross back above the slower line before buying. That will give the market to build a bit od a consolidation base pattern.

Traders: the rally at week’s end, could be a two day pause in the beginning of a bigger down draft. Give it some time to see how it unfolds.

That is the technical opinion. If you have a fundamental reason to buy individual stocks and are willing to dollar cost average over a longer time frame, that is a different strategy. There are good values in the market. We like Nat Gas as a value industry at this time and are willing to dollar cost average with a stop loss on our dollar cost average cost basis at some point in time. You should never use this second strategy in an ETF. ETF’s were created as trading vehicles.

Email to ask questions if you have them. Tom @ Livingoffthemarket.com

Where Value meets Buy Signals!

LOTM is a free newsletter. Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security. These Investments are bought and sold constantly.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

![]()