- History of Demand out running Supply

- Increasing Demand from Industrial application

- Increasing Demand from Investors Seeking Safe Haven Investing

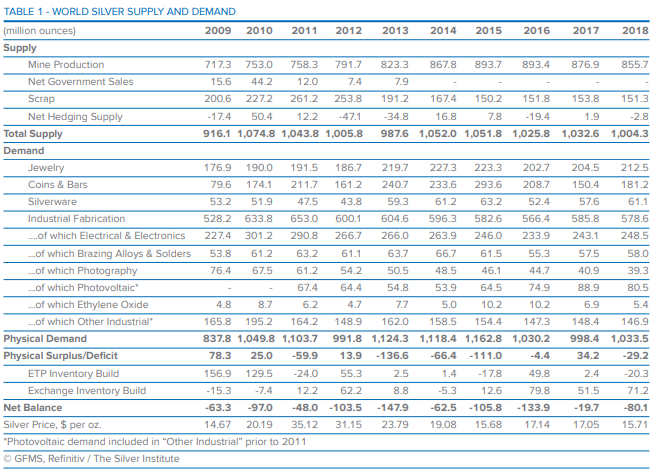

There is currently a supply shortage in silver. In the table below – see the fourth line from the bottom: Net Balance. There has been a shortage of silver production to demand for each of the ten years in the table.

- Industry uses of silver are close to 60% of annual silver production. The top users are solar industry and electronics.

https://www.silverinstitute.org/wp-content/uploads/2019/04/WSS2019V3.pdf

https://www.silverinstitute.org/wp-content/uploads/2019/04/WSS2019V3.pdf

Demand for silver caused the jump in silver’s price from the $16 – $17 dollar to $26-$28 in ten weeks from Late May to early august 2020. See chart below. Demand for silver is increasing faster than supply is growing.

Ahead in the poles, Joe Biden and the Democratic party has a repressive policy towards fossil fuels and a very pro/aggressive policy towards solar – one of the biggest users of silver. Democrats and environmentalists in the USA also have a very anti-mining attitude, thus potential for restricting supply through additional environmental regulations.

- Should Democrats win in the November election, we believe owning silver will be one of the best ways to benefit from a Biden/Democrat victory.

- If Trump and the Republicans win in November, we also expect silver to stay strong and rally. As a pro growth advocate, Trump and Republicans will spur growth and consumption which in turn relates to a strong electronics and semiconductor industry.

- No matter who wins in November, the massive printing and devaluation of fiat currency purchasing power, will drive the accumulation of gold and silver as a storehouse of value.

- Fed Policy has implied that interest rates could stay at a very low level for the entire term of the next president. The Fed and governments around the world need inflation to help pay the extreme levels of outstanding debt. They cannot afford to allow interest rates to rally. Perfect environment for Precious Metals.

Rising inflation will push silver prices to all-time highs at $50 – Mitsubishi

Neils Christensen, Tuesday September 08, 2020 – (Kitco News)

It’s not just gold investors who should be paying attention to potential rising inflation pressures as one market analyst notes that silver could rise to all-time highs as real interest rates push further into negative territory.

In a report published Monday, Jonathan Butler, precious metals analysts and head of business development at Mitsubishi, said that silver prices rallied 14% in August as rising inflation pressures pushed real interest rates to below negative 1%.

“In the period since real interest rates went negative at the start of the pandemic in March, silver prices have risen from $14 to highs of $29.86 – an increase of 113%,” he said.

Gold, last month, rallied as much as 4% as prices hitting all-time highs above $2,000 an ounce. Although silver and gold are off their August high, silver is finding some initial support around $26 an ounce; at the same time, gold is seeing initial support around $1,920 an ounce.

Although silver has significantly outperformed gold in the last few months, Butler said that it is still relatively cheap by historical standards. The gold/silver is currently hovering around 72.5, meaning it takes nearly 73 ounces of silver to equal the value of one ounce of gold points; Butler noted that the historical average for the ratio is around 59 points.

“Were inflation to continue to rise, as the US Federal Reserve are now allowing for, real interest rates could conceivably go further into negative territory than the current –1%, and silver could correspondingly rise further as investors seek cheap inflation protection and position their portfolios to benefit from low opportunity costs of holding a non-yielding asset,” he said in the report. “Silver still has another $20 to run before it reaches the 2011 nominal high, but this level is looking more achievable than it was a month and a half ago.”

Butler said that the Federal Reserve’s new inflation target of an average of 2% will bode well for precious metals.

Check us out at: LinkedIn: LivingOffTheMarket.com & Tom’s Blog / LivingOffTheMarket.com

Where Value meets Buy Signals!

LOTM is a free newsletter. Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security. These Investments are bought and sold constantly.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()